Does the FRB Findings Present a Buy Opportunity for Morgan Stanley Stock?

At long last, the Federal Reserve Board of Governors (FRB) has announced the findings from its 2013 Comprehensive Capital Analysis and Review. This is great news for Morgan Stanley (NYSE: MS). As part of its review, the Fed approved Morgan Stanley’s Capital Plan. More specifically, part of the approved plan was a proposal for MS to acquire the remaining interest in the Wealth Management business of Morgan Stanley Smith Barney, which could provide a boost to MS's future revenue earning potentials.

The question foremost on the mind of investors might be whether the Fed announcement now spells a real turnaround for Morgan Stanley stock (MS). In view of this fact, investors might be wondering whether the stock is a Buy, Hold or sell.

Let's review some of the key stock valuation analysis and data for MS that might help answer that question.

Morgan Stanley– Stock Valuation Analysis Report (NYSE: MS)

- MS Fundamental Analysis

- MS Valuation Overview

- MS Stock Technical Perspective

- Favorable/Negative Catalysts for Morgan Stanley Stock

- Bottom Line Conclusion on MS Stock

- MS Fundamental Analysis

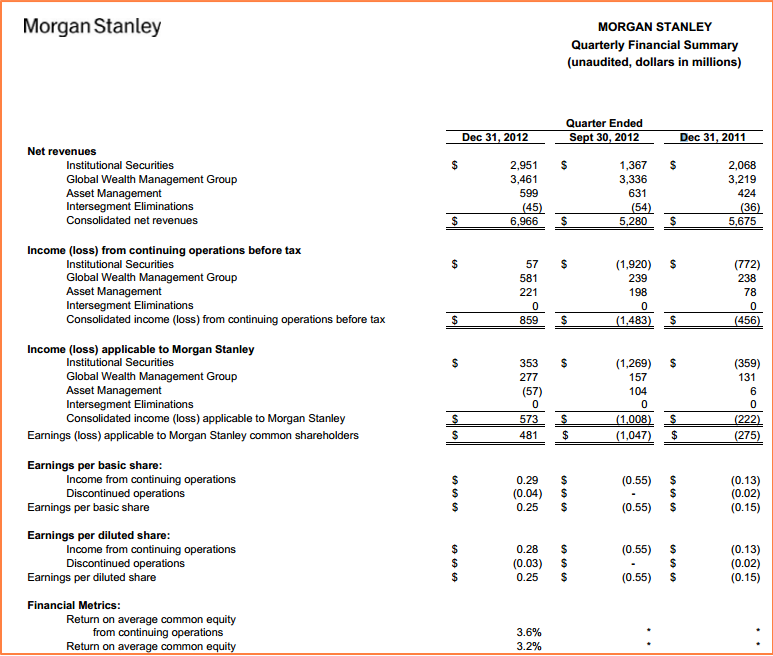

Morgan Stanley (NYSE: MS) reported Q4 and full-year 2012 results on January 18th 2012. Of note for shareholders were a couple of reversals that these results represent.

First, the Q4-2012 Earnings per diluted share (EPS) of $0.25 was a reversal from the -$0.55 loss from the previous quarter. For Q4-2012, on a per diluted share basis MS's GAAP income came in at $0.28, which was a significant improvement over the same-period last year when the company reported a loss of $0.13 per diluted share. Overall, the company handsomely beat the $0.27 Q4-2012 EPS expected by stock analysts (see below) by reporting a $0.45 Q4-2012 EPS. This represented a 66.70% beat to the upside.

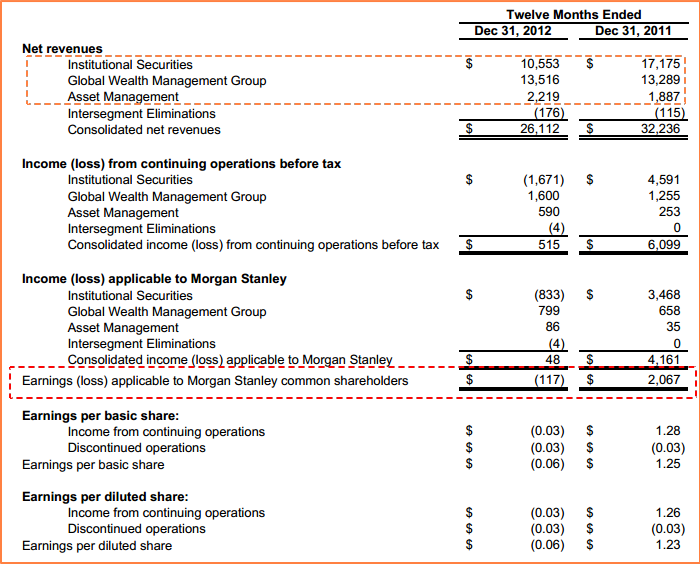

Shares of MS rose sharply, by 7.86%, on the earnings announcement, closing at $22.38 on Jan 18th, up from the previous day's close of $20.75. The company did, however, post a $117M loss for full year 2012, compared to a $2.06B profit for full year 2011 (as shown on the below table). Also, there was a 39% net revenue decline in its Institutional Securities business, which reported 2012 net revenue of $10.5B versus the $17.17B reported in 2011.

Both its Asset Management (AM) and Global Wealth Management (GWM) businesses experienced an increase in revenue from the previous year. With the AM business reporting $13.5B in 2012 net revenue versus the $12.3B reported in 2011. The GWM business reported an 18% increase in revenue from the previous year.

- MS Valuation Overview

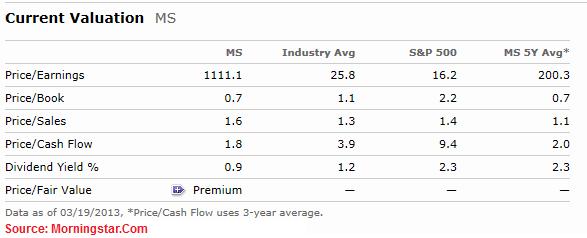

At the time of this analysis, MS appears to be trading at a slightly lower valuation on most metric when compared to the Industry Average and the S&P 500. When looked at on a Price/Book valuation (0.7x), the stock trades at a slight discount than both the Industry and the S&P index. Competitor Goldman Sachs Group Inc (NYSE: GS) and JP Morgan Chase & Co (NYSE: JPM) are trading at slightly higher P/B valuations (at 1.0x) than MS.

(See Also: JP Morgan (JPM) – A Value Stock to Buy after Q4 Earnings?)

Overall, MS is also trading at a fair value compared to its 5-year average for the major valuation metrics. However, shareholders should take note that MS offers a much lower Dividend Yield (0.9%) than the Industry (1.2%) and the S&P (2.3%). Even competitors GS (1.3%) and JPM (2.4%) offer a better dividend value proposition.

When compared on a forward P/E basis, MS looks fairly valued (at 9.1x) against both GS (9.5x) and JPM (8.3x).

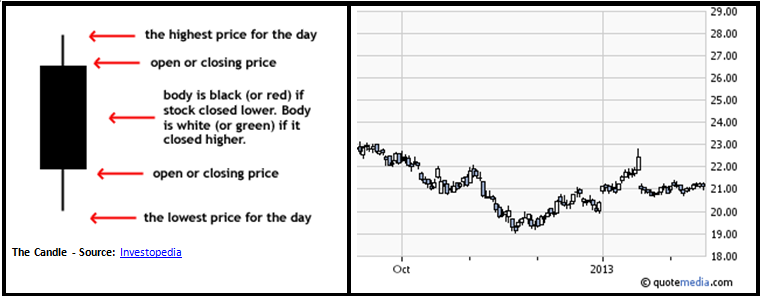

- MS Technical Perspective (For those interested in the technical details)

At the time of this analysis, MS is trading at $22.73 which is close to its 52-week trading range of between $12.26 and $24.47. The stock was trading at $19.358 around this time last year, which means that at current levels the stock is up almost 17%.

From the chart above, we can see that the stock has executed the classic Golden Cross manuver, where shorter-term Simple Moving Averages (SMAs) rise above their longer-term ones. This has happended on at least two occasions during the past 52-weeks. In November of 2012, the stock found support at its 200-day Simple Moving Average (SMA), and used it to move higher.

(Other News: Is Netflix Stock (NFLX) a Buy, Sell or Hold? Stock Soars 63% in 4 Days)

Over the past few sessions, the stock has tested its 50-day SMA of $22.54, but has not stayed below it for long. For most of March 2013, the stock seems to be building a base at its current levels. This is a good technical indicator that MS may have found support at these levels and is poised to move even higher. Investors should pay close attention to whether the stock is able to hold on to its current momentum, especially in the wake of the ongoing US financial crunch. Should the stock fall through its 50-day SMA support, the next milestone will likely be to see if it drops below its 100-day SMA of $20.03.

- Favorable Catalysts

As the US economy recovers, corporate mergers and acquisitions is beginning to pick up, as is other corporate investment activity, providing opportunities for MS's Investment Banking operations to grow further.

MS's expansion of its Wealth Management business is definitely a positive. As stock prices continue to surge and clients see their asset values improve, they are likely to offer MS additional wealth management opportunities, which will result in higher fee income.

While receiving Fed approval for its Capital planis a positive sign, the financial industry, especially trading and investment banking, is still living under a cloud of regulatory uncertainty. Increasing liquidity requirements, restrictions on trading and investment banking activity, or additional reporting and oversight requirements by the Fed could prove a negative catalyst for MS stock.

MS's decision to acquire Smith Barney from Citigroup has not yet started bearing the fruit that company management had hoped. The longer the integration takes, the more costly the acquisition will become, and the more revenue-earning opportunities MS will lose out on. This could then become a drag on overall company growth and profitability in the coming quarters.

Finally, with MS's global financial exposure, European economic woes could be a significant negative catalyst for its future growth plans.

- Bottom Line Conclusion

Based on the above analysis, Morgan Stanley would rate between a HOLD and a MODERATE BUY on weakness. (By: Monty R. – MarketConsensus News Contributor)

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

————————————————————————————————-

[related2][/related2]