Alpha Natural Resources (ANR) Stock Analysis – Is ANR Stock a Buy, Sell or Hold?

The last two years have seen tremendous economic turmoil in the energy sector, with coal prices taking a big hit. Low prices for natural gas (a substitute for Coal) continues to reduce coal demand. The slowdown in the global economy is another factor impacting the coal industry and coal companies like Alpha Natural Resources (Stock: ANR).

As is apparent from the stock price chart above, ANR’s stock has performed poorly in the last 12 months, more so than its competitors Arch Coal (ACI) and CONSOL Energy (CNX). Investors in ANR would be wondering whether its time to bail out, or whether there is still some upside left by hanging on to their ANR holdings.

Let's review some key fundamental and valuation information to help determine if Alpha Natural Resources (ANR) stock is a good buy, sell or hold.

Alpha Natural Resources (ANR) Stock Analysis and Valuation Proposition

- Alpha Natural Resources Fundamental Analysis

- ANR Valuation Overview

- Technical Analysis – Alpha Natural Resources Stock

- Favorable/Negative Catalysts for the Stock

- Bottom Line Conclusion

- Alpha Natural Resources Fundamental Analysis

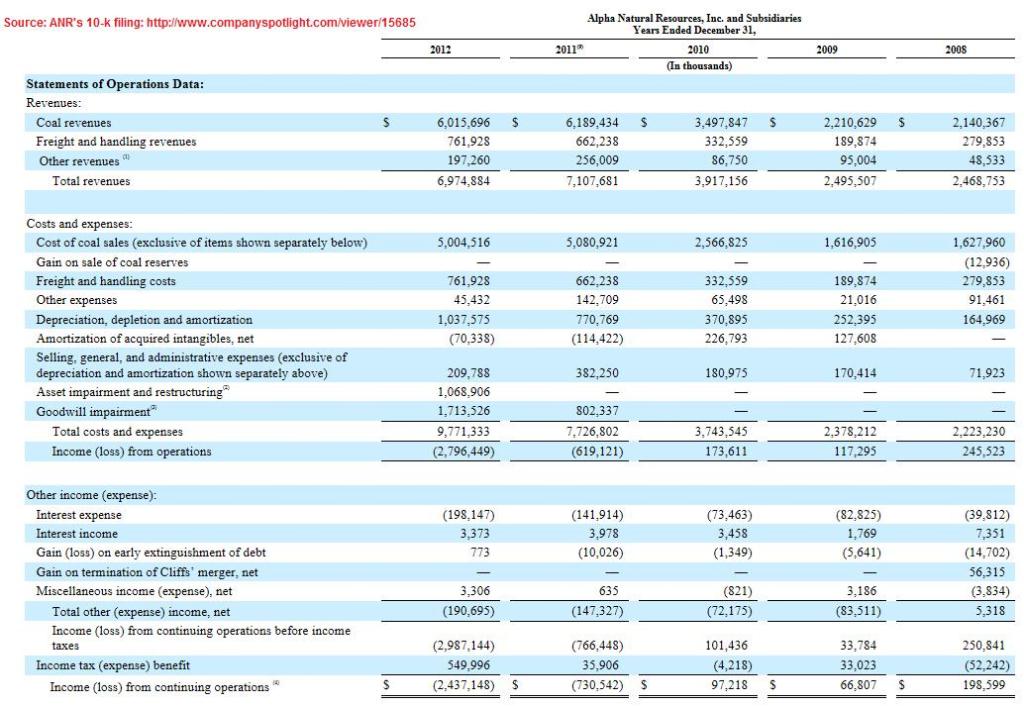

For the fiscal year ended Dec 31, 2012 ANR reported Total Revenue of $7.0B, which also included a full year's contribution from its June 2011 acquisition of Massey Energy. This reduced total revenue by 2% from the $7.1B reported in 2011. Total 2011 revenue also included 7 months of revenue from the then newly acquired Massey company. Over a 5-year horizon, this is the first year that ANR's total revenue has declined year/year since 2008.

(Other News: Delta Stock Soars 51% in 1 Year. Too High, or is DAL still a Good Buy?)

While investors reacted negatively to the decline in revenue, the decrease was largely the result of management's decision to pare down production of Met coal in a dwindling coal price environment. The decline in revenue, however, would have been much worse, had it not been off-set by an increased in the volume of the firm’s Eastern steam coal sales. Given the reality of pricing differentials between the various coal prices, analysts believe this was the most appropriate strategy to adopt.

While coal revenues declined 2.8%, from $6.2B in 2011 to $6.0B in 2012, the company reported a significant (15%) increase in Freight and handling revenues, from $6.6M in 2011 to $7.6M in 2012.

The company shipped a total of 108.8M tons of coal during 2012, including Met, PRB and Eastern steam. This was a 2.35% increase from the 106.3M tons it shipped in the previous year. Even though this represents a slight improvement, the increased shipments come at a time of global slowdown in the demand for coal, and comparatively cheaper natural gas prices, which makes even this slight increase in coal shipments commendable.

(See Also: Cisco Stock Valuation Analysis. Will CSCO Continue to Rise?)

The bottom line was that, despite a strategic (yet necessary) reduction in production operations, and judicious cost-cutting measures in both its Eastern and Western operations, the company reported a net loss of $2.4B, which translated to $11.06/diluted share.

Even though this was the second straight year of losses reported by ANR (2011 loss was $730M), investors reacted slightly favorably to the results. Although the shares closed at $8.38 on Mar 12th – a day prior to the earnings announcement, and slid down to $8.01 following the earnings announcement on Mar 13, by March 18th the stock closed at $8.66, up by over 8% from its post-earnings announcement closing price.

- ANR Valuation Overview

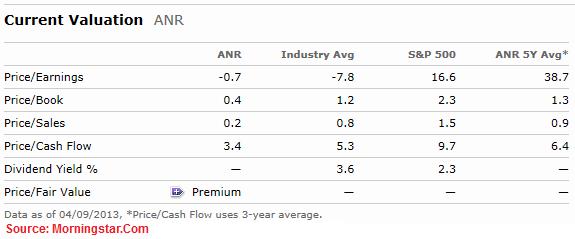

On a Price/Book, Price/Sales and Price/Cash Flow basis, ANR trades at valuations (0.4x, 0.2x and 3.4x respectively) that are well below both the Industry average (1.2x, 0.8x and 5.3x respectively) and the S&P 500 (2.3x, 1.5x and 9.7x respectively). This makes ANR a rather cheap stock.

Looking at ANR's competitors, CNX trades at a staggering 19.8x its current Earnings, and at 10.6x its Cash Flow. It also trades at 14.6x its Forward Earnings. On a comparable basis, ACI is trading at a -1.7x discount to its current Earnings, and 3.5x its current Cash Flow. However, its forward valuation, on a P/E basis, is a whopping 87.7x. With ANR trading at -15.4x its forward Earnings, the stock seems to be relatively undervalued in comparison to its 2 industry peers.

Continue: Is ANR Stock a Good Investment?

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related2][/related2]

(By: Monty R. – MarketConsensus News Contributor)