There are a wide range of Leveraged Short/UltraShort ETFs (FAZ, ERY, BGZ, etc.) that average individual investors can use to protect against a stock market correction.

These Exchange Traded Funds (ETFs) are structured to move inversely to the market as a whole or to specific market sectors. As such, they perform well (go up in value) when markets are on a decline and do very poorly when stocks are rising. Leveraged ETFs are available for most indexes (Dow, Nasdaq, S&P, Russell, etc.) and for a broad range of sectors: Financial, Technology, Small Caps, Large Caps, Health Care, Real Estate, etc.

How They Work

For our explanation of how defensive ETFs work, let us assume you own banking shares (e.g. Bank of America shares) and also purchased one of the various Financial Services Defensive ETFs available.

- Short ETFs (1x): Short ETFs are structured to move in an inverse 1:1 relationship with their underlying index or sector. So if your Bank of America shares drop by 1% during the day, then the Financial Services Defensive ETF would be expected to move up 1%.

- UltraShort ETFs (2x): Ultra Short ETFs are structured to move in an inverse 2:1 relationship. So if the bank stocks you have in your portfolio go down 1% during the day, then the UltraShort Financials ETF (2x) will be expected to move up 2%.

- UltraShort ETFs (3x): 3:1 relationship. If your bank stocks decline 1%, then the UltraShort Financials ETF (3x) should go up 3% during the day.

It is very important however to understand that leverage ETFs are structured for daily movements. As best stated by Direxion Funds (fund manager of the widely followed Direxion 3X ETFs):

“our leveraged 3X Defensive ETFs seek a return that is 3 times the return of its benchmark index for a single day. The fund should not be expected to provide three times the return of the benchmark’s cumulative return for periods greater than a day”.

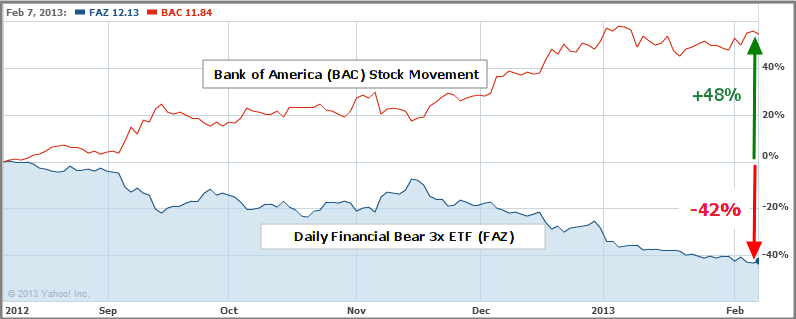

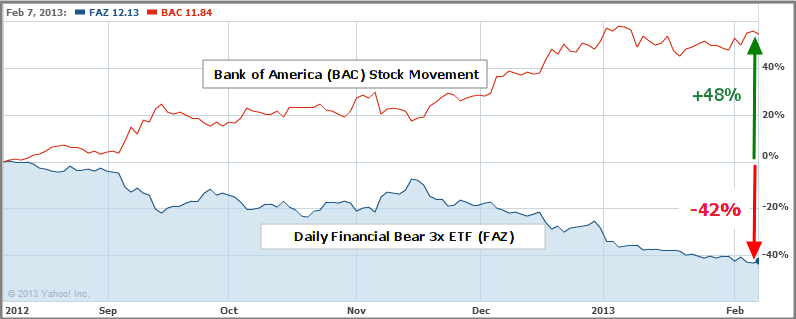

In other words, if you plan to hold the Daily Financial Bear 3x ETF (FAZ) for longer than one day, then you might not get the exact 3:1 relationship. It could be higher or lower than 3:1 as can be seen in the diagram below.

Chart – Bank of America vs. Direxion 3X ETF

This is a 6-month chart between Bank of America (BAC) stock versus the Daily Financial Bear 3x ETF (FAZ). If you had both securities in your portfolio over the last 6 months, then you would have seen your BAC stocks increase by 48%, while your FAZ holdings would only have dropped 42%.

BAC Stock & FAZ ETF Chart

August 8th 2012 to February 7th, 2013

Chart Source: Yahoo! Finance

Overall, the highly leveraged ETFs are meant to be used only on a short term basis for hedging your stock holdings. To protect against a short term market correction, they have proven to be effective defensive products – but don’t hold them forever.

Profit Making Approach

In addition to using these instruments for hedging purposes, they can also be used for profit making strategies. For example, even if you don’t have any banking stocks, you can still buy the FAZ Defensive ETF if you believe the market or the banking sector in particular will drop in value.

If you are right and bank stocks/banking sector do indeed decline in value for some reason (e.g., higher regulations, lower profit margins, etc.), then your FAZ ETF will soar in value and you can cash out with a big profit.

List of Leveraged ETFs

Below are some hedging ETFs that investors can invest in during or before a market correction – depending on your risk appetite and level. However, please note that with these leveraged financial instruments, you can make a “boatload” of money in a very short period or get taken to the cleaners. MarketConsensus strongly recommends that you consult with an independent financial advisor regarding your investing choices.

7 Highly Leveraged Defensive ETFs (3x)

| ETF Name | Ticker | Benchmark Index |

| Daily Large Cap Bear 3x | BGZ | Russell 1000 |

| Daily Mid Cap Bear 3x | MWN | Russell Midcap Index |

| Daily Small Cap Bear 3x | RTY | Russell 2000 |

| Daily Energy Bear 3x | ERY | Russell 1000 Energy |

| Daily Financial Bear 3x | FAZ | Russell 1000 Financial Services |

| Daily Technology Bear 3x | TYP | Russell 1000 Technology |

| Daily Real Estate Bear 3x | DRV | MSCI US REIT Index |

7 Leveraged Defensive ETFs (2x)

| ETF Name | Ticker | Benchmark Index |

| UltraShort Basic Materials | SMN | Dow Jones U.S. Basic Materials |

| UltraShort Financials | SKF | Dow Jones U.S. Financials |

| UltraShort Industrials | SIJ | Dow Jones U.S. Industrials |

| UltraShort Real Estate | SRS | Dow Jones U.S. Real Estate |

| UltraShort Semiconductors | SSG | Dow Jones U.S. Semiconductors |

| UltraShort Oil & Gas | DUG | Dow Jones U.S. Oil & Gas |

| UltraShort Technology | REW | Dow Jones U.S. Technology |

5 Short ETFs (1x)

| ETF Name | Ticker | Benchmark Index |

| Short QQQ | PSQ | Nasdaq-100 |

| Short Dow 30 | DOG | DJIA |

| Short S&P 500 | SH | S&P 500 |

| Short Mid Cap 400 | MYY | S&P Mid Cap 400 |

| Short Small Cap 600 | SBB | S&P Small Cap 600 |

| Short Russell 2000 | RWM | Russell 2000 |

Gold and Silver ETFs / ETNs

| ETF Name | Ticker | Risk Level |

| ProShares Ultra (2x) Silver | AGQ | mid to high risk appetites |

| ProShares UltraShort Silver | ZSL | mid to high risk appetites |

| ProShares Ultra Gold | UGL | mid to high risk appetites |

| ProShares UltraShort Gold | GLL | mid to high risk appetites |

| DB Gold Short ETN | DGZ | Lower level of risk |

| DB Gold Double Short ETN | DZZ | mid to high risk appetites |