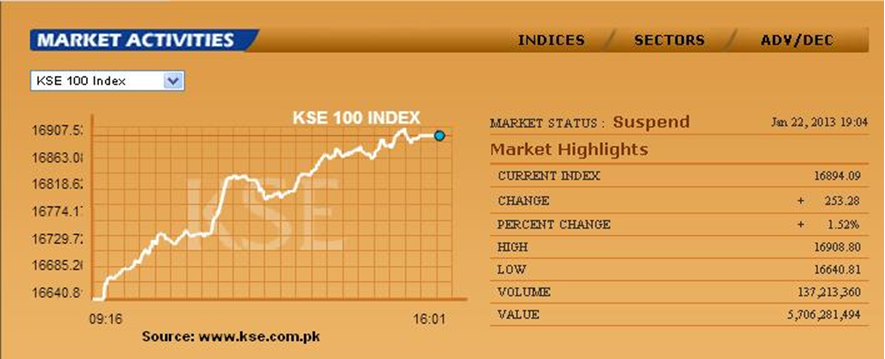

Tuesday’s trading session might have augured well for all three stock exchanges in Pakistan. The benchmark Karachi index, KSE-100, gained 253 points to reach 16,894. Lahore’s general index dropped 30 points to end the day at 3,398 points, and Islamabad’s general index rose by 5 points to 2,444 points.

Whether this is a sustained development, or a short-term spike, remains to be seen. Of the top 10 gainers at the Karachi Stock Exchange on Tuesday, half were foreign multinationals. Disappointingly to some Pakistani stock investors, the overwhelming majority of the top 10 ‘losers’ on Tuesday’s trading at the KSE were Pakistani companies. Two of these companies belong to the Textiles sector and another two to the Agricultural sector. The remaining six were in the Chemical and the Services sector.

See Also: KSE 100 Index Makes Gains – Pakistan’s Situation Remains Bleak

The story was not drastically different across the other stock exchanges. All of the five top gainers on Tuesday’s trading at the Lahore stock exchange belong to the Oil and Gas sector. Meanwhile, the hardest hit companies spanned the spectrum from Telecommunications, Construction Materials, Commercial Banking, and Textiles to the Oil and Gas sector.

On the Islamabad Stock Exchange, two of the top 10 gainers belong to the automotives sector, with a smattering of other companies from a diversified array of other sectors. It may be too early to tell if the relative calm following the political unrest and insecurity is starting to bear fruit, but cautious optimism about the short term outlook of Pakistani stock exchanges may be the most prudent strategy to follow.

[related1][/related1]

Although a number of civilians were killed in blasts and assassinations in Karachi on Tuesday, the insecurity is generally perceived to have improved somewhat. No political uncertainty surrounding the arrest of the Prime Minister looms large as it did during the previous week. The expatriate cleric-cum-politician marching for fair and transparent elections had been satisfied with certain concessions. These two major factors mean that while the prospects for sustained upswing in the Karachi, Lahore and Islamabad exchanges are unlikely at this time, a generally bullish attitude tempered by cautious optimism may be in order.

Other News: Pakistan’s Stock Market Crisis – An Unfolding Chaotic Story