As trading closed on Monday, 1/14/13, AT&T stock (T) finished lower by $0.10, but it somehow managed to make it to the MarketWatch Hot Stocks list at the end of the day. It had everything to do with the volume being up over its average volume of 25.83M, as 27.07M shares exchanged hands during the trading day.

AT&T announced blockbuster smart phone sales in the last quarter

Apple (AAPL) stands to gain considerably from the telecommunications giant's iPhone sales with a record 10 million smart phones sold by AT&T in the last quarter. However, it is interesting to note that both stocks are down with Apple actually tanking. Analysts feel that this is a good entry level to buy Apple stock as it has supposedly reached its long term support level. As for AT&T, the stock has a price target of around $32 and a "hold" rating.

Source: DailyFinance

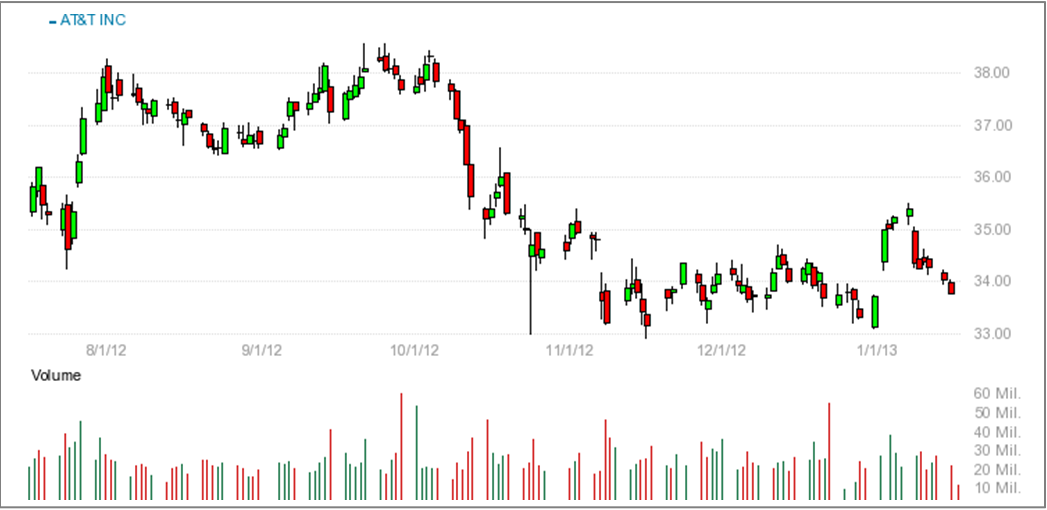

Technically speaking, the stock actually looks bullish, and the MACD has only now touched the bullish area. It should move in this way for the near term. This is after a bearish continuation flag pattern that can be seen on the chart starting from mid November to New Year's Eve.

This flag is somewhat horizontal and signifies a slight uptrend.

The Fundamental Side

The thing that is appealing about AT&T to investors is its net profit margin of 11.76% and operating margin of 19.19% in Q3 2012, which are much higher than the 2011 figures of 3.30% and 7.27% respectively. The market cap of $192.10B is always going to make AT&T a very liquid stock.

What to do with AT&T?

The stock has been on an uptrend over the last four years, and its 5.32% dividend yield makes it an attractive investment opportunity. Q4 2012 earnings will be out on January 24 with expected EPS of 0.49, which is higher than the Q3 EPS of 0.42. There isn't much in store for bulls, but bears can take advantage of the large volume the stock is trading at and short AT&T with a strike of '33'.

If you're not a speculator, it's still great to have AT&T in your portfolio as it does have significant growth prospects with a P/E ratio of 43.88 and ROAE of 14.28%.

[related1][/related1]