- Valuation Overview

(Continuing from Segment 1: "GE Stock Value Proposition for Investors – Fundamental Analysis")

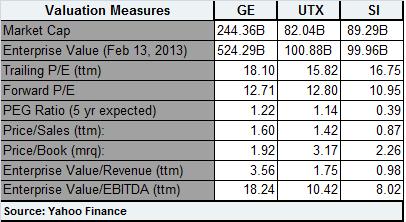

In continuing our fundamental valuation analysis on whether General Electric (GE) stock is a buy, sell or hold in 2013, we'll be reviewing some key valuation metrics for GE and its two main rivals. We believe that price-based valuation metrics are better comparators when measuring peers. That's because they boil down some of the more complex, cost-based and percent-based metrics and present them in simple to understand terms that even shareholders with average investing knowledge can understand.

The table below highlights some key price-based valuation metrics for GE, United Technologies Corp. (UTX) and Siemens AG (SI). Looking at the Trailing P/E metric, we see that investors paid slightly more (18x) for a dollar of GE earnings than they did for UTX (15.82x) or SI (16.75x). On a Forward P/E basis though, GE fares well against UTX, its major rival, but is not overly expensive compared to SI either. At 1.92x, GE does look comparatively undervalued on a Price/Book Value basis, but does seem over valued on a Enterprise Value to Revenue and EBITDA basis.

Given GE's massive Market Cap ($244.36B) and Enterprise Value ($524.29B) however, it may not be surprising that these metrics (Enterprise Value to Revenue and EBITDA) come in higher than the competition.

- Technical Perspective

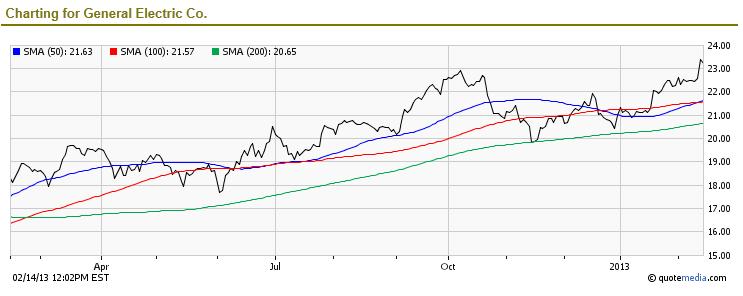

Based on Morningstar data, GE's stock is trading in a 52-week range of $18.02 and $23.48. As seen in the chart below, for most of the past year the stock has been moving in an upward trajectory, moving from $18.133 on Feb 15th 2012 to its current levels ($23.24) 12 months later.

Over this course of time, the stock has attempted to breach support levels at its 200-day Simple Moving Average (SMA) once, but bounced back to claim new highs. Since the start of 2013, the stock has also found support at its 50-day SMA, being unable to fall below that level. At the time of this writing, the stock has only closed lower 7 times in the past 20 trading sessions. From a technical perspective, it would seem as though this stock might be poised to set newer 52-week highs. Next: Favorable Catalysts that make GE Stock a Buy (2013 Buy or Sell Analysis)

SERIES:

- Series 1 of 3: GE Stock – Value Proposition for Investors (Fundamental Analysis)

- Series 2 of 3: Is GE Stock a Buy, Sell or Hold? 2013 Valuation & Technical Analysis

- Series 3 of 3: Favorable Catalysts that make GE Stock a Buy (2013 Buy or Sell Analysis)

(By: Monty R. – MarketConsensus News Contributor)