MU Stock Surges 72% in Six Months. Technical Stock Analysis and Favorable Catalysts

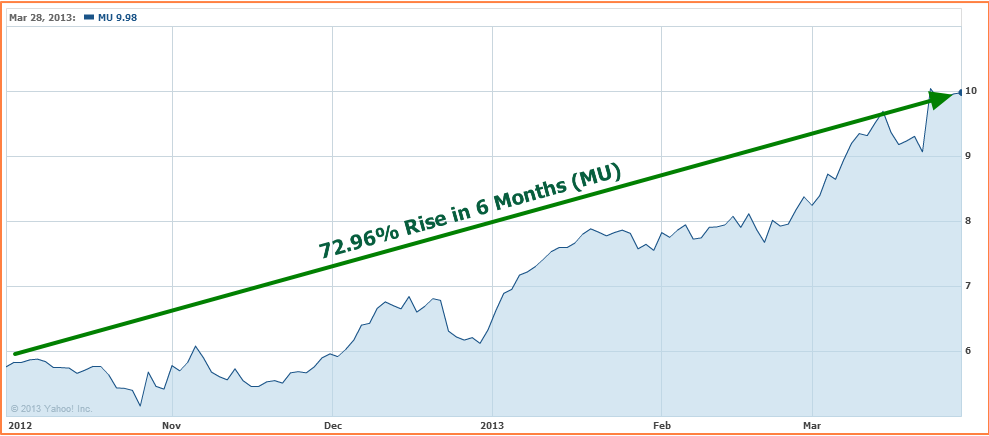

As discussed in part one (MU Fundamental Stock Valuation Analysis) of this 2 part series, Micron Technology’s shares have been on an upward trend. The company's stock price has risen 72.96% in the last six months alone.

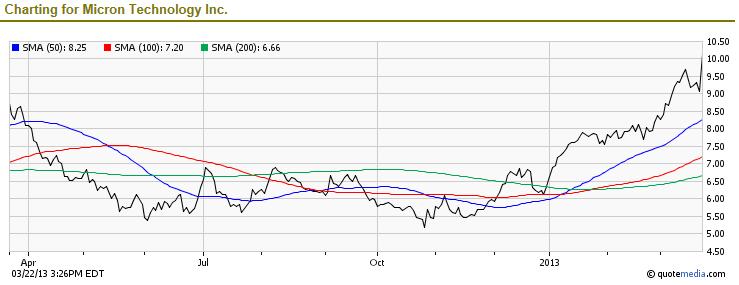

Yahoo Chart: MU 6 Months Stock Rise

The previous article addressed MU’s Fundamental Analysis and provided a Valuation Overview of the stock. Based on the recent surge in the stock price, shareholders and potential investors alike are wondering whether Micron Technology continues to rate as a buy or whether it should now be considered a sell?

This article covers the Technical Perspective, Favorable/Negative Catalysts for the Stock and a Bottom Line Conclusion on Micron Technology (MU) Stock

Micron Technology (MU) Stock Valuation Analysis Report

- MU’s Fundamental Analysis (Article 1)

- MU’s Valuation Overview (Article 1)

- Micron Technology (MU) Stock Technical Analysis

- Favorable/ Negative Catalysts Impacting MU Stock

- Bottom Line Conclusion on MU

- Micron Technology (MU) Stock Technical Analysis

At the time of this analysis, MS is trading at $10.05. This is close to the high-end of its 52-week trading range of between $5.16 and $10.27. The stock was trading at $9.07 at close of business on March 21 2013, down 2.58% from the previous day. However, following announcement of its Q2-2013 results on Mar 21, the stock spiked almost 11.30%.

As indicated by the stock movement chart above, for the first half of 2012 MU had been largely on a downward spiral, breaking support at its 50-day, 100-day and 200-day Simple Moving Averages (SMAs) on the way down. Since July last year however, the stock broke its descent and moved sideways, trading losely within a narrow band between its 50-day and 200-day SMA. The stock executed a classic Golden Cross movement in early Jan 2013, when its 50-day SMA ($8.25) moved above its 100-day SMA ($7.20) and its 200-day SMA ($6.66). This usually is a strong technical signal for a stock to move higher, as MU has done since early 2013.

(Read Also: Just2Trade – $2.50 Per Trade Disrupts Online Stock Trading Industry)

Based on current chart readings, MU seems set to make new 52-week highs if it is able to build a base at current levels that it can then use for further upward momentum.

- Favorable Catalysts Favorable/ Negative Catalysts Impacting MU Stock

The very commoditization of memory chips today means that MU faces significant competition. That, and the cyclical nature of the supply and demand for those chips, given competition amongst users of those commodities, is a serious negative long-term catalyst for the company. To deal with this situation, MU will have to re-invent and re-position itself over the next several years.

The mid-2012 $2.5B acquisition of Elpida by MU has provided MU significant opportunities of scale for its DRAM production capacity. Such scale will prove a positive catalyst for future growth of the company. However, also on an encouraging note, non-DRAM (flash-based) NAND memory has so far been the mainstay of MU's revenue, bringing decent margins to the company. With advances in Solid State Drive (SSD) technologies, it is likely that cheaper SSD products will also spur growth for Micron Technology.

While second-tier players like Micron and Hynix may enjoy short to mid-term growth, in the longer term it will be chip-making giants like Samsung and Intel that could dictate the demand and supply dynamics. However, the fact that MU has shown that it is willing to compete through an aggressive growth-by-acquisition strategy (as demonstrated by the Elpida and Numonyx acquisitions) bodes well for shareholders.

(Other News: Is Zynga Still King or is the Zing Gone? Is ZNGA Stock a Buy or Sell?)

Finally, Micron's diversified product portfolio of DRAM, NAND and NOR memory chips serves as an excellent "economic moat" to attract a broad range of clients and help the company through periods of volatile demand.

- Bottom Line Conclusion

Based on the above analysis, Micron Technology Inc. (MU) would rate as a BUY. However, it is always prudent to wait for a major pullback on the stock before taking new positions. (By: Monty R. – MarketConsensus News Contributor)

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

————————————————————————————————-

[related2][/related2]