KeyCorp is up 18% YTD – Is the Stock Still a Good Buy? Or at the End of its Run?

This article is a continuation of the KeyCorp Stock Analysis article (Is KeyCorp Stock a Buy, Sell or Hold?), which presented an overview of KeyCorp's stock potential from a fundamental analysis and stock valuation perspective. (Make sure to check out the first article before reading the below.)

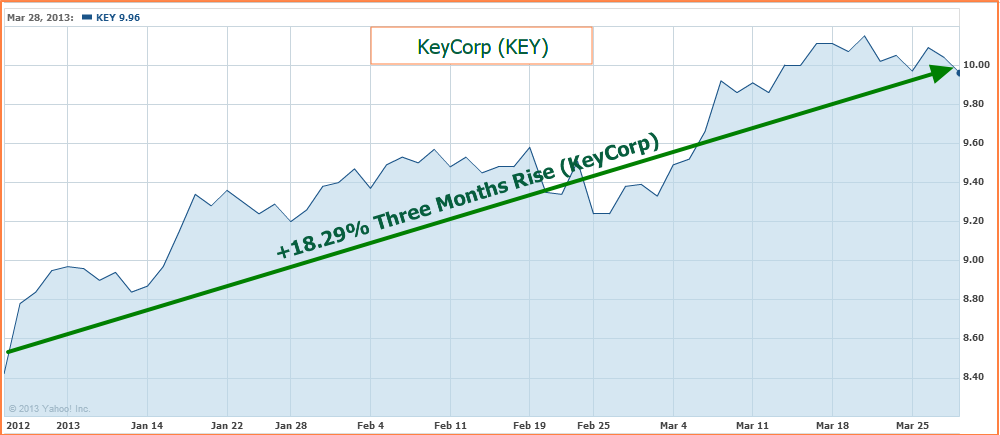

Yahoo Chart: KeyCorp 3 Months Chart

Based on KeyCorp stock’s 18.29% rise over the last 3 months, investors are asking whether KEY is still a good Buy or if it has risen too high, too fast. This article presents an overview of KeyCorp's stock potential from a technical, favorable catalysts and bottom line perspective.

KeyCorp Stock Analysis Breakdown [Is KeyCorp (KEY) Stock a Buy, Sell or Hold?]

- KeyCorp (KEY) Fundamental Analysis (Article 1)

- KEY Valuation Overview (Article 1)

- Technical Perspective on KeyCorp Stock

- Favorable Catalysts for the Stock

- Bottom Line Conclusion

- Technical Perspective

At the time of this analysis, KeyCorp is trading around $9.50, which is close to the higher end of its 52-week trading range of between $6.68 and $10.19.

The stock spent most of the first half of 2012 in a downward slide, recovering gradually in late June 2012 to a high of around $9.00 in September. However, the stock then went into yet another dive, hitting a low of $7.87 in early December. Since then, however, the stock has been performing extremely well, setting higher highs throughout.

(See Also: Citigroup Turns its Business Around. Is the Stock (C) a Buy/Sell/Hold? )

A clear pattern of a classic Golden Cross is visible in the stock’s price in late Jan 2013, where the 50-day Simple Moving Average (SMA) moved above its 100-day SMA, usually signaling that a stock is on the upward march. The last several sessions have seen the stock hover between the high-9's and low-10's, possibly signaling technical investors of a base-building pattern at these levels. Should this trend hold, the stock is likely to move higher over the next few weeks.

- Favorable Catalysts

Through its community and corporate bank networks, KEY's significant exposure to "bad" real estate loans and poor-quality consumer loans has meant that the company needs some time to get its financial house in order. However, the burgeoning U.S. real estate market, and an upswing in overall economic conditions is likely to prove a favorable catalyst for the Bank's recovery. Any downturn in the economy however could adversely impact KEY's ability to mend its balance sheet.

(Other News: 5 Best Online Trading Sites (2013) for Investors – Best Online Brokers)

KeyCorp’s shareholders were pleased when the Bank finally got rid of its $2.5B Troubled Asset Relief Program (TARP) obligations in 2011. However, should the company make any missteps from here on, investor sentiment could turn sharply negative for the bank. After diluting shareholder capital and slashing dividends over the past few years, investors are currently only receiving a yield of around $0.20/share. While this is definitely an improvement over the nickel per share it paid at the height of the financial crisis, it is far lower than the $0.38 per quarter that it distributed in 2008.

A positive for KEY is that a significant portion of its revenue (around 40%) comes from fee income. This means that the bank’s exposure to interest rate sensitivity is relatively lower than some of its peers. This situation should prove a favorable catalyst for steady and predictable income even if the economic recovery falters a bit.

KEY's commercial and industrial loan portfolio represents around 45% of the company's loan investments. Any negative sentiment in the economy would mean further risk of loan defaults, especially if businesses can't get credit or are forced into bankruptcy.

(See Also: Is Alcoa Stock (AA) a Buy or Sell? Depends on the Price of Aluminum)

- Bottom Line Conclusion

Based on the above analysis, KeyCorp rates between a HOLD and a MODERATE BUY on weakness. However, it is always advisable to use caution when buying stocks, especially those that have risen as much as KEY has. There is a strong possibility of a major market correction in the next couple of months. As such, those investors looking to buy the stock might want to consider waiting for it to pull back before jumping in. (By: Monty R. – MarketConsensus News Contributor)

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

————————————————————————————————-

[related1][/related1]