First Premier Bank Reviews | 2014 Pros, Cons, Complaints, Benefits, Rates

This First Premier Bank review article is a follow up to similar reviews that we’ve published on other banks, as presented below.

[related1][/related1]

Based in Sioux Falls, South Dakota, First Premier Bank specializes in providing banking services and credit cards to a wide range of consumers, including those with bad, developing or new credit.

Although, there are a lot of consumer complaints about the high interest rate that First Premier Bank charges, the purpose of this review article is to present an objective review of the pros and cons of using First Premier Bank.

First Premier Bank Review

- Origin and Growth

- Account Requirements

- Rates & Fees

- Bank Services and Products – First Premier Bank Review

- Pros – First Premier Bank Review

- Cons – First Premier Bank Review

See Also: Lloyds Bank Review | History, Rates and Analysis of Lloyds Online Banking

Origin and Growth

For the past 30 years, the bank has been owned by T Denny Sanford, with much of the profits being donated to charity via the T Denny Sanford Foundation.

Today, First Premier Bank is the 10th largest issuer of credit cards (in the US) to those with new, poor or developing credit histories.

Don’t Miss: Union Bank Reviews 2014 | History, Rates, Fees, Pros, Services, and Complaints

Account Requirements

- Checking accounts – these start from a basic, free account, with no monthly fee and no minimum balance required.

- Interest earning accounts require a $500 per month balance.

- A rewards account is available, but requires you to maintain a $10,000 balance.

- There is a Premier Account available to those over 55 years of age. This account pays interest, but doesn’t require a balance.

- Finally, the e checking account is a financial checking tool that gives you a First Premier Bank check card, but no check book. It is ideal to be used for a student account or those with less than perfect credit.

- Savings accounts can be opened with as little as $50 at a charge of $2 per month.

See Also: PNC Bank Reviews | 2014 Review of PNC Rates, Fees, Complaints, Online Bank

Rates & Fees

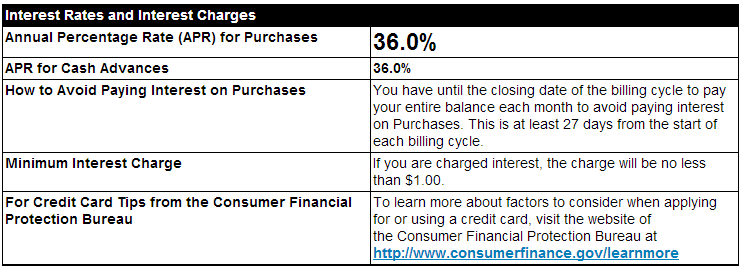

First Premier Bank Interest Rates and Interest Charges:

[related1][/related1]

First Premier Bank Fees

[related2][/related2]

Bank Services and Products – First Premier Bank Review

First Premier Bank offers a wide range of services and products for both business and personal customers, including:

- Checking accounts

- Savings and CDs

- ATM and debit cards

- Merchant card services

- Treasury card services

- Group banking benefits

- Business financing

- Corporate credit cards

- Retirement planning

- Brokerage service

- Trust and investment services

[related1][/related1]

First Premier Personal Banking Products:

- Checking accounts

- Savings and CDs

- ATM and debit cards

- Telephone banking

- Safety deposit boxes

- Reorder checks

- Personal loans

- Personal lines of credit

- Mortgages

- Retirement planning

- Brokerage services

- Trust and investment services

[newsletter1][/newsletter1]

First Premier Bank Loan Products:

- Fixed interest rate personal loans can be arranged over different periods of time. These loans can be secured or unsecured and there is no early payment penalty.

- First Premier Bank offer different types of mortgages. The most popular one is a conventional loan that ranges from 10 t0 30 years in term.

- They also offer Government loans, Home Construction financing which is a short-term loan for those building their own home and South Dakota Housing Development Authority loans (SDHDA), which offers home loans at below market rates

Pros / Benefits of Banking with First Premier Bank

- With a comprehensive list of products, First Premier Bank is able to meet the needs of a wide range of consumers.

- Its products are designed for people of all ages, from someone just starting out on their first job to someone interested in retirement planning investments.

- First Premier Bank is well known for providing services to the sub prime market, so if you have struggled to achieve any sort of decent credit rating, it is likely that you will have been turned down for a credit card or any form of finance by most of the mainstream banks.

- Whilst the interest rates charged by the bank are extremely high, First Premier Bank offers banking services to most people that have been turned down by other banks.

- The bank offers many banking services on its online platform, saving you a trip to your local branch.

[related1][/related1]

Cons of Banking with First Premier Bank

- High credit card interest rate charges

- Bank charges are levied wherever possible, so you’ll want to read the fine print very carefully

- The bank seems to charge a fee for just about everything

- Purchases made on the credit card are not automatically updated on statements, so it is difficult to budget properly, which can lead to more debt

- High annual and application fees on the credit card

MarketConsensus Contributors: Suzanne H. and Ogbe Airiodion

[related2][/related2]