2. LinkedIn Stock Valuation Analysis

(continuing from: “LNKD Rises 52% – Is LinkedIn Stock (LNKD) a Good Buy or Sell in 2013?”)

When valuing a stock, investors normally analyze a firm's financial margins, management effectiveness, growth rates and other valuation matrices (EPS, P/E, Debt Ratio, etc.)

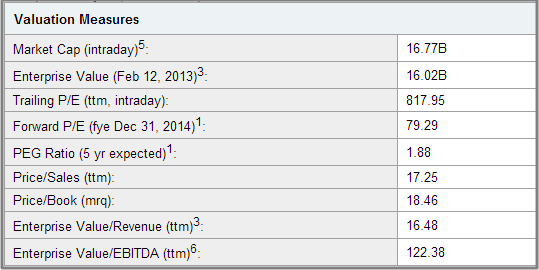

LinkedIn has a Trailing Price/Earnings (ttm) of 817.95. The Price to Earnings ratio tells investors what they are paying for each $1 of earnings. On average, depending on the industry sector, a P/E greater than 100 is considered high and might signify a stock is expensive – LinkedIn has a P/E that is 8 times more than what is considered high.

Basic Valuation Matrix (LinkedIn Stock Analysis)

No matter how great a company is, if an investor pays too high a price for the stock, any upside gain will most likely be limited. However, in LinkedIn’s case, investors will need to pay attention to the Forward P/E for fiscal year 2014. In the above table you’ll see that LNKD has a Forward P/E of 79.29. What this means is that, although the stock price is considered really high relative to current earnings, the stock market has a good grasp of LinkedIn’s true future value and is weighing it accordingly.

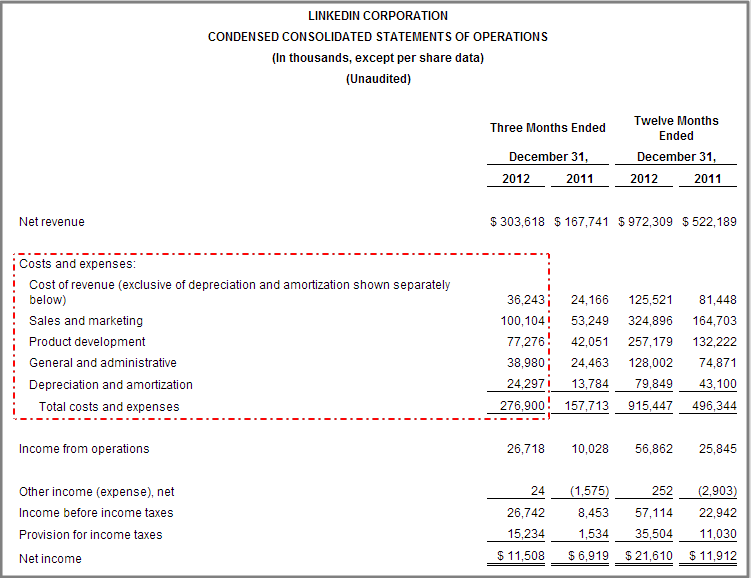

The firm has a high quarterly earnings growth of 66.30%, one of the highest among its peers. This means the company is in “high growth” mode, a situation that contributes value to the stock. LinkedIn’s Return on Equity (ROE) of 2.82% and Return on Assets (ROA) of 3.15% (the last 12 months) are on the lower end of what should be expected. ROE and ROA are variables used by investors to determine management effectiveness. However, LNKD’s low ROE and ROA are mostly due to management’s growth and expansion strategies which have resulted in a lower Net Income for the firm. Net Income is one of the variables that go into calculating ROE and ROA.

ROE = (Net Income / Total Equity)

ROA = (Net Income / Total Assets)

Net Income = Revenue – (Expenses, Costs, Interest, Taxes)

LinkedIn’s Net Income has been greatly reduced due to the firm’s investments in product development, innovation, expansion and site improvements (see below table). Such investments increased the firm's expenses, which led to a decline in Net Income.

Management is basically investing in the company’s future, in the same way a business entrepreneur would concentrate on expanding his or her business during the growth stage rather than focusing on profits. This normally leads to higher revenue and profits in the future, making the firm more valuable.

[newsletter1][/newsletter1]

LinkedIn has 749.55 million in cash, an amount that can facilitate further innovation and expansion. In 2012, the company redesigned its website and continued to aggressively pursue international growth (Hong Kong, Brazil, etc.) LinkedIn announced that “page views” rose nearly 70% as a result of the website redesign.

- Analysts’ Recommendations on the Stock

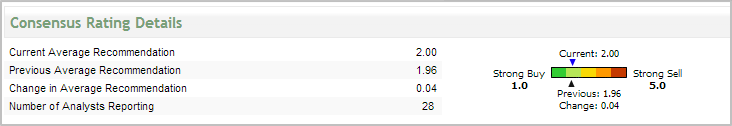

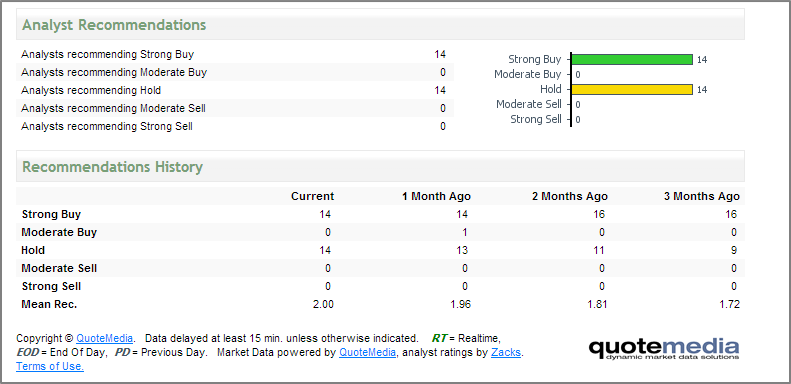

Stock analysts consider LNKD a buy. Between a 1 (Strong Buy) and a 5 (Strong Sell), they rated the stock a 2.

Analysts’ Recommendations

- Bottom Line Conclusion

Taking the various fundamental, valuation and other analyses into consideration, we believe LinkedIn stock has great potential for investors and will make a great long term buy. LinkedIn is a great growth story and we see more potential on the upside for the stock. However, we believe investors should wait for a pull back on the stock before they invest.

- Impact of a Stock Market Correction

MarketConsensus would like to caution investors on what we see as a potential 10% correction in stocks. Market trend indicators are pointing to an overbought situation and investors should take this into consideration in their short term investing decisions.

[related1][/related1]