Can the Music Continue to Charm Investors? Is SIRI Stock a Good Buy, Sell or Hold?

We all love to listen to our favorite music channel while working, when stuck in traffic or during a long commute. It's a great pass time indeed, but it takes a different tune to appease investors.

Sirius XM Radio (SIRI)'s stock has risen 48% in the last six months. The questions that a lot of investors are asking now is whether there is more to SIRI than what meets the ear? Is Sirius XM stock, SIRI, a buy, sell, hold or even a short? Has it risen too high, too fast?

Let’s assess the facts and try to address those questions.

Source: Yahoo Finance

Sirius XM Stock (SIRI) Analysis Breakdown

- Fundamental Analysis

- The Competitive Landscape

- Risks

- Technical Analysis

- Will the Music Stop?

- Bottom Line Conclusion

A company's Earnings Per Share (EPS) is a popular litmus test used by many investors to quickly gauge the relative value of the firm. SIRI has reported quarterly EPS of $0.01, $0.02, $0.48 and $0.01 for the quarters ending Q4-11, Q1-12, Q2-12 and Q3-12 respectively. For Q4-12 the company is expected to report (in Feb 2013) an EPS of $0.02, with EPS forecasts for the subsequent 3 quarters expected to come in around $0.03 every quarter. On an annual basis, SIRI's EPS were $0.01 (actual), $0.07 (actual), $0.53, $0.10 and $0.13 for the years 2010 through 2014 respectively.

In plain terms, what these numbers mean is that the company has been delivering steady positive EPS growth (barring the exceptionally high 2012 EPS) throughout the last 3 years, and is expected to continue that momentum over the next 2 years as well.

2. The Competitive Landscape

The company is in a pretty competitive business, where the sports, talk, traffic, weather, news, music and entertainment broadcasting business already had some serious players even before the company first burst into the scene.

business already had some serious players even before the company first burst into the scene.

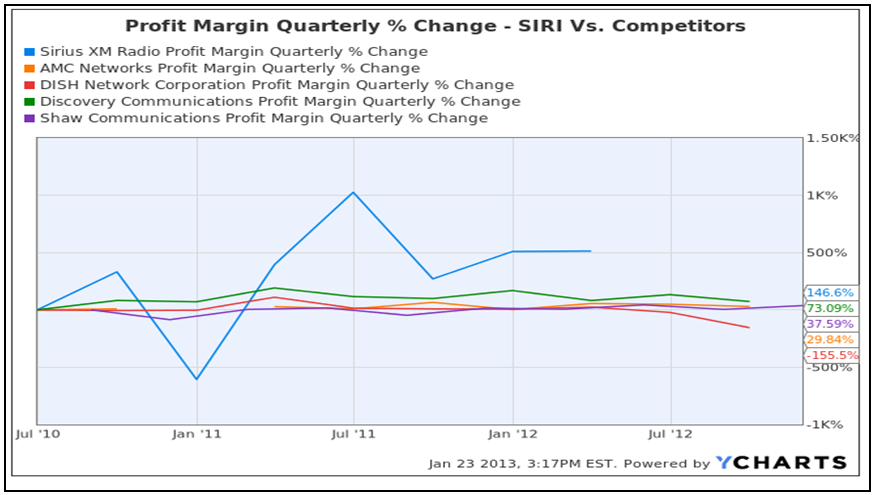

However, as our graph on the right seems to indicate, SIRI has consistently been able to hold its own, even against heavy hitters like Discovery (DISCA) and Shaw (SJR), delivering comparatively better quarterly profit margins to its shareholders than many of its peers.

The company has delivered acceptable revenue growth of around 11% year over year for the quarter ending Sep-2012, with gross margins of 56.1% for the trailing 4 quarters ending Sep-2012.

When viewed against some of its other industry peers, SIRI offers a pretty compelling story for its shareholders on a valuation basis. For instance, take a look at some of the metrics below:

|

Stock |

Trailing PE |

Forward PEG |

|

Sirius (SIRI) |

6.1x |

0.6x |

|

Time Warner (TWX) |

14.4x |

1.3x |

|

Direct TV (DTV) |

10.7x |

0.6x |

|

Discovery (DISCA) |

24.7x |

1.3x |

SIRI also offers investors a better Price Earnings Growth (PEG) looking forward. With a Forward PEG value of 0.6, and with its 5-year average of this metric standing at 2.6, the stock trades at a discount of 75%. Compared with the S&P 500 Forward PEG of 1.8, SIRI is a relative steal at a discount of almost 65%.

Continue: Risks to Buying SIRI Stock (Sirius XM Stock Analysis)