What are bank routing numbers?

Until we conducted the research needed to draft this article, I always thought the routing numbers at the bottom of a check were just randomly selected and assigned to a particular financial institution.

I was wrong.

A bank routing number is more than another set of information on a check. Think of routing information as a GPS, or Get-Paid System with predetermined and well defined set of numbers.

History of check routing numbers

In 1910, the American Bankers Association (ABA) created the check routing number, also known as a routing transit number.

The goal was to identify the financial institution responsible for a financial transaction. Today, check routing numbers have expanded to include automated clearinghouses, electronic funds transfer and online banking.

Accuity is the official registrar of ABA routing numbers and charges registering institutions a $500 fee for the first routing number and $625 for each additional number.

How to read a check routing number

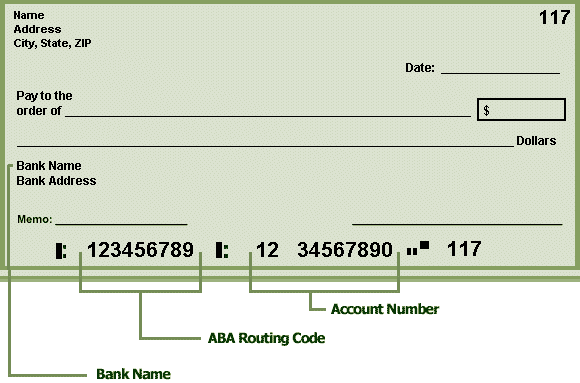

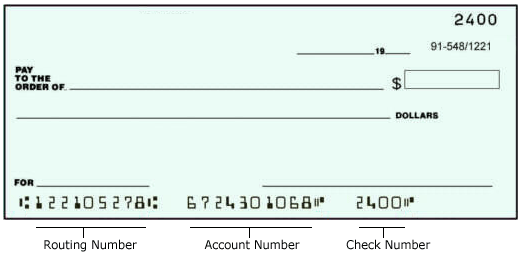

Routing numbers come in two forms – a fraction at the top of a check and the magnetic ink character recognition, or MICR, number at the bottom.

The information is not a random grouping of numbers or merely a sequence of digits. Each part of a routing number provides a clue to the identity and location of a financial institution, providing assurance that the money will find its way to the correct checking account.

Routing numbers – fraction (Top right section of check)

When written as a fraction, a routing number usually includes eight to 10 digits (e.g. XX-YYY/ZZZZ) at the top of a check.

The fractional form is used to manually process a financial instrument.

The parts of the number on the top right hand of the check (91-548/1221) are as follows:

- 91: city or state where a financial institution is located

- 548: specific identifier for a financial institution

- 1221: Federal Reserve district in which the financial institution is located

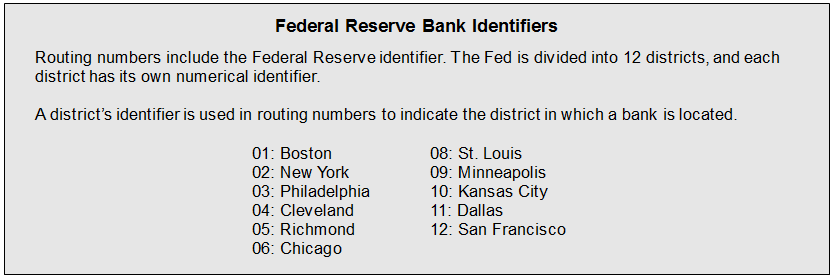

A routing number written as ##-###/1221 would indicate the bank is in the San Francisco district of the Federal Reserve, because of the "12"

The “0” that is in front of 01 to 09 for Federal Reserve Bank Identifiers (shown below) are not included on the check.

Routing numbers – MICR (Left bottom section of check)

The nine-digit MICR routing number at the bottom of the check incorporates the same numbers as its fractional brother but places the numbers in a different order.

The number is printed in magnetic ink that can be read by a check-processing machine, such as at a retailer.

The parts of the number (122105278) tell a story.

- 12: the Federal Reserve district where the financial institution is located

- 2: the number that identifies the check-processing center that created the check

- 1: the number is a zero if the financial institution is in the same city as a Federal Reserve bank. Otherwise, it will be a digit from one to nine, according to the state in which the institution is located.

- 0527: the financial institution’s unique ABA identification.

The last number of the nine-digit MICR number (8) is called a check digit. The number does not correspond to the check number, but is a way to verify the other eight digits follow the ABA’s routing number scheme.

Calculating MICR check digits

To calculate the check digit, multiply the first, fourth and seventh digits in the routing number by 3; the second, fifth and eighth digits by 7; and the third and sixth digits by 1.

The eight products are then added. Next, subtract the sum from the next number divisible by 10.

The difference is the ninth and final digit in the routing number. Let’s say for example that the first eight digits in a routing number are 11190078. To calculate the check sum digit, perform the following computation:

(1×3)+(1×7)+(1×1)+(9×3)+(0x7)+(0x1)+(7×3)+(8×7). The sum is 115.

The next number after 115 that is divisible by 10 is 120. When 115 is subtracted from 120, the difference is 5.

Therefore, the complete MICR routing number is 111900785, indicating the bank is in the Dallas district of the Federal Reserve, though not in the city of Dallas.

And that is all there is to bank routing numbers. Hope you found this article helpful.

Ogbe A.