Day Trading for New and Intermediate Investors and Traders

Day trading first became popular during the period of the dot-com bubble. Transaction costs were low and little investing knowledge was needed because prices mostly went in only one direction during that period (Up). Today, day trading is still seen as an attractive way to earn a living.

What is Day Trading?

Strictly speaking, day trading involves buying and selling an asset in the same day. Day traders are known for “In and Out” movements in a particular stock. This means they might buy shares in a stock and sell those same shares (Or short a stock and buy to close) within minutes or hours. And they quite often do this all day long. Some day traders focus only on price momentum, while others concentrate on technical patterns. The asset of choice is usually equities on the stock market, but could be currencies, gold, you name it.

(See Also: Why Bank of America Stock is a good Buy – Valuation and Technical Stock Analysis)

Nevertheless, you will sometimes find a few individuals who identify themselves as day traders, but stay in a position for as long as a few days. These individuals, however, are in the minority. Such traders believe in letting the profits run, and choose not to sell (or buy to cover) the shares until the next day or for a couple of days.

Most day traders, however, will close out their positions before the market closes. This is done to avoid and mitigate unexpected / unanticipated risks. For example, a stock that closed at $10 today could open at $8 tomorrow, a situation known as negative price gap. In fact, there are a couple good reasons why a day trader would want to have nothing but cold, hard cash in their account at the end of the day. One is “leverage”, which we will discuss in a moment. The other is simply the peace of mind knowing that nothing bad can happen to your account or trade while you sleep.

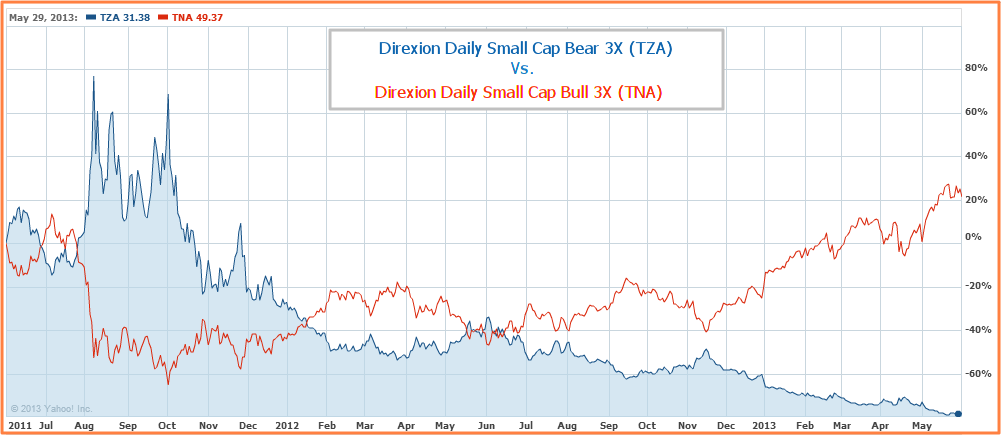

Leveraged EFTs (TZA, TNA, FAS, FAZ, etc.) are Favored by Day Traders

Of course, the Securities and Exchange Commission, which regulates activities in the U.S. stock market, has its own definition of a “pattern day trader”. According to the rules, a pattern day trader is one who makes at least 4 day trades in a 5-day period. Such traders are required to keep at least $25,000 in their trading account. The advantage to being subject to this rule is that you are permitted to trade up to 4 times the normal margin capacity of your account.

What is the Best Way to Approach Day Trading?

That depends on your risk tolerance and knowledge of the markets. Do you prefer a high probability of making a small profit on each trade? Or do you want to reach for big gains, at the risk of suffering big losses? Can you look at a chart and immediately understand what is happening, or are you the type who likes to run the numbers through a spreadsheet? Your first task for day trading is to find a style that you are comfortable with.

(See Also: Will AAPL Rise Again in 2013? Is it a Good Day Trading Stock?)

Do you have the self-discipline to make a plan and stick to it? How will you react when the market goes against you? Many poor traders refuse to take losses and their day trade turns into an “investment” – a bad investment.

Day Trading Tools and Platforms

There is quite an amount of online trading sites available for the individual investor or trader looking to day trade. MarketConsensus News recently published a top-ranking report on the best online trading firms. Applying various comparison ranking factors, we narrowed our list down to the top five online discount stock brokers.

While some investors and traders are contented to using full-service brokers that provide them with a one-stop investing or trading platform, most day traders use online brokers which offer low cost pricing and plenty of powerful tools for use in managing day trading strategies.

(See Also: Top 10 Best Forex Brokers, Futures and Options Trading Firms)

Breakouts and Reversions

Many traders like to trade breakouts. A breakout could be defined as a new high for the day or a move out of a sideways congestion area. The idea is that you are catching the beginning of a new trend and, as they say, the trend is your friend.

(See Also: Stock Trading Risks, Rewards and Exit Strategies)

On the other hand, some will use a “reversion to the mean” strategy. In this case, you are looking for situations where prices have moved too far, too fast. This is sometimes known as “fading” the market.

Both approaches can be profitable. Veteran traders often employ a handful of different strategies at the same time. But new day traders would be better served by mastering one technique and then slowly adding new weapons to their arsenal.

There are as many ways to make money in the market as there are successful traders. But there is one method which almost certainly will not work: hope. Buying and selling based on hope is obviously not a path to long-term day trading prosperity.

(See Also: How to Trade Vodafone (VOD) Stock: Valuation Analysis & Trading Strategy)

Most people fail at trading because they are either unable or unwilling to come up with a proven plan and stick with it. If you can do it, then the odds are in your favor.

Traders Checklist:

- Capital – at least $25,000, but the more the better

- A repeatable method – know exactly why you are getting in and out of a trade

- A willingness to be wrong – it is ok to be wrong, but it is not ok to stay wrong

- Patience! – applies to your learning as well as your day trading

And, finally, remember this: The market wants to separate you from your money. After all, to the person on the other end of your trade, you are “the market”!

[related1][/related1]

—————————————-

Best of luck in your investing,

Don’t hesitate to email us if you have any questions, comments or feedback,

MarketConsensus

Stay in Touch:

Contact Us (Questions/Comments)

Facebook (Like MarketConsensus)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)