Is News Corp Stock (NWSA) a Good Buy, Sell or Hold? (Stock is up 60% since 1 year ago)

As seen on the below 1-year stock performance chart, stocks of the three major players in the media industry seem to be moving almost in lock step, though News Corp. (NWSA) is clearly the better performer by far (surging 60% since April of 2012).

Shareholders and investors, however, might be wondering whether investing or holding on to the company's stocks still makes sense – especially with the fallout of the recent controversies (i.e., the UK phone-hacking scandal) still an overhang on the company.

Let's review some key fundamental, valuation and technical data for News Corp. to better analyze whether News Corp. (NWSA) stock is a good buy, sell, hold or even short.

1-Year Stock Performance Chart – News Corp (NWSA), Disney (DIS), CBS Television (CBS)

News Corp (NWSA) Stock Valuation Analysis

- News Corp (NWSA) – Fundamental Analysis

- News Corp (NWSA) – Valuation Analysis

- Technical Perspective – News Corp (NWSA)

- Favorable/Negative Catalysts for News Corp (NWSA) Stock

- Stock Analysts Recommendation

- Bottom Line Conclusion

- News Corp (NWSA) – Fundamental Analysis

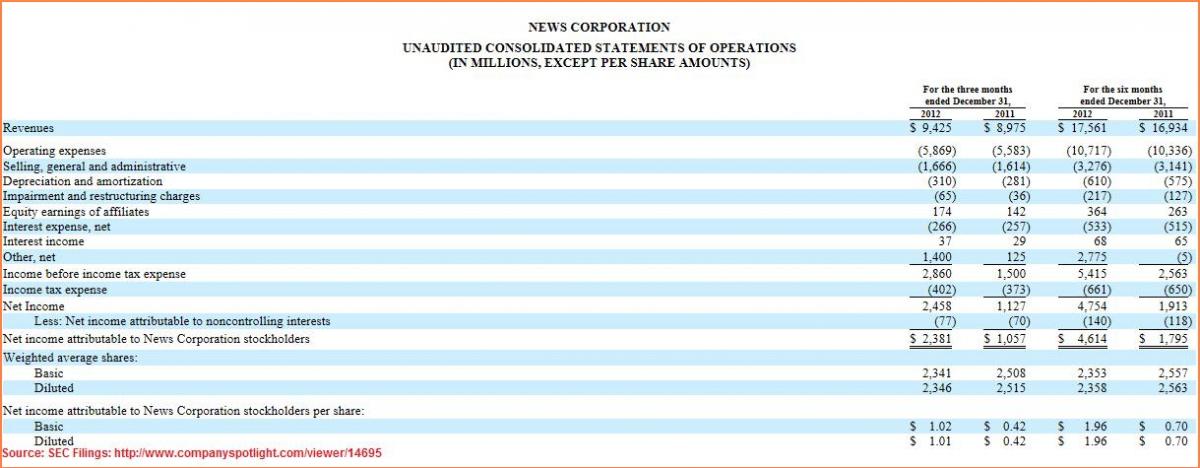

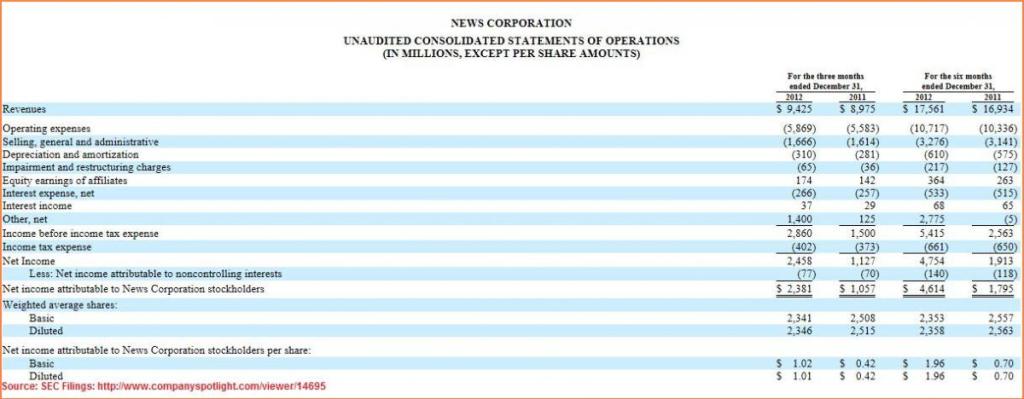

Overall, News Corp delivered solid Q2-Fiscal 2013 results with revenue rising from $8.97B to $9.43B and Total Segment Operating Income increasing by 5.33%. Income from operations (Income before income taxes) surged by a whopping 90%, from $1.5B (Q2-Fiscal 2012) to $2.86B (Q2-Fiscal 2013).

Shareholders were extremely pleased to note that, despite all of the scandals and turmoil it experienced, NWSA was able to grow its Cable Network revenue ($2.6B) by over 18% compared to the same-quarter last year ($2.1B).

Other significant highlights of these stellar results include the growth of the firm’s US affiliate revenue (up 13%), while fees from international affiliates saw a healthy 42% improvement. Also encouraging was the news that advertising revenues, both internationally and within the US, grew 29% and 8% respectively.

The company saw a Net Income rise of over 118% (from $1.13B to $2.46B). EPS/basic share came in at $1.02, compared to $0.42 in the quarter a year earlier. All in all, this was a very impressive quarter for the company, and represented yet another earnings surprise to the upside, 2.30% higher than stock analysts’ estimates.

- News Corp (NWSA) – Valuation Analysis

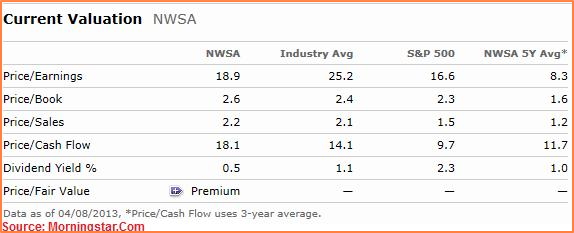

Using various valuation metrics, we determined that NWSA trades at a mixed valuation relative to the Industry average and the S&P 500 index. At a P/E of 18.9x, NewsCorp stock is trading at a discount to the Industry average of 25.2x.

However, when compared against the S&P 500’s P/E ratio of 16.6x, NWSA’s P/E of 18.9x means the company is trading at a slight premium. On a competitive analysis basis though, NWSA's Forward P/E valuation of 10.5x is the lowest amongst its two other peers, DIS (14.7x) and CBS (13.2x).

The most compelling of NWSA's valuation metric is its Price/Cash Flow (P/CF) which, at 18.1x handily beats the 14.1x and 9.7x valuation of the Industry and the S&P 500 respectively, making it a slightly more expensive stock.

Except for its P/CF valuation, which at 18.1x is a bit higher than both DIS (14.2x) and CBS (16.8x), NWSA is equally valued compared to its competitors on most other valuation metrics. However, with a current Dividend Yield of only 0.5%, the company is the lowest yielder amongst the peer group being compared. Both DIS (1.3%) and CBS (1.0%) offer much higher Dividend Yields than NWSA.

Bottom line: From a Fundamental and Valuation perspective only, NWSA would rate as a BUY. Part II of this 2-part series will cover NWSA’s value proposition from a Technical Analysis and Positive/Negative Catalysts perspective and will present a bottom line perspective on whether investors should consider the stock a Moderate or Strong Buy.

Continue: (Part 2) News Corp Technical Analysis and Bottom Line Rating

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Google + (Connect with Us on Google+)

Facebook (Like Us on Facebook)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related2][/related2]