Just2Trade.com is an online stock trading website that is revolutionizing the online brokerage industry. Unlike many online brokers, Just2Trade owns its technology and “manages every step of the trading process to ensure smooth, high quality service and exceptional order executions”.

See Also: Protecting Yourself against a Market Correction – Defensive Investing

For the past six years, the company has been carving its niche in the online stock trading world. Touted as the economical option amongst its competitors, the firm boasts rock-bottom rates while maintaining quality service. More bells and whistles can be found at other sites, but Just2Trade sticks to its clean interface, no-frills research and discount price.

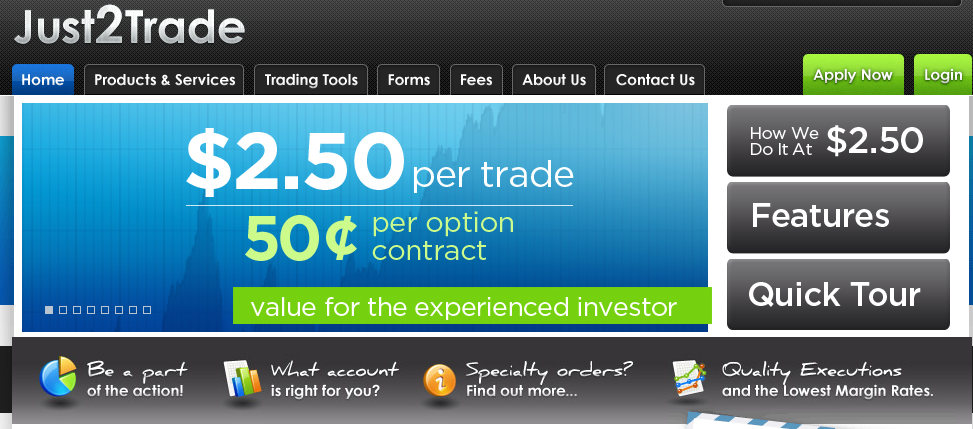

The company’s $2.50 per trade fee, along with low margin rates, places it among the most cost effective platform for individual investors looking to trade and invests in stocks.

See Also: 5 Top Online Trading Sites (2013) for Investors

This relatively new startup is headquartered in Washington, DC and is an offshoot of parent company Success Trade Securities, founded in 1999 by CEO Fuad Ahmed. Ahmed combined his passion for finance and technology – insisting that programming be done in-house – to build a bare bones stock trading platform that quickly became popular for its incredibly low cost. The company maintains a straightforward way of dealing with trading and commissions, ensuring that there are no gimmicks or tricks.

Early versions of the platform were criticized for being unfriendly to users and lacking important options; for instance, users were not able to see portfolio positions and account balances in real time. An overhaul in early 2011 updated the platform’s features, making the features of the site comparable to those of more pricey brokers. The updated features include the ability to cancel or modify open orders, the option of setting up trailing stops by either a specific dollar amount or percentage loss, and customization options that enable personalizing the home page.

See Also: Why BAC is a good Buy in 2013 – Bank of America Stock Analysis

Just2Trade has capabilities that others lack. The platform allows investors to receive fractional shares of a stock after reinvesting dividends – most other brokers only purchase whole shares of stock, stashing surplus money in your cash balance brokerage account.

Some critics are still frustrated with what they identify as some lingering shortcomings; the site has no live chat or true phone support, account minimums are steep, and the choice of mutual funds is relatively poor. These issues likely arise from the low cost of the site, but have admittedly led some investors to choose other sites.

Many competitors exist, and most lie in the more expensive range of $7 to $15 per trade. Some notable online trading companies in direct competition include Zecco, OptionsHouse, SogoTrade, Lightspeed Trading and optionsXpress.

Just2Trade has a mobile site but no apps currently; their lead programmers are currently working on several mobile interfaces that are expected to be rolled out sometime this year. Multileg options trading should be available as the mobile apps are introduced.

[related1][/related1]