Tuesday, March 12, 2013 – Here is today’s summary of U.S. stock market activities – Major Headlines, Biggest Losers, Stock Gainers, Top Advancers & Decliners.

Stock Market Headlines

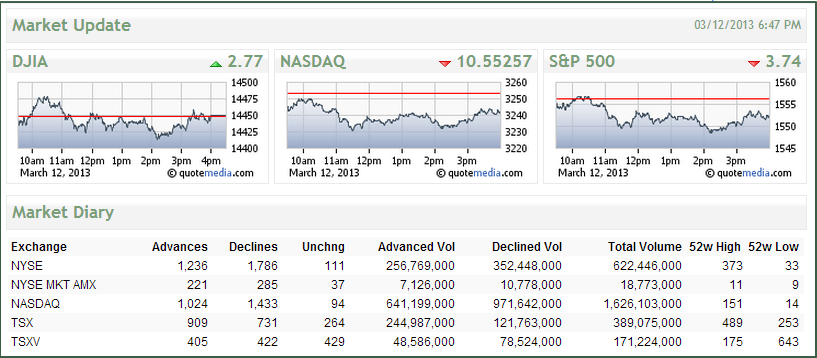

The Dow (DJIA) index managed to end the day slightly higher, closing at yet another new high. Since last week, the index has been breaking new records on a daily basis. Today, however, “the S&P 500 snapped a seven-day winning streak, dragged by financials and techs, logging its first drop in the month of March”. The Nasdaq also closed lower with a slight drop of -0.32%.

On the NYSE, declining stocks (1,786) outpaced advancing stocks (1,236), while the Nasdaq had 1,024 advancing stocks versus 1,433 decliners.

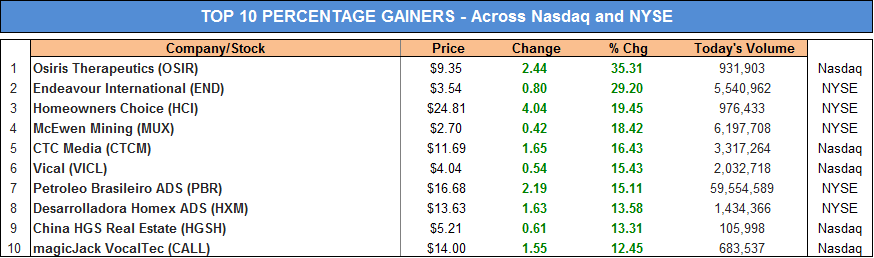

Most Active Stocks – Top Gainers by Percentage (NYSE & NASDAQ)

- Elbit Imaging was the highest gainer across the NYSE and Nasdaq, surging 20.18% to end the day at $2.62.

- Glu Mobile stock was the next highest gainer. The stock surged today after news broke that the firm had “partnered with Probability to bring elements of Glu's popular Samurai vs. Zombies Defense to a gambling product”. As stated by the firm’s management: "We plan to leverage Probability's extensive partner network to further extend Glu`s successful original IP to new demographics”.

- Shares of Tandy Leather Factory were the third highest gainers, rising 15.72% to end the day at $7.14. The firm released Q4 2012 financial results and reported a 17% rise in its EPS from 2011. EPS came in at 55 cents.

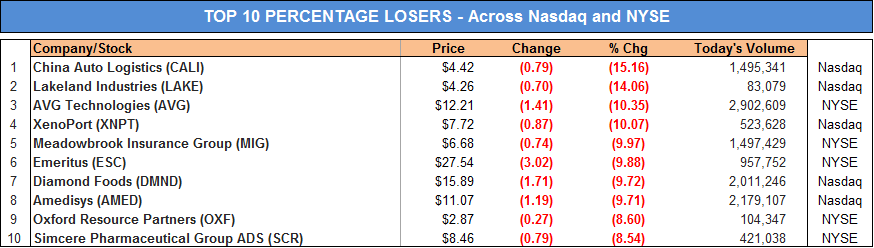

Most Active Stocks – Top Losers by Percentage (NYSE & NASDAQ)

- Shares of China Auto Logistics stock plunged -15.16% today after having risen 88.77% yesterday.

- Lakeland Industries (LAKE) was the next biggest stock loser across the NYSE and Nasdaq. The stock declined -14.06% to close the day at $4.26 after the company reported major material developments to its business operations, including a $11.5M charge, lower than expected sales in Brazil and a potential default on a bank line of credit.

- AVG Technologies (AVG) was next in line with its stock dropping -10.35% to be the third top loser across the Nasdaq and NYSE. “Shares of AVG Technologies tumbled Tuesday after Morgan Stanley analysts downgraded the software company's stock because its CEO is leaving as the company works on growing a newer business”.

Financial Market Data powered by Quotemedia.com. All rights reserved. Quote data delayed 15 minutes unless otherwise indicated. View the Terms of Use. Data was also obtained from The Wall Street Journal