Santander Reviews 2014 | Pros and Cons of Using Santander US/UK Bank

Following up on previous Bank Reviews that we’ve recently published, we are releasing this 2014 detailed review article on Santander bank (Santander US & Santander UK).

Choosing a bank can be confusing. There are so many to choose from, all offering different products and services. As such, our goal with this article is to present an objective viewpoint on the pros and cons of using Santander Bank, including the various rates that the bank offers.

Although Santander is fairly new to the UK/US markets compared to the traditional US and British banks, it is one of the largest banking and financial groups in the world.

Santander Reviews and Bank Analysis

- Origin and Growth (Santander UK and USA)

- Bank Services and Products (Santander UK and USA)

- Pros of Banking with Santander

- Cons | Santander Complaints

- Santander’s Response to Consumer Complaints

- Benefits of Using Santander Bank

- Santander Rates and Fees

[related1][/related1]

Origin and Growth

Santander Bank was created in the northern part of Spain in 1857. The Santander Group is now one of the largest banking and financial services group in the Euro zone.

Santander in the UK

- In November of 2004, Santander entered the UK market by acquiring three existing banking institutions.

- The first acquisition was Abbey National plc, which was approved by the courts and was integrated into the Santander Group. This was followed in September 2008 by the acquisition of Bradford & Bingley’s retail branches and savings business, which was also integrated into the Santander Group.

- The third acquisition took place the following month in October 2008 when Santander acquired and integrated the building society, Alliance & Leicester.

- Two years later, in January 2010, both Bradford & Bingley and Abbey National were rebranded as Santander. This was closely followed in November 2010 by the rebranding of Alliance & Leicester.

- Santander is now firmly established as one of the leading banks and financial institutions in the UK.

Santander in the US

- Santander Bank is one of the top 25 retail banks in the United States based on deposits.

- It has branches across Connecticut, Delaware, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania and Rhode Island.

- From their US banking headquarters in Boston, Santander is focused on serving the financial goals of its customers and business clients through its 700 branches, 2,200 ATMs and 9,000 employees.

[related2][/related2]

Santander Services and Products – UK

In the UK, Santander offers its customers a vast amount of personal and business services.

Whilst it doesn’t have quite the variation of products on offer that some of the other banks advertise, it has everything you could want for your day to day needs, and for all your personal, private and corporate needs.

From a basic bank account to buying your first home to financing your multi-million-pound business, Santander is likely to have the product that you need.

These products include:

Personal

- Current accounts – including basic and standard accounts, accounts for students and children and accounts that offer cash back and interest.

- Credit cards – cash back and balance transfer cards

- Insurance – home, travel, car and life

- Personal loans – for new and existing customers with a repayment term of between 12 to 60 months

- Mortgages – for existing and new customers as well as remortgages

- Savings – instant access, cash ISA, fixed rate bond and 123 savings account

Business

- Business current accounts

- Loans – Unsecured business loan to help grow your business

- Overdrafts – unsecured business overdrafts to help manage day to day cash flow

- Commercial mortgages

- Business savings accounts – instant access, fixed rate business bond, client business reserve and business reward savings

- Business insurance – including public liability, employers liability, working from home, office, professional indemnity, van, shop and surgery insurance

- Card acceptance terminals – Elavon and iZettle, allowing business to accept debit and credit card payments.

Corporate

Financial services designed especially for:

- Small businesses

- Small commercial

- Medium commercial

- Large commercial

- Corporate business

[related1][/related1]

Santander Services and Products – USA

Just like in the UK, Santander USA offers a wide array of personal and business services, including:

Santander USA Checking Accounts

- extra20 Checking

- Premier Banking

- Preferred Plus Banking

- Classic Banking

- Basic Checking

- Student Banking

- Business Owner Banking

Santander USA Money Market Savings

- Premier Money Market Savings Account

- Preferred Plus Money Market Savings Account

- Money Market Savings Account

Santander USA Savings

- Santander Goal Savings Account

- Classic Savings

- Basic Savings

- Santander Student Savings

- Statement Savings Account

Santander USA Online and Mobile Banking

- Online Banking

- Mobile

- BillPay

- e-Bills

- Online Statements

- Additional Features

- Security

Santander USA Certificates of Deposit

- Premier CD

- Choose Your Terms CDs

- Rising Rate CDs

- IRA CDs

[related2][/related2]

Pros of Banking with Santander

- In the UK Santander regularly offers new customers a £100 bonus when they open a bank account with them

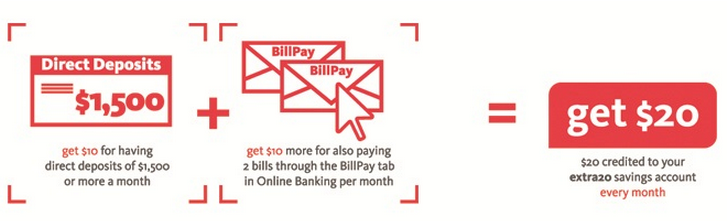

- In the US, Santander has a promotion where it pays you $20 every month. With its “extra20 checking” account you can get paid each month when you have direct deposit and pay your bills online.

- In addition to the above pros, the bank has an easy to navigate website. Information is clear and important information such as interest rates are set out in an easy to understand manner.

- Most banking transactions can be carried out online

- Excellent UK and US based helpline, with English speaking staff

- Online banking for most products and services

- Mobile banking app allows you to bank on your smart phone

- Current account switch guarantee ensures simple and hassle free switching

- Bank accounts to suit all circumstances from students to children to cash back to current (checking) accounts

[related1][/related1]

Cons | Santander Complaints

- According to the FCA (Financial Conducts Authority) Association, Santander had the most banking problems as per customer complaints in April 2013

- The most complaints from Santander customers involved the bank’s investments and mortgages products and services

- In the last year, about 4% of the bank’s customers complained about various issues, according to the FCA. 4% is a pretty high number when you take into account that the bank provides services to millions of consumers

- Other Santander complaints: the bank was the fifth highest most complained about bank in the UK.

[related2][/related2]

Santander’s Response to Consumer Complaints

Steve Pateman, Head of UK Banking at Santander admits that Santander has a lot more to do and needs to focus relentlessly on improving the levels of customer service.

In their response, titled “How we learn from complaints”, Steve released the below statement.

[related1][/related1]

Benefits of Using Santander Bank

- Santander has a key goal to build a bank that always puts customers first and believes that customer relations are at the heart of everything they do.

- Each customer is treated as a business partner

- Santander has an exceptional balance sheet. Their prudent approach to risk management along with a strong capital position has resulted in them having one of the best ratings out of many of the UK banks. For example: Standard & Poor have recently given Santander a long term “A” rating and “A-1” short term rating.

[related2][/related2]

Santander Rates and Fees

- 123 Current (Checking) Account – pays cash back on many bills and day-to-day purchases and pays between 1% to 3% interest depending on your balance. A minimum of £500 has to be paid into the account each month

- Everyday Current (Checking) Account – is a straightforward basic bank account with no monthly fee and no minimum balance amount

- 123 Credit Card – gives you cash back on your purchases. There is no annual fee for the first year and £24 thereafter. The interest rate is between 18.9% to 22.8% APR

- Santander Credit Card – offers 0% for a set period of time on balance transfers and a rate of around 17.9% APR thereafter

- Mortgage – there are no booking fees on selected mortgages and you can pay more off the mortgage and leave early with no charge on selected mortgages. Interest rates are variable

- Savings accounts – Santander offer various savings options with interest rates varying from 1.00% to 2.10% per annum

[related1][/related1]

MarketConsensus Contributors: Suzanne Hanney and Ogbe Airiodion