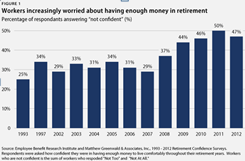

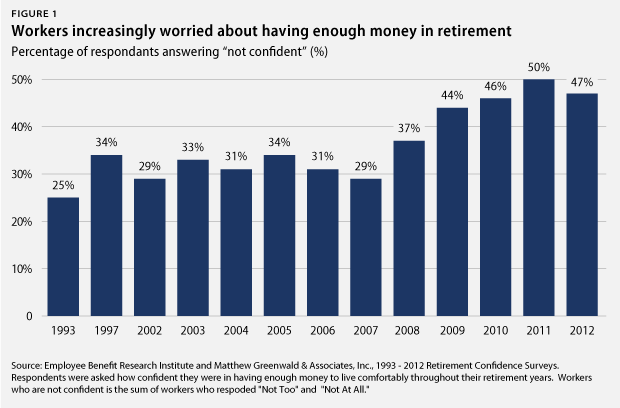

Saving for retirement is on a lot of people’s “to-do” list. Yet, in 2012, the Employee Benefit Research Institute reported that on average 47% of people are “not confident” about their ability to retire with enough savings.

The best way to save for retirement is simply to get started. A 401K is an employer-sponsored retirement plan that allows individuals to invest in their future. It permits an employee to save now and reap the benefits later. Most importanly, the employee chooses how much to invest.

There are a variety of ways to invest in a 401K. A combination of mutual funds, including stocks, bonds and money market funds are available. Another popular commitment is to invest in target-date funds, which become progressively more conservative over time.

Most employers contribute to their employees’ 401K plans. This is called employer-matching contribution. The most common amount that employers match is 3%.

How would a 3% match work? Let’s say an employee contributes 3% of a $60,000 salary to a 401K. This would equate to $1,800. The employer would match this amount by contributing $1,800 to the retirement fund. The employee then misses out on “free” money if they don’t contribute the maximum amount to secure the match.

Two additional benefits of 401K’s:

- 401Ks reduce taxable income – contributions are removed from your pay before taxes are withheld.

- 401Ks allow money to compound more quickly because you don’t have to pay taxes yearly.

With these added benefits, any financially savvy individual should consider maximizing their contributions to their 401K.

[related2][/related2]