- Technical Stock Analysis Analysis – Alpha Natural Resources Stock

(Continuing from the previous article:Alpha Natural Resources (ANR) – Is ANR Stock a Buy, Sell or Hold?)

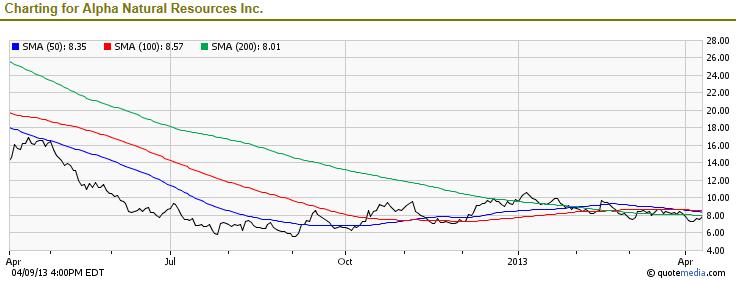

A year ago, ANR traded at $14.27, 44% below its current $7.90 price. Following a decline from $16.82 in late April 2012, the stock dropped to around $5.84 (July, 2012). Since then, the stock has been relatively flat, treading close to its 50-day and 100-day Simple Moving Average (SMA).

Over the last 50 days, ANR has traded sideways in a relatively narrow price channel of between $7.08 and $9.90. The past few trading sessions have seen the stock trade lower than its 200-day SMA as it tries to break that resistance level once again. Technical observers may read the chart above as a form of an "extended" base building pattern, hopefully providing the stock a strong rallying point for an eventual bounce back.

(Other News: Favorable Catalysts that make GE Stock a Buy)

- Favorable/Negative Catalysts for the Stock

During these times of declining (or relatively flat) demand for coal, driven partly by an extended period of low natural gas prices, and more stringent environmental regulations, ANR management have done a great job of stabilizing the company, including making tough decisions around production cuts and cost control measures. Strong management leadership in difficult times is a great catalyst for any company's future prosperity and growth, and ANR management have shown they possess that characteristic.

Uncertainties in the demand for ANR's product, especially metallurgical coal, have been rising as a result of the global economic slowdown. ANR is also feeling the impact of this downturn in the form of the orchestrated "soft landing" in China, which has reduced that country's demand for steel (Met coal is used to produce steel). Should this bearish trend in coal demand continue, ANR may face greater headwinds in the coming quarters.

(Other News: Google Stock Will Rebound. Is GOOG a Good Buy in 2013?)

In times when organic growth is difficult, companies pursue a "growth by acquisition" strategy, and ANR's purchase of Foundation Coal has been extremely accretive for shareholders. However, due to the huge debt that ANR undertook to do it, the company's acquisition of Massey Energy Company has not been as good for creating shareholder value to date. The challenge for ANR management would therefore be to reign in any further desire to make acquisitions that may hurt longer-term shareholder value in the company.

The biggest negative catalyst for future growth for ANR would be the fact that the company has a sizable portion of its revenue coming from its Appalachian thermal coal operations. Increasingly, ANR utility customers are shifting away from high-cost Appalachian coal in favor of lower-cost Powder River and Illinois Basin coal. Many are even shifting to much cheaper natural gas as a power source. This shifting dynamic could create a huge dent in ANR's long-term growth and profitability. The more recent uptick in the price of natural gas however could be a positive catalyst for the company.

- Bottom Line Conclusion

As a result of the above analysis, Alpha Natural Resources (ANR) is a MODERATE BUY.

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related2][/related2]