Coca-Cola (KO) Valuation and Stock Analysis

This stock valuation and analysis article is a continuation of our previous positing: Is Coca-Cola Stock a Good Investment? Check out the previous piece as it presents a fundamental analysis of Coca-Cola

- Coca-Cola – Comparative Valuation Analysis

With a current Market Cap (MC) of $178.11B, Coca-Coal (KO) is easily the largest compared to its two main rivals: PepsiCo (PEP), with a MC of $124.90B and Dr Pepper Snapple (DPS), with a MC of $9.38B.

Trailing 12-Month P/E (TTM P/E): Both KO and PEP are fairly evenly valued on this metric, with TTM P/E's of 20.93x and 20.69x respectively. However, DPS is trading at a comparatively discounted TTM P/E of only 15.33x. The Industry average for this valuation is 23.0x, which means while DPS is trading at a significant discount to the Industry average, both KO and PEP are valued fairly close to their Industry peers.

Forward P/E (F P/E): On a F P/E basis, the three companies are valued within a fairly narrow range of each other, with DPS (13.81x) the most discounted, and PEP (16.90x) and KO (17.09x) in 2nd and 3rd place respectively. The S&P 500 average for this metric is 14.6x, which means PEP and KO are valued at a slight premium to their S&P 500 peers.

TTM Price/Sales (TTM P/S): With a valuation of 3.79x, KO is trading at a comparative premium to both PEP (1.91x) and DPS (1.59x). The Industry average of 2.4x for this metric also means that KO is trading at a premium to its other Industry peers.

- Technical Perspective

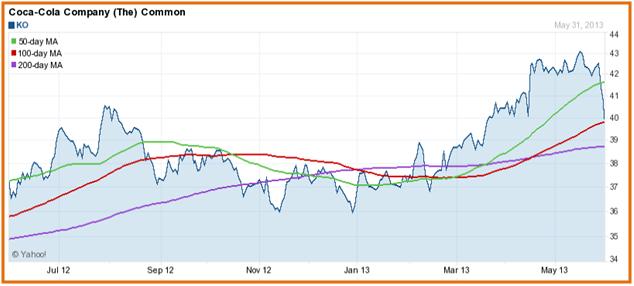

As is apparent from the stock movement chart below, Coca-Cola stock saw a sharp decline during the month of August 2012, at which point the company had executed a 2:1 stock split (on Aug 13). During August 2012, the stock lost 8% of its value (down to $37.40 on Aug 31 from $40.51 on Aug 1). From then, up to mid Feb 2013, the stock has seen a fair bit of volatility while trading in a semi-base-building pattern.

Having established a fairly eratic base, the stock started an upward movement in the second half of Feb 2013, which saw it break resistance at its 50-day, 100-day and 200-day Simple Moving Averages (SMAs), peaking at $43.09 on May 16.

Since then however, KO has dropped precipitously, closing lower in 8 of the last 10 trading sessions (as of May 31). The last 3 trading sessions have seen the stock lose more than 6% o its value in a free-fall, dropping through support at its 100-day SMA ($37.44), and heading downward towards its 50-day SMA ($37.20).

Technical-minded investors would do well to watch and see if the stock finds support at the 50-day SMA. If not, the next technical milestone will likely be at the 200-day SMA ($37.85), beyond which the stock could very well see levels that it saw back in late Dec 2013-early Jan 2013 (in the $35 range).

- Bottom Line Conclusion

Based on the categorical results from our above analysis, MarketConsensus rates Coca-Cola stock, KO, as a MODERATE BUY.

Best of luck in your investing,

In the meantime, do let us know if you have any questions. Also check out the below stock analysis news articles.

Contact Us (Questions/Comments)

Facebook (Like MarketConsensus)

Twitter (Follow Us on Twitter)

[related1][/related1]