In addition to using Leveraged ETFs, short selling is another way to hedge your stocks or portfolio against a market correction. It can also be used as a revenue generating strategy and not just for hedging purposes.

Let's assume you believe a stock (for example, AAPL – Apple) is going to decline in value. If you currently own this stock, then your best bet is to sell it and then buy it back when (and if) the price does drop. But what if you don't currently own the stock, in that case Wall Street has a process in place, called Short Selling, which allows you to place a bet that a stock will fall in value. This is a very simple process, but one that is very difficult for a lot of investors to fully comprehend.

Our goal is to explain the Short Selling process in a way that makes it easier for average investors to understand and consider as an option for their hedging or revenue generating strategies.

Entering a Short Selling Trade (Just as easy as buying a stock)

Let's assume it is September 2012 and AAPL stock is selling at $702 a share. You, as an investor, have reasons to believe the stock will drop in value and want to Short the stock. All you would have to do is:

- Log into your brokerage account (Ameritrade, E*Trade, Scottrade, Fidelity, etc.)

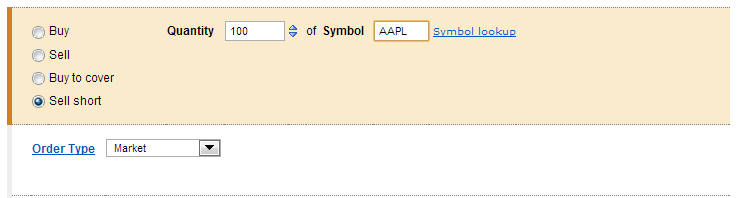

- Enter the stock symbol & quantity, select "Sell Short" and submit the trade (at the existing market price or as a limit order).

What this trade allows you to do is basically borrow 100 AAPL shares from your brokerage firm (who keeps such shares on hand for buying/selling/shorting purposes on behalf of its clients) and sell the shares to someone who believes AAPL will go up in value. All of this is covered within this one easy trade. However, do remember that you have borrowed (loaned) the shares from your broker, and at some point (at a time of your choosing) you will need to return these shares back to your broker.

A Short Selling trade is similar to the process of buying a stock (long sale), waiting for the stock price to go higher and then selling the stock. The only difference is that a Short Sale is a flipped version of a long sale. With Short Selling, the expectation is that you “borrow and sell” now and buy back the shares at a much lower price, pocketing the difference. See below:

LONG (Normal) Sale – Buy Bank of America Shares

100 Shares

SHORT Sale – "Borrow and Sell" Bank of America shares

100 Shares

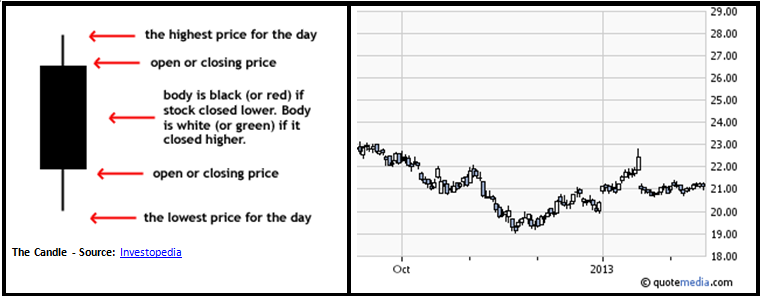

Now, fast forward 5 months to February 2013. AAPL is now selling around $460 a share, a 34% drop from the $702 price. You were right! You called it and AAPL has dropped in value! What now?

Source: Yahoo! Finance

Well, remember that you borrowed 100 AAPL shares from your broker and still need to return these shares. To return the shares, all you will need to do is enter a “Buy to Cover” sale. Your broker already has it on their system that you owe them 100 AAPL shares, so when you enter a “Buy to Cover” sale, the system knows that you are returning back the 100 shares of AAPL that you borrowed on September of 2012.

So, let’s say you buy the shares back at $460 a share, in the process closing out the short sale. You have now made a gain of 100 shares x (Sale Price minus Buy Back Price) = 100 x ($702-$460) = $24,200.

This is how easy it is for you to conduct short selling. This is also how easy it is for you to lose all your savings as short selling is considered one of the most risky forms of investing.

RISK

Here is why: short selling works great when the stock price does decline as you predicted. If you are wrong, however, and the stock price goes up instead of down, then you are in for a big loss.

Your broker does not care how much you pay per share to buy back the stock, they only care that the borrowed shares are returned at some point.

So let’s say that instead of dropping to $460, AAPL had risen and risen and risen from $702 to $750, $800, $900, $1000. At this point, you can’t take the pain (loss) anymore and decide to buy back the stock at $1000 (a $297 rise from the $702 at which you sold it). Then you would have taken a total loss of 100 shares x (Sale Price minus Buy Back Price) = 100 x ($702-$1000) = -$29,800.

Note: If the losses pile up and you refuse to buy back the stock, (maybe because you are hoping against hope that the stock price will halt its rise and decline), then your broker will have to step in at some point and liquidate the trade (or account) to ensure they don’t end up holding the bag on your loss.

REWARDS

Short selling can be a lucrative way for you to speculate that a stock (or stocks in general) will decline. You gain a lot of money if you get it right. However, if you get it wrong, then you need to know when to cut your losses and not wait until it is too late.