AMD CEO: “We Will Be Profitable in 2013”

On January 22, 2013, Advanced Micro Devices CEO, Rory Read, announced to the world that the firm would be profitable in the second half of 2013. Read stated on the company’s conference call that AMD was undergoing a major restructuring of their business and operating models, which will allow the firm to turn around its declining prospects.

Click here to Review the Latest Article on AMD Stock (Buy or Sell: 2013 – 2014)

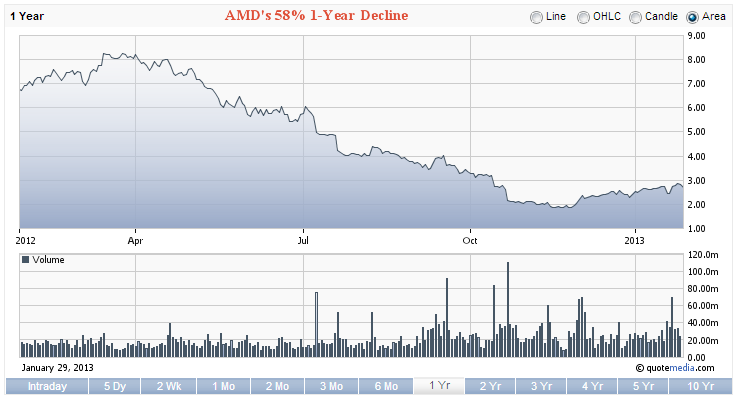

AMD Stock: 2012 – 2013

Since the beginning of 2012, AMD’s stock price has dropped 58.16%. Advanced Micro Devices continues to face weak demand and a slowing PC market – two major factors causing a decline in the company’s top line revenue growth.

Wall Street seems to be taking a wait and see approach. But a lot of investors are asking: Is it possible for the company to turn itself around in time to avoid bankruptcy?

Financials

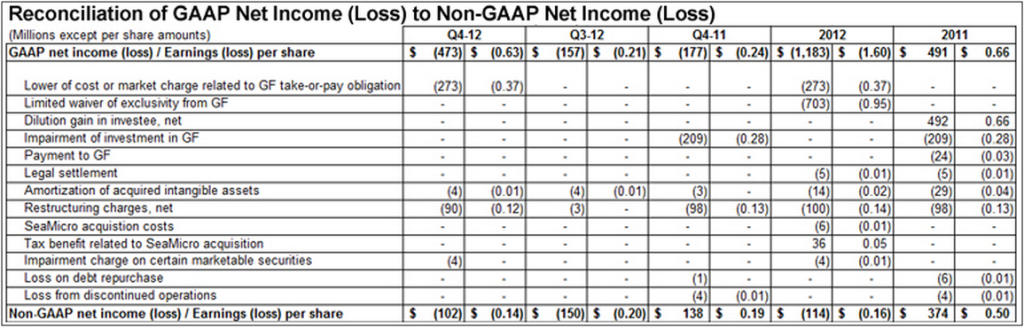

On January 22, 2013, AMD reported 2012 Q4 and full year figures.

2012 Q4

- Revenue for the quarter declined 32% (from one year ago), down to $1.16 billion.

- The firm had an operating loss of $422 million and a net loss of $473 million.

2012 Full Year

- 2012 revenues declined by 17% (year over year), down to $5.42 billion.

- AMD had a 2012 operating loss of $1.06 billion and a net loss of $1.18 billion.

Key Takeaways

- The company's financial condition continues to worsen.

- AMD has a poor balance sheet with more debt ($2 billion) than cash ($1 billion). Operating cash flow is -$338 million (trailing twelve months – TTM), and quarterly revenue growth is -31.70% (year over year).

- Management effectiveness is below average. The firm's assets are not generating value for shareholders. Return on Assets is -13.35% (TTM), and Return on Equity is -111.18% (TTM).

- The firm is not profitable, with a negative profit margin of – 21.82% (TTM) and a negative operating margin of -17.63% (TTM).

Source: AMD Press Release

Competition

As reported by Zacks.com, "The company operates in a highly competitive market, which is being increasingly cannibalized by tablets from well-established players, such as Apple, Samsung, Microsoft , HP and Dell among others”. Compared to its peers, AMD has the most negative growth rates and profit margins. It has a -167.92% EPS growth (MRQ) compared to the industry average of -6.40%.

See Also: AMD Stock is Up 23% in 3 Months – Is AMD a Buy, Sell or Hold in 2013?

Conclusion

We do not see the stock as a BUY at this time. At best, we can rate it as a HOLD. We will continue monitoring the firm’s restructuring and transformational efforts and will most likely adjust our ratings based on any improvement on the company’s financial and operational prospects.

Good luck in your investing,

MarketConsensus Stock Analysis Team

Stay In Touch:

Facebook (Like Us on Facebook)

Twitter (Follow Us on Twitter)

Google + (Connect with Us on Google+)

Contact Us (Questions/Comments)

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related1][/related1]