Citizens Bank Reviews 2014 | Pros, Cons, Checking, Rates, Online Banking

Although there are various pros, cons, benefits and consumer complaints on using Citizens Bank, our aim with this article is to present an objective overview of the key findings from our analysis of Citizens Bank, the services it provides and the various rates / fees offered.

Citizens Bank Review Analysis

- History and Growth of Citizens Bank

- Rates (Savings, CDs, Loans, Credit Cards)

- Services Provided

- Pros and Cons of Citizens Bank

History & Growth of Citizens Bank

The origin of Citizens Financial Group goes as far back as 1828 in Providence, Rhode Island, growing from a small community bank to a huge billion-dollar corporation today.

Citizens Bank is a subsidiary of RBS Citizens Financial Group, which is owned by The Royal Bank of Scotland Group (RBS).

The British-owned American financial group has an asset base of approximately $12 billion, a branch network of 1,400 and more than 3,500 ATMs.

The bank’s network of branches spans 12 states in New England, the Mid-Atlantic and the Midwest, with affiliate locations in over 30 states and over 18,000 employees. In 2013, Citizens Financial Group was ranked #21 on the list of America’s largest banks.

Rates (Savings, CDs, Loans, Credit Cards)

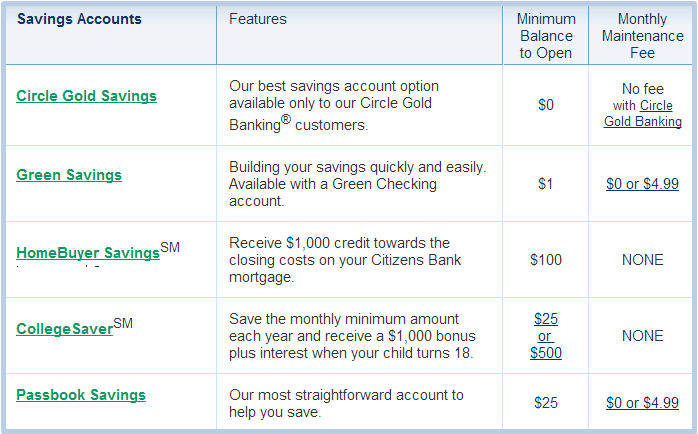

Citizens Bank Savings Rates

Citizens Bank offers bank accounts that can be opened with as little as $1, with interest rates varying from 0.01% to 0.10% for special accounts such as the College Saver Savings Account.

Citizens Bank Savings Rates

* Note: Pease visit Citizen Bank’s website for the most recent rates and figures.

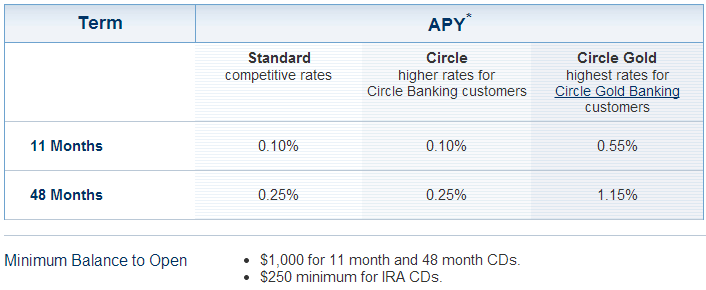

Citizens Bank Savings Certificates of Deposit Yields

Certificates of Deposit (CDs) range from 0.10% to 0.45% for deposits of 11 months, to between 0.25% and 1.05% for deposits held for a period of 48 months.

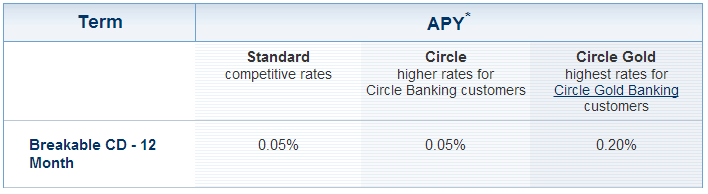

Breakable 12-month CDs range in interest rates from a low of 0.05% to a high 0.20%. Breakable CDs are easy to open, provide flexibility with one withdrawal without penalty during your term and have preferred rates preferred banking customers.

Citizens Bank Breakable CD Rates

* Note: Pease visit Citizen Bank’s website for the most recent rates and figures.

Loan Rates

Fixed Mortgage rates currently stand at 4.5% on a 30-year repayment plan, and 3.375% for 15-year repayment; adjustable rates range from 2.75% to 3.375%.

Home equity loans range from a low of 2.99%, to a high of 7.09%.

Credit Cards

Citizens Bank offers three credit cards to its customers, all with no annual fee whatsoever. Interest rates on these card range from 13.99% to 19.99 based on creditworthiness.

Citizen Bank Services

|

Commercial Banking Products & Services |

Retail Banking Products & Services |

|

|

In addition to the usual products and services offered by the average commercial bank, Citizens Bank provides a number of online resources for customers through MoneyHelp®.

MoneyHelp® is a pool of online resources which includes very detailed articles and step-by-step guides for every customer.

The aim of MoneyHelp® is to assist customers in becoming more educated on financial products and planning in general.

From the family-focused couple, to the risk-averse investor, senior citizen or student, MoneyHelp® provides a plethora of information to suit each customer’s specific needs. In addition, there are a variety of financial calculators available for calculating life insurance, net worth, investment returns, savings and taxes and of course, retirement planning.

Pros and Cons of Citizens Bank

Pros: What’s Good about Citizens Bank

- Heavily Staffed Contact Centre – In an age where the human element is often replaced with automated systems, Citizens Bank maintains a contact center with approximately 1,000 agents that services over 10 million customers.

Customers can receive 24/7 assistance with services ranging from balance enquiries to account opening procedures.

- Great Corporate Citizen – Citizens Bank, in seeking to strengthen the communities served by the bank, donated approximately $16 million to 1,000 non-profits agencies last year.

The initiatives supported by these non-profit organizations included: fighting hunger, providing housing and financial education for community members. Other initiatives included free media exposure for nonprofits through Champions in Action®, and over 60,000 in volunteer hours from Citizens Bank employees.

The bank was rewarded for its corporate social responsibility with more than a dozen prestigious awards in 2013.

- Highest Rated Mobile Apps – In 2012, Citizens Bank’s mobile apps for Android and iPhone received accolades from Javelin Strategy & Research for providing the “best integrated apps”. As a result of these feature-filled apps, the bank reported in its 2012 Annual Report that active mobile customers increased by over 130%.

- Workforce Learning Innovators – Citizens Bank was awarded the 2013 LearningElite Award for its commitment to using best practices to evaluate the relationship between learning and development and increased profits.

The award was granted by the Chief Learning Officer Magazine (CLO), and ranked Citizens Bank at 43 on a list of over 200 companies.

Cons: What’s Not So Good about Citizen’s Bank

- The ever-present overdraft fees – An online search on popular consumer report websites such as Ripoffreport.com and Consumeraffairs.com continue to generate results of numerous complaints against Citizens Bank.

Citizens Bank recently revamped its overdraft fee practices and agreed to pay disgruntled customers approximately $14 million to settle fines and restitution relating to previous complaints about overdraft fees.

The bank was found to be in breach of the Federal Trade Commission Act, following an investigation by the Federal Deposit Insurance Corp. (FDIC). Customers, however, continue to object to charges being applied to their accounts under what they consider to be questionable circumstances.

- Unfavorable reviews from current and former employees online – According to online careers community Glassdoor.com, current and former employees have given Citizens Bank an overall below average score of 2.3 out of a possible 5 points.

The bank was rated on culture and values, work/life balance, senior management, compensation and benefits, and career opportunities.

Only 18% of employees would recommend Citizen’s Bank to a friend.

The general consensus among the employees who registered their vote was that the company is focused too much on sales, and does not spend enough time listening to its staff members and customers.

Conclusion

The Sunday Times in London recently reported that TD Bank Group is pondering a $12.8 billion bid for Citizens Financial.

When asked about the report, Citizen Bank CEO, Van Saun declined to comment. He, however, stated that the bank’s chief focus right now was on its initial public offering, which is set for the fourth-quarter of 2014. As part of the IPO, the company plans to sell about 25 percent of its stock.

Van believes the offering will help the bank. “It will help with brand recognition and visibility, as well as with retaining top talent and it will be nice to have our own currency,” he said.

In the interim, financial analysts continue to debate and speculate about the future of Citizens Bank and the possibility of private interests acquiring majority stakes in the financial institution.

* Note: Pease visit Citizen Bank’s website for the most recent rates and figures.

[related1][/related1]