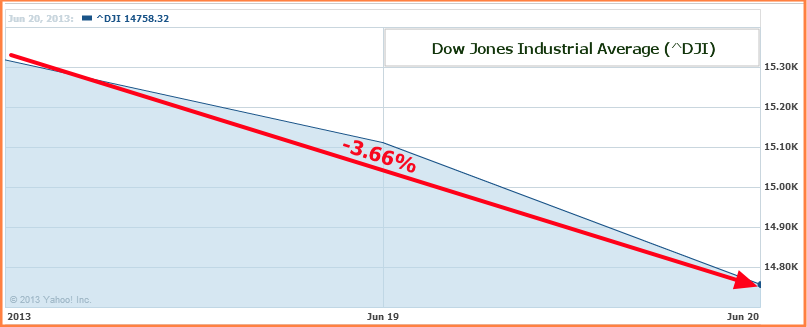

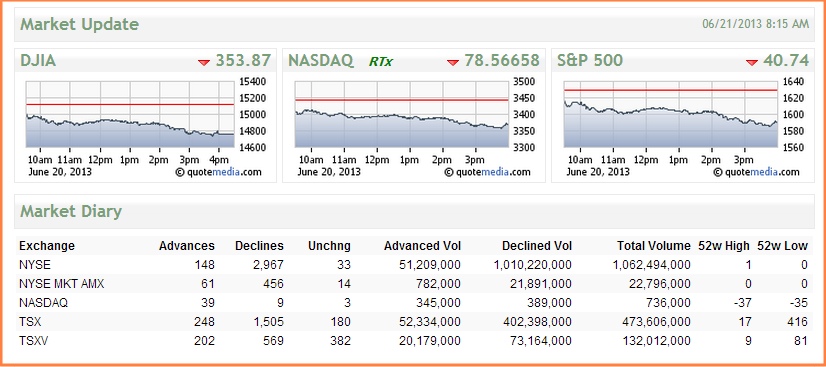

In the last two days, starting Wednesday June 19, the Dow (DJIA) has fallen 557 points, a 3.66% drop. The selloff has been in reaction to Ben Bernanke’s announcement that the Fed could start tapering its $85B a month bond purchase, starting in a couple of months.

Mr. Bernanke, however, advised that any tapering will be based on improving economic conditions: "And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around mid-year."

As of this morning, a lot of investors are wondering if the selloff has been overdone. "People are overreacting a little bit. It goes back to the fundamentals, the economy is improving," said Gene Goldman of the Cetera Financial Group.

Stocks and markets across the world have tumbled in the last two days as investors re-evaluated their economic and financial models to price in a Fed tapering that could come sooner than previously expected.

[related1][/related1]