Simplifying Bond Prices and How They Are Calculated (Easy to Understand Bond Formula)

Investing in bonds can be an exciting process.

However, for most individual investors, getting into the more technical aspects of bonds and bond prices can get a bit overwhelming.

This is understandable.

The below quick and easy-to-read guide has been drafted to help simplify the bonds learning and bonds price calculation process.

The Technical Information

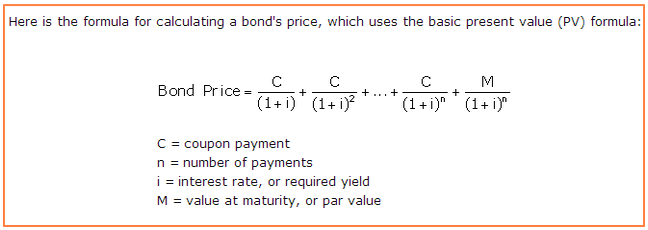

Ok, let’s get the bond formula out of the way first.

That, in a nutshell, is how the prices of bonds are calculated. It takes a little explaining but bear with us.

- How To Get Started With Investing (Stocks, Bonds and Funds)

- How to Value a Stock – for Average Individual Investors

Bond Prices

Bonds have what is called their face value – this is the price that you pay for the bond. You then get a fixed rate of interest on this, which is generally paid to you annually.

Perhaps it is better to explore this with an example. Let’s assume you buy a government issued bond at $1000.

It comes with a coupon (interest rate) of 9% and a maturity span of 10 years.

For the $1000 bond that you have just bought, you’ll get interest payments of $90 every year for 10 years and then get your original investment back.

More than likely the $90 yearly interest payment will work out to be two split payments of $45 as most bonds pay out semi-annually.

Most people will invest a lot more than $1000. However it is a good figure to work with as an example.

- Are Bonds a Good Investment? Should Investors Buy Bonds in 2014?

- US Savings Bonds | Quick Guide | EE and I-Bonds for Average Investors

Why Do Bond Prices Change?

The single biggest element that changes the actual price of bonds is interest rates.

If you are planning on holding onto your bond to maturity then interest rates do not necessarily impact you.

You will keep getting the same percentage of interest every year or 6 months. And at maturity, you will also get back your original capital.

If you want to sell, however, or just looking into the possibility of selling your bond, then interest rates hold the key to what you will get. A basic principle to follow is this; if interest rates fall your bond price rises, and if the interest rates rise then your bond price will fall.

Experienced bond traders will be on the hunt for bonds with long maturity if they think interest rates will fall, and if they start to rise then you will see a scramble to get rid of these investments.

Also, shorter bonds carry less risk with interest rates.

For long term bonds (10 years or more) there is a substantially higher interest rate risks.

- Fun with Funds – Mutual Funds vs. Exchange Traded Funds (ETFs)

- Is Gold Still a Good Investment? Or is it Time to Sell Gold and Buy Stocks?

The Yield

The last part of our little example is the yield. This is basically analyzing the return that you will get on a bond.

It is the rate of interest displayed as a percentage in relation to the market value of the bond (its price).

When you first buy that $1000 bond we talked about earlier, the yield will be 9% (yield = coupon/price).

If the price of the bond drops, then the yield rises to correspond with the rise in interest rate to cover the drop, and also to ensure that the rate paid is the same as the original.

So, a price drop to $800 will mean the yield rises to 11.25%.

What does this mean in terms of your bond prospects?

The higher the yield then the greater the risk it is said to carry.

- Fundamental Analysis – How to Value a Company

- Growth Investing for The Individual Investor (Growth Stocks)

A Fluctuating Bond Price

Price fluctuation doesn’t affect how much interest you get or the face value of the bond. These are guaranteed under the terms of your original investment.

Price fluctuation, however, does reflect the rise or fall in the price of the bond. In other words, how much can I sell the bond for today if I need to get out of it?

The price of your bond (if you need to sell it today) and what it is worth at any present time is heavily reliant on the yield.

Finding Out Bond Prices

Yahoo! Finance offers the latest US Treasury Bond rates with maturity and yield information. It also provides a search function where you can search corporate bonds, as well as coupon price and maturity date.

Complicated, But It Makes Sense

Working out bond prices is not the easiest job in the world, especially for average investors.

If you invest in bonds with the intention of getting the annual yield and your original investment back when it matures, then knowing the actual current price of your bond isn’t much use to you.

However, for those who see an opportunity to make a profit on their original investment, then knowing how much your bond is currently worth and anticipating the market conditions is invaluable to this process.

- Bonds Investment 101 | What are Bonds? How Can I Invest?

- Choosing the Right Investment Advisor and Financial Planner

- Ally Bank Reviews | Pros and Cons | Ally Online Checking, Savings

- Barclays Online Banking and High Yield Savings (UK) – Reviews | Complaints

- Credit One Bank Reviews | Pros and Cons | Rates, Complaints, Build Credit

- Capital One 360 Reviews | Pros, Cons | Rates, Savings, Checking, Online Bank

- GE Capital Retail Bank Reviews | Pros and Cons | Rates, Online Savings, CDs

- American Express Savings Review. Pros and Cons of Using Amex Savings Bank