Regions Bank Reviews | 2014 Pros &, Cons | Regions Rates, Accounts Comparison and Online Banking

As a follow up to other reviews that we’ve published on banks like Ally Bank, US Bank, GE Capital and many more, we are releasing this 2014 report based on a detailed review of Regions bank and its online banking platform.

When looking for a new bank to work with, you’re not just looking for a place to open a checking or savings account. Finding a good bank is becoming much more important than that.

When you open a new bank account, you’re starting what could be a lifelong financial relationship with a bank that years down the road, could manage and maintain all of your financial accounts.

As such, our goal with this review is to present an objective overview of the various pros and cons from our analysis and review of Regions bank, the services it provides and the various rates / fees it charges or offers.

Review of Regions Bank

- Origin & Growth

- Services Offered, Rates & Fees

- Regions Bank Promotions

- Regions Bank Core Values (Can They be Trusted?)

- Regions Bank Core Values

- Consumer Complaints / Negative Regions Bank Reviews

- Conclusion

Origin & Growth

Regions Financial Corporation, the parent of Regions Bank, was created on July 13, 1971, from a merger of three banking entities.

Those entities were First National Bank of Montgomery which opened its doors in 1871, the Exchange Security Bank of Birmingham which opened its doors in 1928, and First National Bank of Huntsville, a bank that opened in 1856.

So in all, Regions bank can trace its history back more than one hundred and fifty years.

Today, Regions Bank manages more than $100 billion in assets and has over 1,700 banking locations.

[related1][/related1]

Services Offered, Rates & Fees

Regions bank offers personal, small business, and corporate banking services, as well as wealth management services.

Below is a list of the various services they offer:

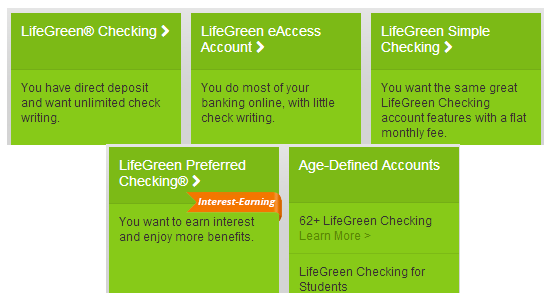

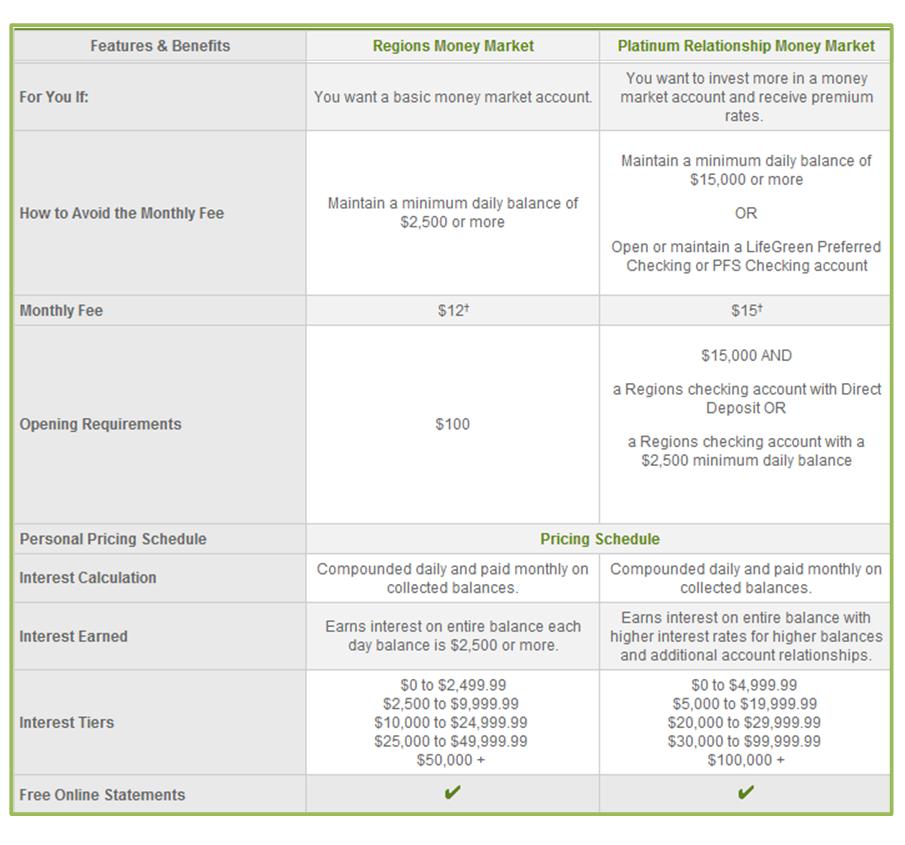

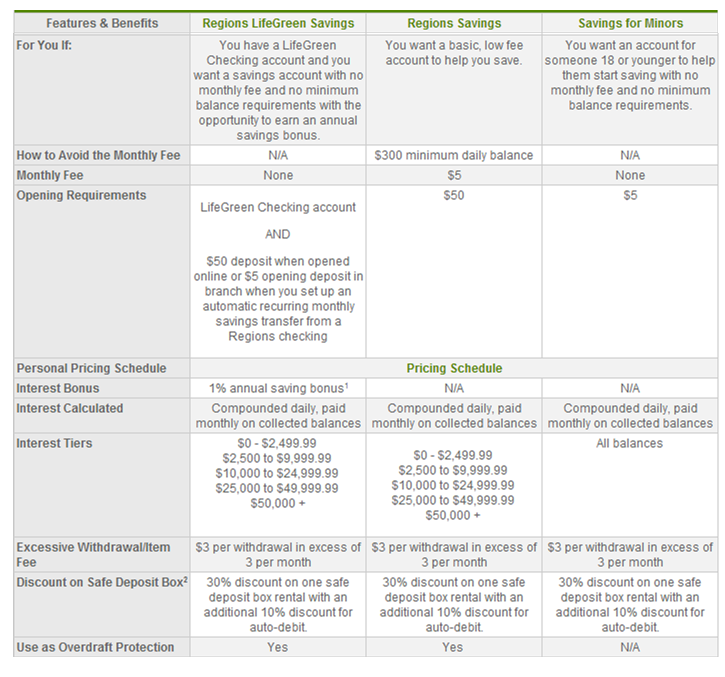

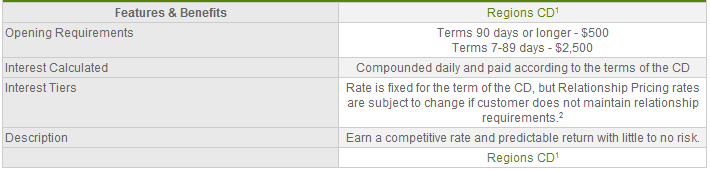

- Personal Banking Services – Checking, savings (Regions LifeGreen Savings, Regions Savings and Savings for Minors accounts), money market, CDs, debit cards, credit cards, home equity lines of credit, mortgages, auto loans, student loans, and more.

Regions Bank Reviews – Checking Accounts

- Small Business Banking Services – Checking, savings, merchant services, treasury management, payroll, audit confirmation, loans, lines of credit, SBA loans, and more.

- Commercial Banking Services – Deposit services, treasury management, merchant services, global trade finance, corporate trust, equipment financing, commercial lending, capital markets, commercial real estate.

- Wealth Management Services – Investment management, asset management, estate planning, charitable giving, insurance, and more.

- Regions Bank CDs – Depending on where you are when you open the account, how much money you plan to put in, and how long you plan for the term to be, the rate on your CD will range anywhere from 1.01% APY to 3.5% APY.

[related1][/related1]

Regions Bank Promotions

The promotions offered by the bank have become very popular with consumers. For instance, currently you can earn a 1% bonus on your savings annually with Regions’ LifeGreen Savings account.

They also have competitive promotions for their checking accounts, credit cards, and several other financial products. For instance, when you open a Regions Bank checking account, you get $100 free.

[related2][/related2]

Regions Bank Core Values (Can They be Trusted?)

Regions Bank operates under 5 core values. These values are to put people first, do what is right, reach higher, focus on your customer, and enjoy life.

The simple fact that they don’t promote the normal banking industry standards of honesty, integrity, blah, blah, blah puts the fact that they take a different approach front and center.

So, let’s take a look at their, well, unorthodox core values and see how they stack up.

Put People First – When it comes to banking, we all know that people should come first. However, in the profit driven industry of banking, often times it’s quarterly earnings that come before consumers in the eyes of banks. That does not seem to be the case with Regions Bank, based on customer reviews that have been posted online.

Do What Is Right – We all know that it’s important to do what’s right from a moral perspective. Regions bank seems to understand this concept too.

Reach Higher – The key here is knowing that there are no limits. The bank looks to inspire their employees to seek better solutions for their customers. In addition, they aim to inspire their customers to set and reach for higher financial goals.

Focus On Your Customer – Have you ever gone to the bank and felt like the teller had something else on his or her mind? Well, that shouldn’t be the case with Regions Bank, as they make it a point to focus on their customers and the needs of those customers.

Enjoy Your Life – This value shows that Regions Bank knows how important it is to have enjoyment in life and that they try to bring enjoyment to their customers as well as employees.

[related1][/related1]

Consumer Complaints / Negative Regions Bank Reviews

Every large bank is going to have complaints here and there. Same goes for Regions bank. Although Regions bank has plenty of positive reviews, here are the most common reasons why consumers complain about their services.

- Some consumers have complained of instances where a Teller was rude or did not provide quick enough service

- High inactivity fees

- Some consumers complained that in some instances, money in savings account did not stop associated checking account from going into overdraft.

(Keep in mind that people are generally more liable to post negative reviews of a product or company than they are to post positive reviews.)

[related2][/related2]

Conclusion

Overall, Regions Bank seems to be a great banking option based on our review of the bank. They offer highly competitive rates on savings and CD’s as well as more than understandable fees on checking and savings type accounts by most consumer standards.

Overall, their customer service is touted as top notch by many, although there have been some instances of rude tellers here and there.

All in all, Regions seems like a great option

[related1][/related1]