NatWest Review – UK | 2014 Pros and Cons | Benefits, Complaints, Rates, Fees

As a follow up to reviews that we’ve published on banks like Barclays Online Banking, Ally Bank, Capital One, and many more, we are releasing this 2014 report based on our analysis and review of NatWest.

As part of our analysis, we identified multiple pros, cons, benefits and consumer complaints on using NatWest. However, with this article, we aim to present an objective overview of the key findings from our analysis and reviews of NatWest, the services it provides and the various rates / fees it offers.

NatWest Review – Bank Reviews

There are many banks in the UK, but just a few “big players” dominate the UK banking market. National Westminster Bank is one of them.

Now rebranded as “NatWest”, the bank has grown to become a household name in the United Kingdom. When looking for a bank account or banking services, this financial institution is usually considered to be amongst the best.

[related1][/related1]

Origin and Growth – NatWest Review

One of the top players in the UK banking market, NatWest is part of the Royal Bank of Scotland Group. The bank was founded in 1968 when the National Provincial Bank (established in 1833) and Westminster Bank (established in 1836) joined together to form the National Westminster Bank.

This merger was entirely unexpected and came as somewhat of a surprise to both the general public and the investors in the City of London.

However, the benefits of the merger quickly became clear, as the formation of National Westminster Bank not only enhanced the balance sheets, but also gave the bank the opportunity to streamline the network of branches, which in turn allowed more investment in upgraded technology.

Improvements in technology allowed National Westminster Bank to introduce many new services such as telephone banking in the 1980s and their first debit card; called Switch was introduced in 1988, allowing customers to pay by electronic transfer of money to point of sale.

The 1990s saw the bank refocus its activities and change its name to NatWest. This was followed in March 2000 by the acquisition of NatWest by The Royal Bank of Scotland Group. In a deal worth £21 billion, it was the biggest banking takeover in British history and has made NatWest part of one of the largest financial services groups in the world.

[related2][/related2]

NatWest Bank Services and Products Reviews

Due to its relatively large size and scale of business, NatWest is a bank that can offer the customer a vast array of different financial products to suit most of your financial needs from the very basic to the very complex.

They cater to personal, private and business banking needs and offer the following products:

Personal Banking

- Current (checking) accounts

- Savings accounts

- Investments

- Loans

- Credit cards

- Mortgages

- Insurance

- Travel and international

- Student bank accounts

Private Banking

- Tailored banking

- Investment and advice

Business Banking

- Bank accounts

- Overdrafts

- Savings accounts

- Credit and debit card

- Mobile banking

- Online banking

- Small business loans

- Commercial mortgages

- Business insurance

- Foreign exchange

- Letters of credit

- Electronic payments

- Bonds and guarantees

- Funding solutions

- Foreign currency accounts

[related1][/related1]

Rates and Fees – NatWest Review

Rates charged will vary depending on the product and the individual’s personal circumstances.

Current (checking) accounts charges, fees and rates:

- There is no charge for the basic Select Account.

- The Select Silver Account charges £10 per month

- The Select Platinum is £16 per month

- The Black Account is £24 per month and includes benefits such as mobile phone insurance, breakdown and travel insurance, access to airport lounges, preferential travel services and Black credit card.

- All bank accounts offer rewards and cash back. The overdraft APR rates vary from 13.96% to 18.28%.

Savings accounts charges, fees and rates:

There are a number of different savings accounts. The gross interest rate per annum paid varies from 0.08% to 1.49%.

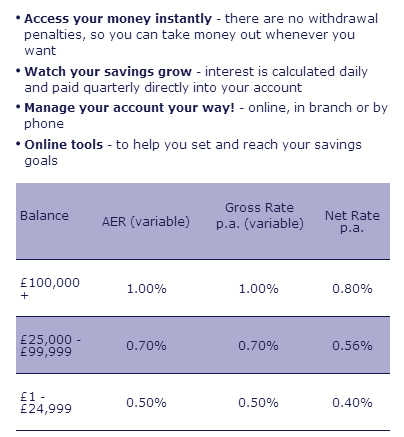

- Instant Saver: NatWest’s Instant Saver allows you to conduct the following:

Note: Rates are Subject to Change. Check NatWest's Site for the Most Updated Rates

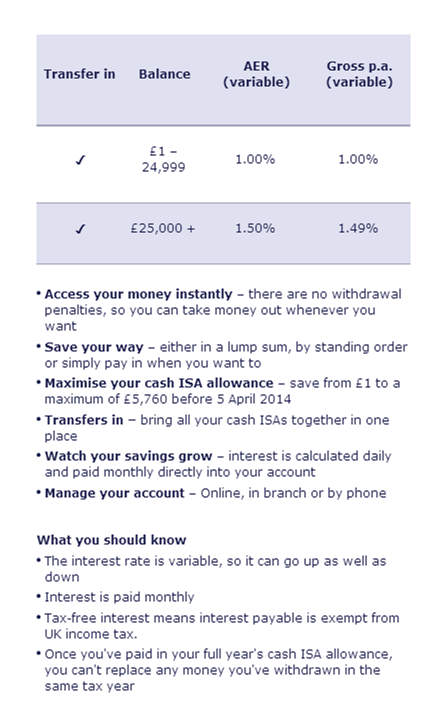

- NatWest Instant Access Tax-Free Savings Yield

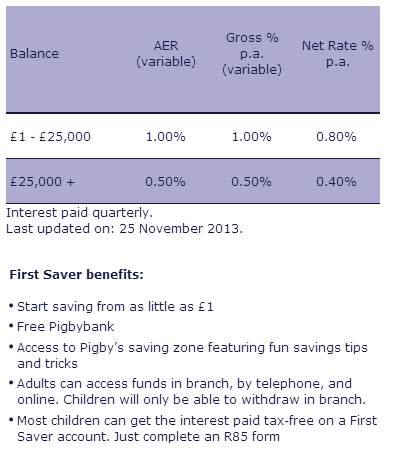

- NatWest First Saver Rates

Credit Cards

NatWest offer bank transfer credit cards, purchase credit cards, reward credit cards, as well as student credit cards. The interest rates vary from 9.9% to 18.9% apr, with some cards having a 0% interest rate for the first 6-18 months.

Mortgages

A variety of mortgages are offered, including: first time buyers, 5% deposit mortgages, remortgages, buy to let and offset flexible mortgages. Rates will vary depending on your personal circumstances and the market rate.

[related2][/related2]

Pros – NatWest Review

- Easy access to your money, thanks to over 3,000 ATMs located all over the country

- ATMs allow you to make balance enquiries, top up your mobile, order chequebooks and make balance enquiries

- You can pay your bills at over 750 ATMs

- NatWest has a fleet of mobile banks that visit remote areas on a regular basis

- Good customer service

- Many branches are open late and on a Saturday

- Financially stable thanks to being part of one of the largest banking financial services groups, so you can be sure that your savings and investments are secure

[related1][/related1]

Benefits – NatWest Review

- There are many advantages to banking at NatWest. These include:-

- Online and mobile banking allows you to carry out most of your banking from your computer or Smartphone

- There are no fees charged on many bank accounts, so long as you do not go overdrawn.

- Most ATM cash withdrawals are totally free

- Peace of mind as you are banking with one of the largest banking groups in the world.

[related2][/related2]

Cons and NatWest Consumer Complaints

- There can be long queues in many banks, particularly at peak times

- High bank charges

- Difficult to speak to your local branch as all telephone numbers take you through to a central number.

- The bank has suffered quite badly from computer glitches recently, resulting in customers being unable to access their accounts. This has led to bad public relations and refunding of bank and other charges due to money not being available and bills not paid.

Complaints about banks have increased quite dramatically over the last few years, due mainly to the financial climate and the strain it has put on everyone’s finances.

In the last few years, complaints about NatWest have risen by more than 75%. Complaints included:

- Long queues in branches

- No late night opening

- High and unnecessary bank charges

- Computer problems affecting day to day banking and restricting access to customer’s money

- Length of time taken to deal with customers complaints

[related1][/related1]

MarketConsensus Contributors: Suzanne Hanney and Ogbe Airiodion (Editor)