Growing Your Investments

This segment focuses on Growth Investing, and provides quick highlights on what you should consider when investing in growth stocks.

What is a "Growth" Company?

Simply put, a "growth stock is a stock of a company that generates substantial and sustainable positive cash flow and whose revenues are expected to grow faster than the average company within the same industry". Other growth metrics include rising revenue, improving sales, expanding market share and higher profits, or a combination of these metrics. When companies grow these metrics at a rate higher than their industry peers, they are considered to be "Growth companies". The rationale for investing in growth stocks is as follows:

- Investors are always willing to pay more for a stock if they believe the stock's price will rise a lot in the future

- If the company continues to deliver increasing performance against some or all of those growth metrics identified above, its share prices will continue to rise

- And the more a company is perceived to be capable of delivering growth in future, the more investment it will attract, and the higher its stock price will rise

And that's the cycle that fuels growth stocks. Unlike Income investing, where shareholders continue to receive periodic dividends while they hold the stock, Growth stocks often do not pay dividends, and even if they do, the dividend yield is likely to be comparatively small, relative to Income stocks. That's because Growth companies prefer to hold onto their earnings to re-invest in future growth opportunities. Instead of paying dividends, they reward their shareholders through share price (capital) appreciation.

What to Look for in Growth stocks

Stocks such as Google (GOOG) and Apple (AAPL) are classic growth stocks which investors buy and hold for the long run, hoping that over time their earnings growth will drive their stock prices higher. Even though Google pays no dividend, and Apple pays only a 2.35% dividend, Growth investors believe they are worth investing in.

A general tendency for growth investors is to buy stocks that show above-average performance in what they believe to be growth metrics, regardless of what the current price of a stock is. All else being equal, the key quantitative characteristics that highlight a growth stock are:

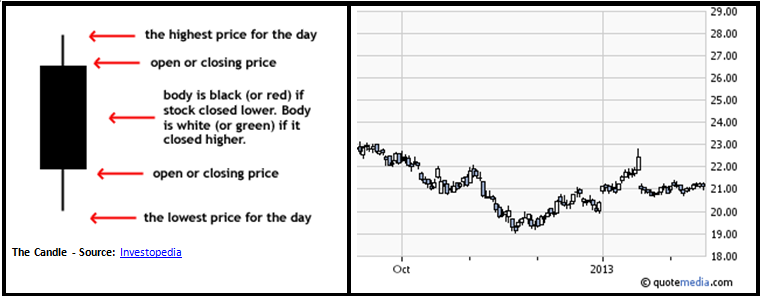

Earnings Growth: Look for companies that report consistently higher earnings growth, even when competitors and the industry might be struggling. If a company has a long track record of increasing earnings, but falters for a few quarters in a row, that may be a sign that a company's long-term growth potential may be in jeopardy (i.e. AAPL: Will Apple Stock (AAPL) Rise Again in 2013? Growth vs. Value Analysis).

Price/Earnings Ratio: By definition, Growth stocks will usually trade higher, on an earnings basis, than "Value" stocks. The reason that Growth stocks have high P/E ratios is because investors are willing to pay the higher price to capitalize on higher future earnings.

Price/Earnings Growth Ratio: This metric tells investors how well (good) a stock is valued, given its expectation for future earnings growth. Investors looking at the P/E ratio as a standalone metric might not get a full measure of a company's earnings growth potential. The higher the PEG ratio, the more growth rate is expected from the company. PEG Ratios of between 0 and 1 might indicate a fair expectation of growth, while negative PEG values indicate declining growth expectations.

Some other measures should be used in evaluating your investment decisions in Growth stocks. These include:

- Growing pool of innovations: A company that continually invents and innovates new ideas and new products, faster and better than the competition, might be a good candidate for Growth investors to consider

- Speculative impact: Some investments might look like growth opportunities based on market speculative influences. The "herd mentality" may cause stock prices to shoot up, producing tempting growth metrics. Look carefully at the volatility in such stocks to confirm whether they are truly growth investments or simply trading opportunities

- Overall growth: While a company may seem great as a potential growth investment based on measures such as PEG ratios, before committing an investment, investors should research how the company is doing relative to growth rates in economies where its primary business is carried out, as well as growth in trends for using the company's products and services

- Shareholder value dilution: Fast growing companies often need a lot of cash to fuel their growth. They get this capital through debt or by issuing additional shares. The more shares that a company issues to fund growth, the more existing shareholder value is diluted. Before investing therefore, carefully review the company's track record in terms of issuing new shares or incurring growth-related debt

Risks Associated with Growth stocks

Investors looking for Growth stocks must realize that the measure of future growth of a company, like predictions of rain, snowfall or inflation, can often be wrong. Professor Cyrus Ramezani, of the California State University, conducted an exhaustive study of 2,000 companies in 2002 to identify whether growth stocks actually delivered better value to shareholders than other types of stocks. The results of his analysis shows that, over the study period, higher revenue growing companies delivered lower share price appreciation than their low revenue generating peers.

High-growth companies are often unable to maintain and sustain their rate of growth. AAPL is a prime example, which has seen its share prices fall sharply, from a high of $700 to as low as $450 (at the time of this writing) primarily because it has been unable to grow at the rate that shareholders expected it to.

Conclusion

The conclusions of Professor Ramesani's study does not mean that "Growth investing" as a strategy is flawed. Whether you are an investor looking for income, or whether you are in search for growth, there are ample opportunities to make money through either Income or Growth investing. The key to coming out ahead is proper analysis and continually monitoring your investments.

[related2][/related2]