Apr 18th, 2013: A quick snapshot of Verizon Communications (VZ)'s top-line and bottom line results.

Financial Highlights: Improved margins, strong cash flows, continued momentum in gaining customers and increasing revenue in most lines-of-business

Total Revenue: Verizon Communications (VZ) reported Operating Revenue of $29.42B, which was a 4.2% improvement over the $28.24B reported last year. This was in line with the average forecast of $29.54B expected by analysts.

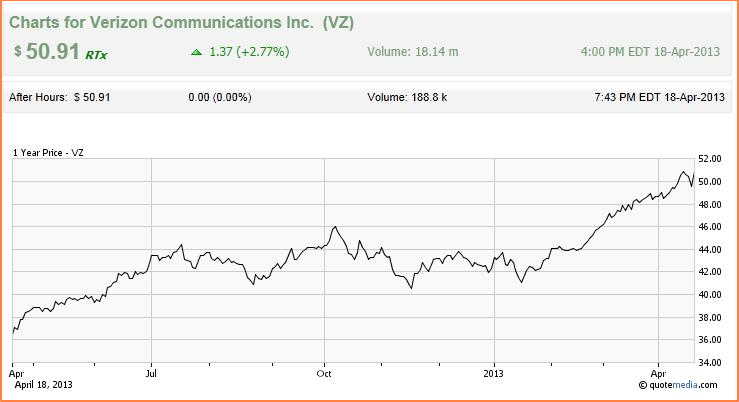

(See Also: Verizon Stock (VZ) Soars 22% in 1 Yr. Time to Buy the Stock?)

Net Income: VZ's Net Income of $4.8B was an impressive 24.3% higher than the $3.9B (Q1 of 2012) reported by the company.

EPS/Diluted: VZ's EPS/Diluted came in at $0.68, which was above the $0.66 estimated by stock analysts, and a 15.25% beat over the $0.59 reported last year.

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related1][/related1]