As discussed in the first article of this two part series (Chesapeake Stock Rises 18% – Is CHK a Buy or Sell?), Chesapeake (CHK) has soared in 2013 and lots of investors are wondering if the stock will continue rising in 2013 and whether Chesapeake stock (CHK) is a buy, sell, hold or short.

Article 1 presented a fundamental analysis of Chesapeake Energy, including an overview of the company’s financial income statement and two major conflicting trends in it.

In this article, we’ll be analyzing Chesapeake’s stock from a valuations perspective followed by our bottom line conclusion on whether CHK is a good buy, sell or hold in 2013.

Chesapeake Energy (CHK) Company Analysis and Research Report

- Fundamental Analysis

- Valuation Overview

- Stock Analysts' Recommendations

- Bottom Line Conclusion

- CHK Fundamental Analysis (click to view)

- Valuation Overview

When determining the value of a stock, investors normally consider some distinct variables in their valuation analysis. These include a firm's financial margins, management effectiveness, growth rates, return on investments and other valuation matrix (EPS, P/E, Debt Ratio, etc.).

Based on its gross, operating, and net margins, Chesapeake converts a percentage of its revenues to profits that is in line with other companies in the Oil, Gas & Consumable Fuels industry. However, the company, like most others in the industry, is losing money on an operating basis.

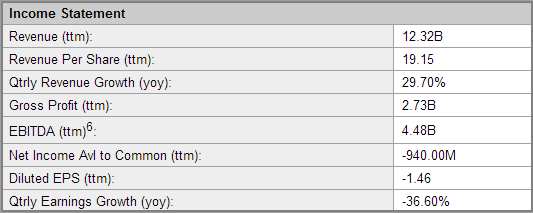

As seen in the below table, CHK’s quarterly revenue is growing at a year over year growth rate of 29.70% and the firm shows trailing twelve months (ttm) revenue of $12.32 billion. In addition to reporting positive revenue figures, the firm also shows a gross profit of $2.73 billion (ttm) (gross profit: revenue minus cost of goods sold).

However, despite the increase in revenue growth, Chesapeake shows a trailing (ttm) net income loss (net income: gross profit minus expenses and taxes), which signifies that the firm has more expenses than overall revenue can cover.

The firm has negative -$940 million in net income (ttm) and shows a -36.60% quarterly earnings growth (yoy). Holding everything else constant, a declining earnings growth never bodes well for a company’s stock. However, with regards to CHK, there are other variables that need to be considered in analyzing whether the stock has a strong potential to keep on rising in the future.

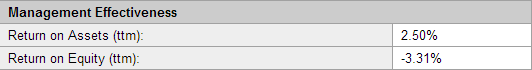

CHK has a Return on Equity (ROE) of -3.31%, but shows a positive Return on Assets (ROA) of 2.50%. ROE and ROA are variables used by investors to determine management effectiveness. For each $1 of equity, CHK’s management is losing $0.0331 and for each $1 of asset, management is earning a return of $0.025. Compared to the industry, Chesapeake Energy is below average in management’s ability to manage the firm’s resources. The ROE (ttm) industry average is 36.57%, while the ROA (ttm) industry average is 23.38%

CHK's debt to total capital ratio, at 41.63%, is in-line with the Oil, Gas & Consumable Fuels industry's average. The company should be able to comfortably repay its debt given its Interest Coverage ratio of 34.75.

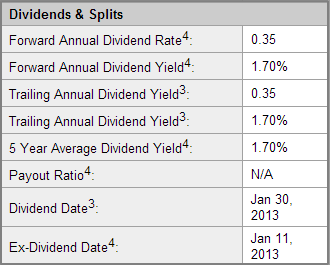

Chesapeake Energy pays an annual dividend of $0.35 and, at its current price, shows a forward annual dividend yield of 1.70%, a level that is in line with both the Oil, Gas & Consumable Fuels industry average and the S&P 500. Additionally, CHK is in the minority as most others in this industry do not pay a dividend.

- Analysts’ Recommendations on the Stock

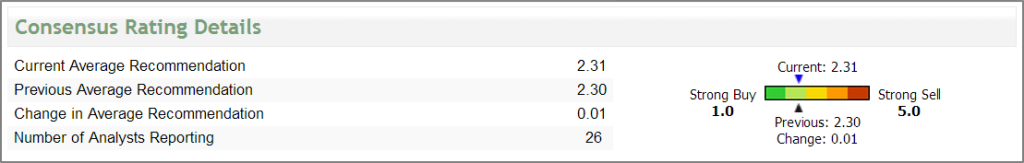

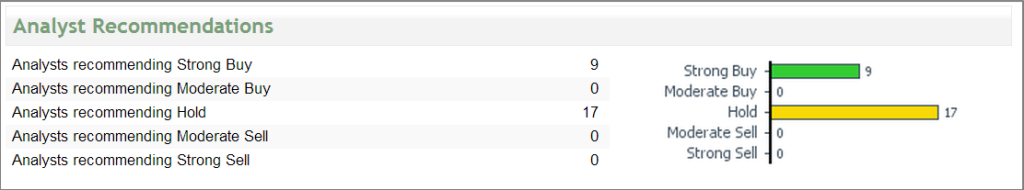

Stock analysts consider CHK a Moderate Buy. Between a 1 (Strong Buy) and a 5 (Strong Sell), they rated the stock a 2.31.

Chesapeake Energy – Analysts’ Consensus Ratings

Analysts’ Recommendations on CHK

- Bottom Line Conclusion

Taking the various fundamental, valuation and other analysis into consideration, we believe Chesapeake stock has great potential for investors and will make a great long term buy. The firm continues to work toward reducing operational cost as a way to improve its net income. It has also reiterated its expectations of improved financial growth and performance in 2013.

As stated by Domenic J. Dell’Osso, Jr., Chesapeake’s CEO "we are pleased to reaffirm our 2013 guidance for liquids production growth and drilling and completion capital expenditures, while at the same time reducing our cost guidance for many significant categories. Additionally, we are reaffirming the commitment of management and the Board of Directors to reducing financial leverage of the company through asset sales."

Nevertheless, MarketConsensus News believes that investors should wait for a pull back on the CHK stock before jumping in.

Good luck in your investing,

MarketConsensus Stock Analysis Team

Follow Us:

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related2][/related2]