Can Intel Corp. Survive in a Fading PC World? Is The Stock (INTC) a Buy, Sell or Hold?

Intel Corporation (NASDAQ: INTC) (current market cap: $104.33 billion) has long been a behemoth in the $30 billion semiconductor manufacturing industry. For over 30 years, it has maintained an unchallenged status as the undisputed king of the Chip hill.

However, the proliferation of mobile devices has seen smaller competitors like Advanced Micro Devices (NYSE: AMD) (market cap: $1.93 billion) and ARM Holdings (NASDAQ: ARMH) (market cap: $19.99 billion) starting to grab market share from INTC.

INTC Stock Price Vs. Competitors

Source: Yahoo Finance

Since the last quarter of 2012 (Sept), INTC has been a weaker performing stock than rival ARMH. Given this performance, shareholders are left wondering whether INTC can hold its own against increasing competition, or whether the company will become irrelevant and hand over the crown to someone else.

Let’s assess the facts and try to address those questions.

Intel Corporation (NASDAQ: INTC) Analysis Breakdown

- Fundamental Analysis

- Valuation Overview

- Technical Perspective

- Favorable Catalysts for the Stock

- Bottom Line Conclusion

- Market Correction Impact

- Fundamental Analysis

In its recent fiscal quarter (Q4-2012), the company reported "year over year" quarterly revenue decline of -31.70%, which translated to a decline in Profit Margins of -21.82% for the last twelve months (Trailing Twelve Months – TTM). Even though INTC reported Q4-2012 revenues to the tune of $13.5 billion, that figure was $400 million less than the $13.9 billion reported in Q4-2011.

Thanks to year end purchases by major clients (governments and corporations) and a robust holiday season, Q4 is traditionally a strong quarter for Intel. However, global economic weakness has hampered growth in 2012, as the company saw a 1% quarter over quarter (Q/Q) decline in PC-based revenues which came in at $8.5B.

On the brighter side though, the company saw a 7% Q/Q hike in its Server-based processor business, which reported revenues of $2.8B. The primary catalyst for this rise is related to increased volume for Cloud-based servers and related services.

With a Gross Margin of 58.8%, overall profitability of the company suffered in Q4-2012, which came in at 63.3% in the last quarter. At $3.2B, INTC also saw a decline of $0.6B in Operating Income from last quarter ($3.8B). This decline in profitability is attributed to the company's strategic decision to reduce inventory of existing chips, and redirect manufacturing capacity to support the upcoming 14-nanometer chip as well as the newer Haswell processor.

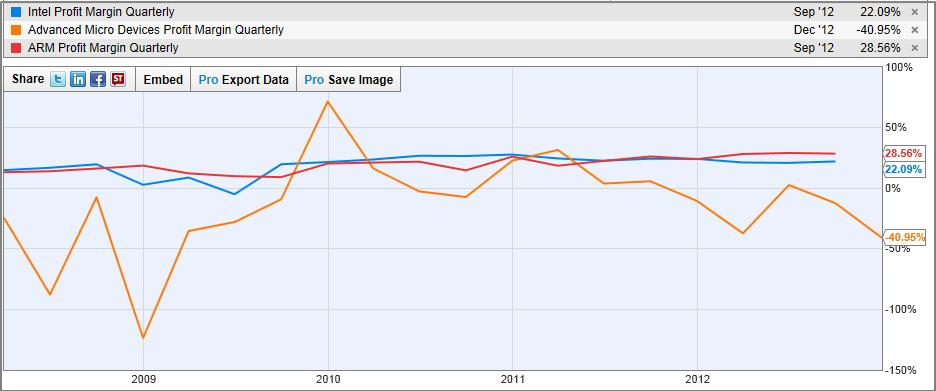

INTC Quarterly Profit Margin Vs Competitors

Source: YCharts

Looking forward to 2013, the firm's management is hoping to see revenue grow (in the low single digits), largely on the back of low double digit growth in its Server-side chip business.

Comparing INTC's fundamentals against its rivals, we can see that over a 5-year period, the company's Quarterly Profit Margins are almost in lock-step with ARM, but are significantly better than its other rival, AMD. Some analysts however believe that ARM owes its success largely to the mobile device market, a situation that INTC is now seen as addressing through some strategic acquisitions it made in the last 2 years.

Continue (Series 2 of 3): Will Intel Corp (INTC) Thrive in a Fading PC World? Valuation Analysis