Thursday, February 07, 2013 – Here is today’s summary of U.S. stock market activities – Major Headlines, Top Losers, Top Winners, Advances & Declines.

Stock Market Headlines

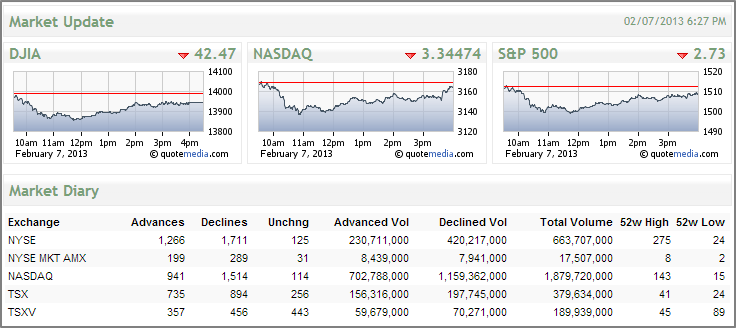

Stocks fell across the board today after ending essentially flat yesterday. Around 12pm, the Dow (DJIA) was trading around13,852 – its lowest level for the day. It recovered to end the day at 13,944, down 42.47 points from the previous day’s close. It was a similar situation for the S&P and Nasdaq indexes.

Today’s decline was mostly due to renewed worries over the political and economic situation in Europe. The ECB (European Central Bank) President, Mario Draghi, voiced concern that conditions for the euro zone would most likely deteriorate during the early part of the year, with some possibility of recovery during the latter part of 2013.

The Bank of England reiterated its decision to leave interest rates unchanged at 0.5%.

Most Active Stocks – Top Losers By Percentage (NYSE & NASDAQ)

- Shares of Ambassadors Group (EPAX) dropped -16.07% today, making it the biggest loser across the NYSE and Nasdaq. The firm, a leading provider of educational travel experiences and online education research materials, reported earnings for 2012. Gross revenue was $139.9 million, a 11% decline from the previous year’s $155.1 million figure. In addition, year-over-year net income declined by 43%, down to $1.7 million. Ambassadors Group also announced that “enrolled revenue for 2013 programs were down 19.2 % year-over-year for all programs”.

- Bon-Ton Stores, a company that provides a wide selection of unique and limited-distribution merchandise, was the next biggest loser, declining -15.31% to close the day at $11.62. The company reported that its January sales figures missed estimates. The firm also announced that it was reducing its guidance for full year 2012.

-

ExOne, a manufacturer of 3D printers, went public today. The stock (XONE) opened for trading at $23.90, 32.7% higher than its $18 IPO price. It ended the day up 47.33% at $26.52 a share. Shares of XONE were the highest gainer across the Nasdaq and NYSE.

-

Shares of First M&F’s stock (FMFC) were the next highest gainer across the NYSE and Nasdaq. The company announced that it was in talks to be acquired by Renasant Bancorp in a deal that would value the firm at $115.2 million. Renasant will be acquiring FMFC in a wholly stock deal, exchanging 0.6425 of its shares for every one of FMFC shares – which reflects a per share value of $12.50 for each First M&F stock.

The WSJ reports that “the deal, expected to close in the third quarter, will create the fourth-largest bank by deposits in Mississippi, and will have combined assets of about $5.8 billion”.

[related2][/related2]

Financial Market Data powered by Quotemedia.com. All rights reserved. Quote data delayed 15 minutes unless otherwise indicated. View the Terms of Use. Data was also obtained from The Wall Street Journal