Is GE Still a Generally Electrifying Stock?

General Electric Company (NYSE: GE) generally makes it a point to dominate market segments within which it operates. Over the past few years, in attempts to refocus its massive resources on key segments, it has made strategic decisions to drop a number of high-profile business ventures, including the recently expedited exit from NBC Universal studios.

GE Share Price vs. Competitors – Source: Yahoo Finance

As the chart above shows, after visibly underperforming its two main rivals, United Technologies Corp. (NYSE: UTX) and Siemens AG (NYSE:SI), GE stock has mounted a steady comeback since late 2011. The question is whether, by exiting many of its steady cash-flow generating non-cyclical businesses, and a decline in other traditionally strong cash cows like “Commercial Lending and Leasing”, does GE offer a Buy, Sell or Hold value proposition to its shareholders?

Let's review some of the facts that make GE what it is today.

General Electric (GE) Corporation Analysis Breakdown

- Fundamental Analysis

- Valuation Overview

- Technical Perspective

- Favorable Catalysts for GE Stock

- Bottom Line Conclusion

- Market Correction Impact

- Fundamental Analysis

Earlier this year GE reported its Q4-2012 numbers. The company ended 2012 on a high note, reporting an EPS of $0.44, which was a 13% increase in EPS over last year. In addition to organic growth, the company is also pursuing a growth-by-acquisition strategy. With nearly $17B of cash sitting on its balance sheet, Bloomberg reported that the company could look to beat one of its competing bidders for the acquisition of Avio SpA Cinven Ltd, the Italy-based aerospace-parts manufacturer. Should that $4B deal go through, it could prove very accretive to investors.

With that much cash on hand, shareholders will likely look forward to GE's continued policy of dividend growth and share buyback, which gave investors a 12% increase in dividends in 2012.

On an operational front GE continues to experience growth across its various global business units with six of the company's nine growth regions reporting double-digit growth. New orders grew roughly 7%, and internally-driven growth came in at 4% for the quarter and 8% for the year.

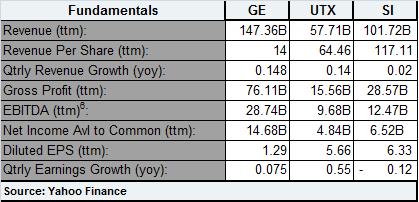

GE Profit Margins Vs. Competitors – Source: YCharts

Assessing a company's quarterly Profit Margins over a 5-year period, versus its industry peers, would provide investors an insight into how strong a company's fundamentals are. While quarterly margins for both GE and UTX have followed in close lock step over the review horizon, UTX seems to have pulled away to lead the race over the last few quarters.

However, GE stockholders should take heart in the fact that their investment is delivering steady, even slightly improving profit margins, unlike the erratic margins of SI.

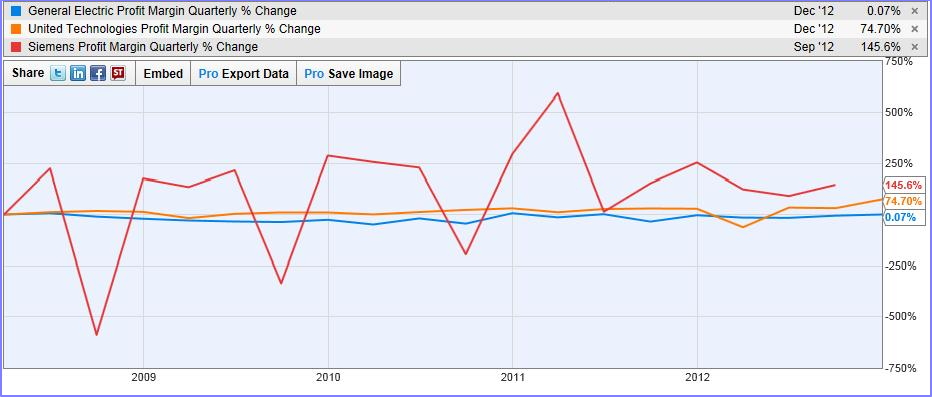

A head-to-head comparison of the fundamentals of each of the three peers, as seen in the table below, clearly shows that GE's TTM dollar metrics (Revenue, Gross Profit, EBITDA and Net Income Available to Common Shareholders) are far greater than either of its two competitors, UTX or SI. Even on a Y/Y (year over year) Quarterly Revenue Growth basis, GE outperforms its rivals.

Nevertheless, GE's Quarterly Earnings Growth (yoy) leaves much to be desired. But with some of the measures taken over the last 2 years, including divestments of non-core businesses, and refocusing on its core-competencies, shareholders should look for GE to become more competitive in some of its other fundamental metrics.

- Valuation Overview

Price-based valuation metrics are better comparators when measuring peers as they boil down some of the more complex metrics and present them in simple terms that even shareholders with average investing knowledge can understand.Here are some key valuation metrics for GE and its two main rivals….Continue: GE Stock Valuation & Technical Analysis

SERIES:

- Series 1 of 3: GE Stock – Value Proposition for Investors (Fundamental Analysis)

- Series 2 of 3: Is GE Stock a Buy, Sell or Hold? 2013 Valuation & Technical Analysis

- Series 3 of 3: Favorable Catalysts that make GE Stock a Buy (2013 Buy or Sell Analysis)

(By: Monty R. – MarketConsensus News Contributor)