OptionsHouse Review – Rates, Tools, Pros and Cons

In the last couple of months we published two key articles on the top 5 stock trading sites and the top 10 options brokers.

OptionsHouse was included on our list of the top 10 options brokers. The below OptionsHouse review and analysis is a following up to that report.

OptionsHouse Review

- Origin of OptionsHouse

- Services

- Benefits only found through OptionsHouse

- Rates

- OptionsHouse Trading Tools

- Consumer Complaints

- Conclusion

Origins

Although OptionsHouse is relatively new (founded in 2005), they were founded by a company by the name of Peak6, which through years of experience has come to be one of the largest investment firms found in the United States.

Peak6 looks to be a trusted pioneer in the industry of trading technology. They provide their technology platforms to you through OptionsHouse.

Services

When it comes to advanced services, our analysis show that OptionsHouse offers some of the best on the market, especially when it comes to options.

In addition, OptionsHouse offers all traditional forms of retirement investments, including IRA’s, 401(k), SEP IRA’s, and much more.

Their platform is incredibly intuitive, a feature which we’ll explore further later in this review.

Benefits Only Found Through OptionsHouse

There are several benefits that are unique to OptionsHouse.

- Free Cash Sweep: This feature allows you to have your extra cash automatically put into investments to earn more interest!

- Trading Features: They not only offer standard stock trades, they also offer some of the most advanced options investing features like butterfly, spread, and collars.

- Low Minimum Deposit: One of the things that makes investing hard for many people is that opening an account requires an incredibly high minimum deposit in most cases. When it comes to OptionsHouse, they allow you to open an account with one of the most reasonable minimum deposits available: $1,000. That’s compared to the industry standard of $2,000 and up!

Rates

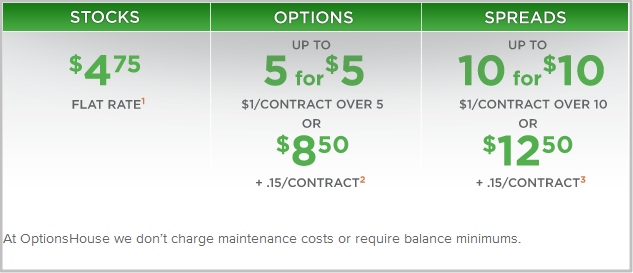

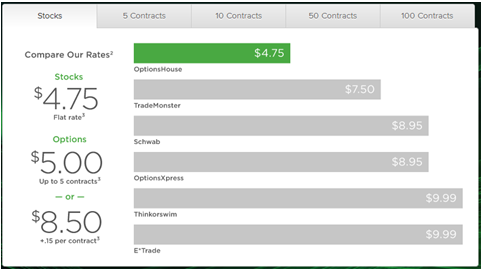

Minimizing trading rates and costs are a high priority for most traders and options investors. In a market where stock trades usually range from $7 to $11 per trade, OptionsHouse charges a flat rate of $3.95 per stock trade.

When it comes to options contracts, you can get them going for only $1 apiece.

The rates at OptionsHouse aren’t only competitive, they’re pretty much slashing everyone else’s rates in half!

OptionsHouse Cost Compared to Other Brokers

OptionsHouse Trading Tools

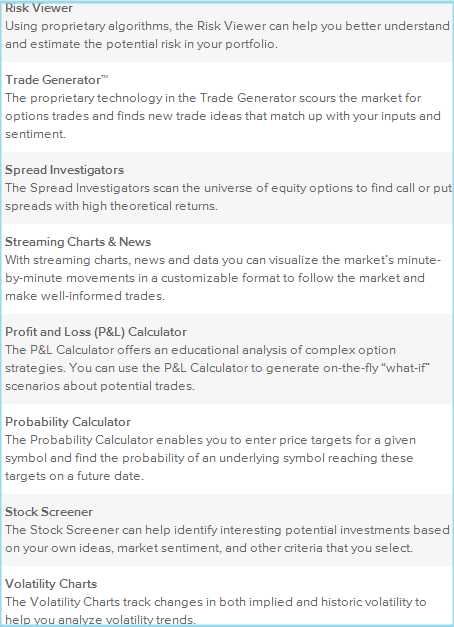

Advanced trading tools are one of the biggest advantages that come with online trading.

Because OptionsHouse was founded by a pioneer in the trading technology industry, they have developed highly advanced and easy to use trading platforms.

Their wide array of trading tools range from probability charts to professional coaching webinars, portfolio analysis tools, research amenities and more.

OptionsHouse Powerful Proprietary Trading Tools

- Professional Training: Financial advisors go through rigorous studies to stay on top of ever changing trading strategies. OptionsHouse offers professional training webinars for all of their customers.

- Options News Network: The Options News Network was and is used to run some of the best investment news websites online. OptionsHouse makes this network available to you for free.

- Volatility Charts: To help you gauge the risk of would be investments.

- Probability Calculators: Probability calculators are another great tool that will help you earn more through your investments and avoid risky trades!

See also: 7 Top Trading Tools for Investors | 2014 Best Day Trading Software Reviews

Consumer Complaints

Before we get into consumer complaints, we would like you to remember that consumers are much more willing to complain than they are to write positive reviews. That being said, as a huge company OptionsHouse has plenty of positive views, but they’ve got their share of negative reviews as well.

Here are the most common consumer complaints found in negative reviews of OptionsHouse.

- Website (account section) can sometimes be complex to navigate for new customers.

- Losses due to bad investments. (Note, however, that the investor is responsible for choosing their own investments.)

- Some investors have had problems with forced liquidation.

Conclusion

Overall, OptionsHouse is a great company and a great option for your trading needs.

Yes, they do have complaints, but the bottom line is: when you serve hundreds of thousands of investors, you may have a few unhappy customers.

The key takeaway here is that most OptionsHouse customers are very happy with the level of service and trading platforms.