Fifth Third Bank Reviews 2014 | Pros, Cons | CDs, Mortgages, Rates, Benefits

Below is this year’s detailed review of Fifth Third Bank. In conducting our review analysis, we identified some key pros and cons that consumers should consider when banking with Fifth Third Bank or when looking to open a new account.

Review of Fifth Third Bank

- Origin, Growth and Main Businesses

- Services Provided

- Net Interest Income

- Fifth Third Bank Rates and Fees

- Fifth Third Bank Customer Complaints / Negative Consumer Reviews

[related1][/related1]

Origin, Growth and Main Businesses – Fifth Third Bank Review

Fifth Third Bank is a diversified financial services firm headquartered in Cincinnati, Ohio. It is among the largest money managers in the Midwest. It has 18 affiliates with 1,326 full-service Banking Centers. This includes 104 Bank Mart locations open seven days a week inside select grocery stores, and 2,374 ATMs in Ohio, Kentucky, Indiana, Michigan, Illinois, Florida, Tennessee, West Virginia, Pennsylvania, Missouri, Georgia and North Carolina.

[related2][/related2]

Fifth Third traces its origins to the Bank of the Ohio Valley, which opened its doors in Cincinnati in 1858. In 1871, that bank was purchased by the Third National Bank. With the turn of the century came the union of the Third National Bank and the Fifth National Bank, and eventually the organization became known as "Fifth Third Bank".

The bank operates four main businesses: Commercial Banking, Branch Banking, Consumer Lending, and Investment Advisors. It also has a 25% interest in Vantiv Holding, LLC.

[related1][/related1]

Services Provided – Fifth Third Bank Reviews

Fifth Third Bank provides a wide range of services, including checking, savings, debit cards and more. When it comes to borrowing money, they offer everything from mortgages to credit cards, auto loans, personal loans and more.

Also, if you’re looking for investment products, they offer the standard CDs and IRAs, as well as more advanced investments like stocks, bonds, and options.

Aside from general banking services, they also offer accounting tools to help you manage your checking, savings, and credit card transactions.

[related2][/related2]

Fifth Third Bank Review – Net Interest Income

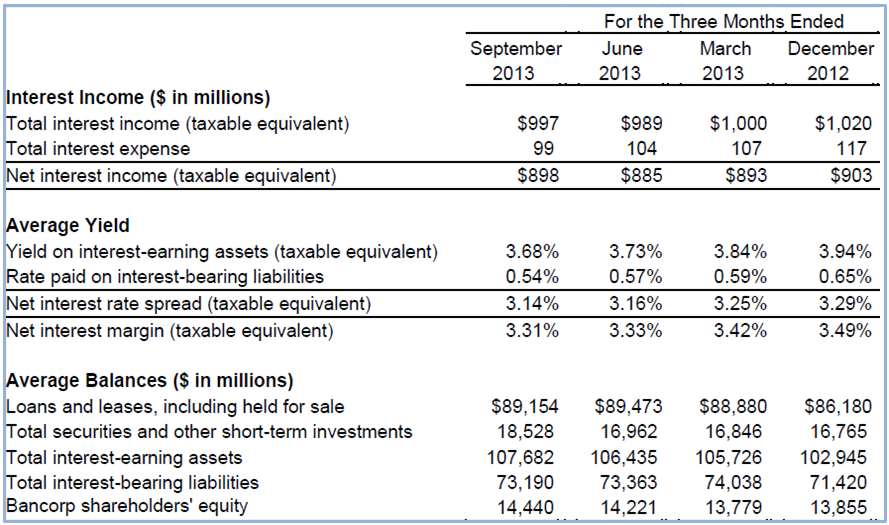

For the 3rd quarter of 2013 (the most recent financial statements available), the bank reported net interest income of $898 million, a 1.45% increase from the previous quarter. The increase was driven by higher balances and higher yields in investment securities.

Fifth Third Bank Financial Statement | Net Interest Income

* Figures are in millions

Fifth Third Bank Rates and Fees

When considering a bank, it’s important to look at the rates and fees across multiple options. From our research, we noticed that Firth Third offers rates that are viewed as very popular.

Related: 5 Best Online Trading Sites (2014) for Investors – Best Online Brokers

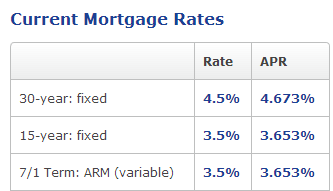

Fifth Third Mortgage Rates:

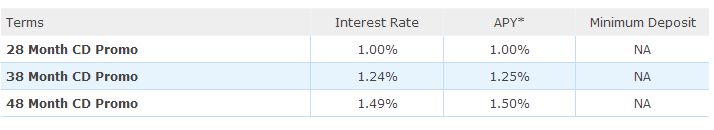

Fifth Third Bank CD Rates:

Equity Flexline Rate:

- Interest rate as low as 2.99%

- Variable rate, revolving line of credit

- Access funds via check, Equity Flexline MasterCard®, online, in person, or ATM

- Earn Rewards Points when using card for purchases

- The interest you pay may be tax deductible

- Interest only payments for the first 10 years

- Ability to lock in your balance at a fixed rate with a fixed term for a $95 fee

[related1][/related1]

Fifth Third Bank Customer Complaints / Negative Consumer Reviews

As with any large bank, Fifth Third Bank is no stranger to consumer complaints and negative reviews. Here are the most common things that people complain about.

- Purchases take too long to show up in accounts

- Unnecessary debt collection practices

- Poor customer service

See Also: 12 Best Banks to Bank With | No Fees, High Yield Savings Accounts, Reviews

Yes, they do have a few complaints, but the bottom line is they have unmatched experience, tools, and options.

Brand Finance, an independent global brand valuation consultancy, recently ranked Fifth Third Bank #100 on its list of the Top 500 Most Valuable Banking Brands in the world.

Fifth Third Bank has also been ranked second on the Ponemon Institute's list of Most Trusted Retail Banks for Privacy.

Overall, Fifth Third Bank is one of the best options that you can choose. Through years of experience, they’ve learned what it takes to provide exceptional banking services to consumers.

[related2][/related2]