Barclays Online Bank Review

No bank is perfect, but it looks like Barclays Online Banking consistently gets a higher than average number of customer complaints.

MarketConsensus News decided to do a deep dive analysis to determine the validity of these complaints and to present a "Pros / Cons" review of Barclays's Online Bank and its famous high yield savings account.

Benefits of Using Barclays Online Bank

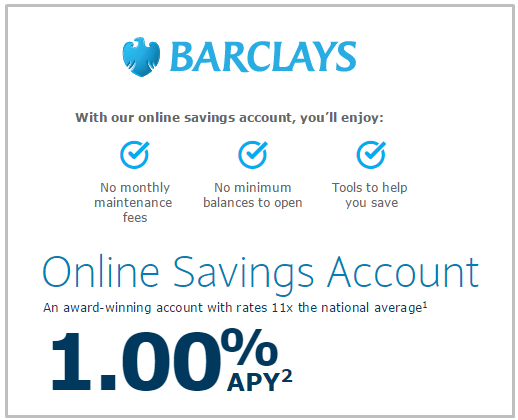

Barclays pays one of the highest annual percentage yields (APYs) available in the financial industry for a savings account.

It currently pays 1.00% and requires no minimum balance to maintain the account.

In addition, the firm's savings account is structured in such a way as to be linkable to any existing account you might have with a different bank, hence you do not have to switch banking firms.

Highlighted below are some key benefits of having a Barclays savings account:

- 1.00%* annual percentage yield, which is a much higher rate than what is offered by most other banks

- No monthly maintenance fees

- The APY compounds daily (unlike a lot of other high yield savings account). Daily compounding allows your deposits to earn interest much faster than weekly or monthly compounding

- Open an account in just a few minutes

- Easy transfers to other banks

-

Simple, scheduled transfers

-

Direct deposit for consistent savings

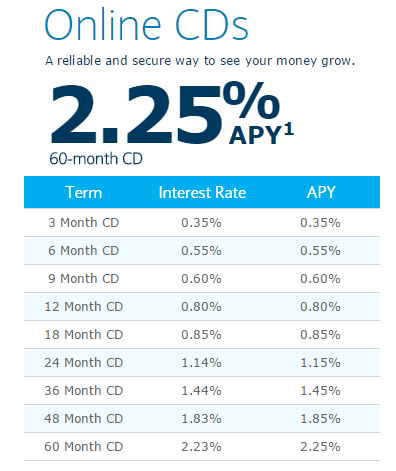

- 2.25%* APY on a 60 month Online CD

* Please review Barclay's website for the most recent figures, rates, and yields

Customer Issues and Compliants – Barclays Savings and Banking

According to reports from the Financial Ombudsman Service, Barclays is at the top of the list of worst banks in the UK based on customer complaints.

The UK Financial Ombudsman Service is an independent body established as a result of the Financial Services and Markets Act to help settle disputes between consumers and UK-based banks.

Of the tens of thousands of consumer complaints received by the Financial Ombudsman Service, Barclays bank alone received over 50%. Santander was next in line, followed by AXA.

Top Customer Complaints

Some of the key areas of customer discontent when using Barclays high yield savings account / Barclays Online Bank include:

- Customer service issues

- Online banking system and technical issues (i.e., site is down, slow, unable to access, etc.)

- Issues with online banking payment, credit, points systems, funding, ACH and others

- Customer accounts getting closed out (without customer consent)

- Paperwork issues

- Sale of controversial payment protection insurance policies

Note: Although the level and number of complaints for Barclays can seem overwhelming, please note that in general, people are more liable to post negative reviews of a product or company than they are to post positive reviews.

The above list of complaints were aggregated from a wide array of online web reviews and postings.

MarketConsensus' Analysis of Barclays Online Banking Issues

To validate some of these complaints, we started off by testing Barclays’ "live web chat" customer service, which was a point of issue for some Barclays Bank customers.

When we saw the “we have agents ready to help” text, we immediately clicked to chat.

Upon clicking on “Start your online chat”, we were shown a message informing us that an adviser would be available within 54 seconds.

54 seconds came and went, without any rep coming online to chat.

A full six minutes went by before a Barclays Online Banking adviser came online to chat with us.

Next we called Barclays to test their customer service line.

Based on complaints that we’ve reviewed, we were expecting to have to wait a long time before a representative came on the phone.

But we were really surprised when a customer service agent came on the line within two minutes.

We then spent some time searching for and reviewing both good and bad Barclays’ customer reviews that have been posted on the web.

For every good review, there were over 142 bad reviews and complaints.

As stated above, we do understand that in general, people are more likely to post negative reviews of a product or company, more so than they are to post positive reviews.

On the other hand, if a firm receives 30,000 negative reviews in a particular year, while its main competitors (peers that are just as large or very similar in nature) on average are each receiving 4,000 negative reviews, that alone could be a big issue.

Conclusion

Ultimately, you as the current or future account holder have to determine whether the benefits of opening or maintaining a Barclays savings or checking account outweighs the numerous issues that past and current customers are experiencing.

As presented above, Barclays does have issues that need to be resolved or are currently being resolved.

The bank is undergoing a restructuring of its business lines to better streamline processes and procedures, and to improve its business practices.