Guide to Improve Your Credit Score | Understanding Your Credit Score Rating

Since the 2008 recession, the number of people with excellent credit scores continues to dwindle.

While not everyone has bad credit, the majority of us could do with a better credit score rating than we currently have.

Why do People have Low Credit Scores?

There are different reasons for this. Some people borrow beyond what they end up being able to afford.

Others fall into unexpected financial constraints that impact their abilities to pay their debt or credit obligations.

In addition, if you’ve never had a mortgage, loan or credit card, then it is likely that your credit rating will be below average.

Below we provide a quick and easy guide on how your credit score is calculated.

In addition, we present the various ways in which you can actually increase your credit rating and improve your credit score.

- Investing in a 401K Plan

- What to Invest In, Where and How to Invest Money (New & Beginning Investors)

What Is My Credit Score?

Basically your credit rating is worked out by calculating your ability to repay a lender.

This is based on your credit history; so if you have had a credit card in the past and religiously made your repayments every month, then your credit score is going to be good.

However, if you have missed some of your credit card payments – either through accident or being unable to pay – your credit score is lowered because your reliability in terms of paying back your debts is reduced.

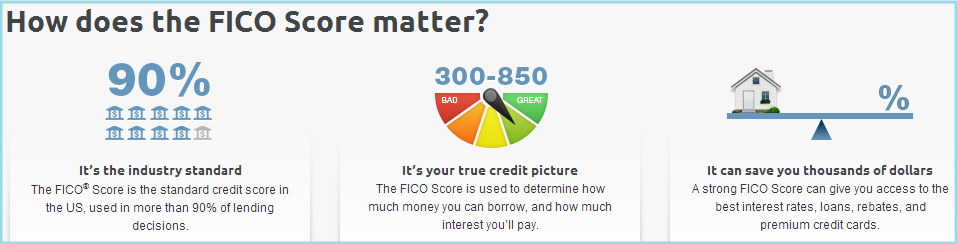

The FICO score is the most widely used barometer of your credit rating. It started back in the 1980’s and is currently used by over 90% of lenders to determine your reliability and ability to repay a loan.

It is made up of 5 components:

- Payment history

- Credit utilization (ratio between your credit limit and your credit debt)

- Credit history length

- Credit type

- Requesting new credit (for example: applying for a new loan or credit card)

All of these elements combined make up your FICO score and are used by lenders to forecast how trustworthy you are.

- What Do You Really Know About Those Numbers at the Bottom of Your Check?

- The Housing Market Has Reached a Bottom – Time To Buy?

FICO Scores

FICO scores range between 300 and 850. The higher your score, the better credit rating you have.

Most people fall around the 700 mark and will be given credit. The terms you get, however, will not be as good as the terms offered to those with credit scores around the 800 level.

A High FICO Score Can Translate Into Big Savings

In the long run a high FICO score enables you to pay less interest than you would with a lower score.

For example, a lender offering a 4.743% annual percentage rate (30-year mortgage) to borrowers with high FICO scores (760 to 850) might charge a 6.332% interest rate to borrowers with a FICO score between 620 and 639.

- Choosing the Right Investment Advisor and Financial Planner

- Declining Gold Prices Indicate all that is Gold Does Not Glitter

Impact of FICO Score on Payment

On a $250,000 mortgage loan, that monthly payment for high FICO score borrowers would be around $988.13 (interest payments only), versus $1,319.17 for those in the lower FICO score range.

That’s a difference of about $119,175 in interest payments over the 30-year life of the loan!

So, you can see in the simple example above how financially better off you can be with an improved rating.

Getting Your Credit Report

A problem that a lot of people have is that they don’t actually know what is in their credit report. So, they might be unaware of the credit activities, past credit events or mistakes that are having a negative effect on their credit score rating.

Getting an actual, accurate credit report is now free in the USA under the FACT Act (or the Fair and Accurate Credit Transactions Act) which was passed in 2003.

It means that every US citizen is entitled to one free credit report on their credit status every 12 months and you can get a free report from any of these three agencies: Equifax, Experian, and TransUnion.

[related2][/related2]

Improving Your Credit Score

Now onto the big question: how can I improve my credit rating?

This is no easy feat (if it were then everyone would have a good rating). However, it can be achieved through fairly basic means.

For example, it sounds obvious, but paying back your debts goes a long way towards getting a good to excellent credit rating.

If you have a credit card then make sure that you can make a payment every month on or before the due date.

Even missing just one payment will adversely affect your credit score and subsequently impact many aspects of your credit profile.

Auto-Payments

A good idea is to set up automatic online banking and online repayments.

Sometimes our credit card statements and bills are caught up in the mail and we end up missing the payment by a couple of days.

But monitoring your account online or setting up auto payments will ensure there are no missed or late payments.

[related1][/related1]

Many Payments Due at the Same Time

If you have a lot of bills due at a particular time or in the same week, then ask your credit card company to change your repayment dates.

Moving it by 10 days or so gives you a better chance to make the payment, which makes a big difference to your credit score.

Temptation – Taking on too Much Debt

Having access to multiple sources of credit sounds great, but if you can’t pay it back or if it is going to leave you in a ton of debt then it might not be worth it.

Rather than ending up heavily in debt and having issues paying your bills, it is much better (and we do understand it is not easy) to stop it at the source and avoid taking out unnecessary credit cards.

Sometimes retailers entice you by offering credit that will allow you to save money on purchases from their store.

This sounds like a great idea if you shop there regularly. However, it can leave your credit score worse off.

Even opening up a new credit line impacts your score as, for the first month or so, you have no credit history with that lender and it is seen as an unpaid debt rather than something you are actively repaying.

The best advice is to only take out a credit card if you a) don’t have one already or b) are able to make the repayments without any issues.

[related1][/related1]

Those with no Credit History

It might seem strange, but you are actually penalized for having no credit at all. So if your credit rating is low you need to get a credit card.

It sounds counter-intuitive; you want to have a good credit rating but you essentially need to get into debt (credit) and pay this off in order to build great credit.

If you don’t have a credit card or have never borrowed in the past then your credit rating is going to be quite low, especially if you are elderly. It is best explained by Anthony A. Sprauve, one of FICO’s Public Relations managers:

“Some people may move to a cash-only existence when they retire. This can result in a ‘thin’ credit file, which could make getting new credit tough – to replace an aging car, for example, or to downsize to a smaller home.”

This also applies to the younger generations as well. It may seem great to be one of the few without any debt or credit lines.

However, when it comes to getting a mortgage or even just taking out a cell phone contract, this will inhibit your ability to do so.

Finally get rid of your old credit cards. Opinion is actually somewhat split on this, as some people will argue that keeping old credit cards means that you will have a longer credit history on file.

However look at it another way. When you are applying for a loan the lender will conduct a credit check.

Say, for example, they find out that you already have 2 other credit cards in your name. You might not have used these for months or even years. However, the potential is there for you to use them, max them out and then reduce your ability to pay for the loan.

Getting rid of them and leaving on good terms (for example with a positive rating from the company) makes you a much more attractive prospect to future lenders.

[related1][/related1]

Good & Excellent Credit Is Not That Difficult

Getting a good or excellent credit score is not easy, but it isn’t that difficult either.

When people claim they are unable to improve their bad credit score, there are usually other factors contributing to this other than just not being able to make repayments.

It is sometimes easy to use hindsight and look back at all the things you should have done to gain a good credit rating. But that is in the past. What matters now is that your credit score can be fixed or greatly improved.

By taking action and repaying your debts in a timely manner, and refraining from taking out new loans or credit, you can vastly improve your credit rating.

Following a few simple steps and creating a great credit score for yourself will aid you in several financial aspects.

Everything from getting a mortgage to buying a new car is determined by this credit rating. Sound personal financial management will lead to a much better credit score and a more stress free life.

– Alasdair S. and Ogbe Airiodion

[related2][/related2]