Despite Better Financial Margins, Coca-Cola Stock Lags its Competitors

The Food and Beverage industry is a highly competitive one, and is much more dependent on consumer discretionary spending than many other industries into which shareholders could divert potential investment dollars.

A look at the stock price movement chart below, comparing Coca-Cola (KO) against industry peers Dr. Pepper Snapple Group (DPS) and Pepsico (PEP) indicates trend lines that are moving more or less in lock-step, with PEP a clear winner for most of 2013, and KO the most depressed of the three stocks over the past year.

Coca-Cola though has the better Profit Margins (18.19% versus 10.53% and 9.33% for DPS and PEP respectively), better Return on Assets (8.08% versus 7.77% and 7.78%) and much higher Operating Margins (13.25% versus 18.24% and 14.19%).

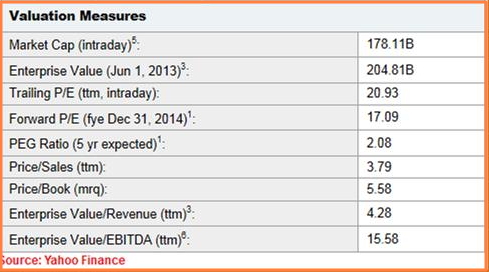

On a F P/E (Forward P/E) basis, the three companies are valued within a fairly narrow range of each other, with Dr. Pepper (13.81x) the most discounted, and Pepsico (16.90x) and KO (17.09x) in 2nd and 3rd place respectively

Coca-Cola’s Current Valuation Matrix

The biggest favorable catalyst that KO has going in its favor is its solid portfolio of brands and the company's vast world-wide network of distributors that has allowed it to dominate the non-alcoholic beverage market in over 200 countries.

Despite that, a growing consciousness in the developed world (especially in the U.S. and parts of Europe) over the unfavorable health effects of over consuming carbonated drinks could cause a dampening impact on profits from these markets. These headwinds are however more than compensated for by longer-term prospects of increased consumption in many of its other international markets.

—————————-

Best of luck in your investing,

Don’t hesitate to email us if you have any questions, comments or feedback,

Contact Us (Questions/Comments)

Facebook (Like MarketConsensus)

Twitter (Follow Us on Twitter)

[related2][/related2]