How do I buy or sell stocks online (using a brokerage account)?

As individuals look towards investing by themselves, rather than using a financial adviser, a key general question being asked by new and intermediate investors is “how do I buy and sell stocks online?”

As a follow-up to our previously posted Top 5 Online Brokers report, MarketConsensus News is publishing the below article on some key steps needed to buy, sell, invest or trade stocks online without the use of an investment financial advisor.

[newsletter1][/newsletter1]

5 key steps for new investors to buy and sell stocks online

- Open an online brokerage account

- Deposit funds into the brokerage account

- Research stocks/bonds/forex/etc. to find those that match your investing preference and risk tolerance

- Invest

- Manage / monitor your investments

Opening an online brokerage account

The first step to investing via an online brokerage account is to research and find the online broker that bests meets your investing needs. Check out this MarketConsensus comparison analysis on the top 5 online brokerage firms.

After selecting a top broker, you’ll then need to fill out an application form, which normally takes 5 to 15 minutes to complete. On the application form you’ll need to enter your name, address, email, phone number, social security number and select whether you want an Individual Brokerage Account or Joint Brokerage Account (where multiple individuals can invest with and manage the same account). You might also need to enter your employment status and information, and state any affiliations with a securities firm, a securities exchange, the SEC or the Financial Industry Regulatory Authority (FINRA).

Depositing funds into your brokerage account

There are multiple options available for you to fund your new brokerage account before you can start buying and selling stocks, bonds, options, etc. These include:

- Electronically transfer in funds

- Send a check

- Transfer in an existing account from a different institution (i.e., if you have an existing account that is already being managed by a financial advisor)

- Deposit stock

Conducting research

Before you buy and sell stocks, bonds, options and other financial instruments, there are numerous websites available to aid you in your research. Included in this list are CNBC, CNN Money, Business Insider and our veru own MarketConsensus News. Check out the Top Financial News Sites and Business Blogs (Best News Sites).

To determine what a stock should be worth, you’ll want to analyze the stock or company’s fundamental, valuation and technical variables. Note that a lot of factors impact the price of a company’s stock, and in a lot of cases will cause the current price of a stock to be disconnected from the true value of what the stock should be trading at. One example of such a factor is investors’ perception of future events / performance.

Here is a great example of a stock analysis article that you can use as a template for conducting your own stock analysis: Is IBM Stock a Good Buy or Sell? Does it make a Great Long Term Investment?

Also see: Pros and Cons of Ally Bank | Reviews, High Yield Savings, Rankings

Investing

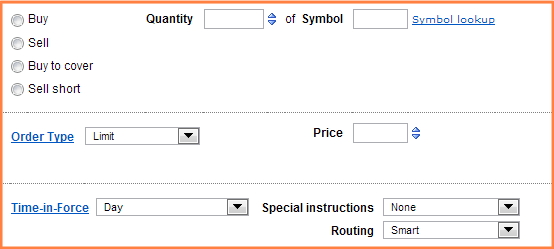

After you select a stock, the next step is to enter a Buy order (or a Sell order if you already bought the stock and are looking to sell it). Also see: Short Selling as an Investment Strategy

Managing your investments

After you invest in a financial product or products (portfolio), your next step is to actively monitor the securities in your portfolio to ensure that they continue to meet your long term investing strategy or short term trading plan.

[related1][/related1]

————————————————

Best of luck in your investing,

MarketConsensus News

Join the MarketConsensus Community