TORC Oil & Gas Stock (Canada: Toronto) – Is TOG Stock a Buy, Sell or Hold in 2013?

Shares of TORC Oil & Gas stock (TOG) were the most actively traded on the TSX (Canada: Toronto) exchange today. The price of the stock ended 4% lower from the previous day’s close as over 21.5 million TOG.TO shares traded hands.

Since June 28, 2012, when TORC’s stock price hit its 6-year low of 1.55, it has risen over 40%. However, viewing the stock from a longer time frame, we see that the stock has fallen by over 34% over the last one year (March 2012 – Feb 2013). In the last two years, it has fallen more than 66% – leaving many investors asking: Is TORC stock, TOG.TO, a Buy, Sell or Hold in 2013?

Let’s take a look.

March 2012 – February 2013: TORC Stock Movement

Source: Yahoo! Finance (Canada)

TORC Oil & Gas (TOG) Analysis Breakdown

- Fundamental Analysis

- Analysts’ Consensus

- Trading Perspective

- Market Correction Impact

- Fundamental Analysis

TORC Oil & Gas Ltd. operates, produces and explores oil and gas in Western Canada. It is engaged in the acquisition, exploration, development and production of crude oil and natural gas assets.

On September 30, 2012, the firm released its latest revenue numbers via its “Q3 2012 Interim Report” and announced that on September 13, it had entered into a joint agreement to acquire Vero Energy and form a new light oil focused company.

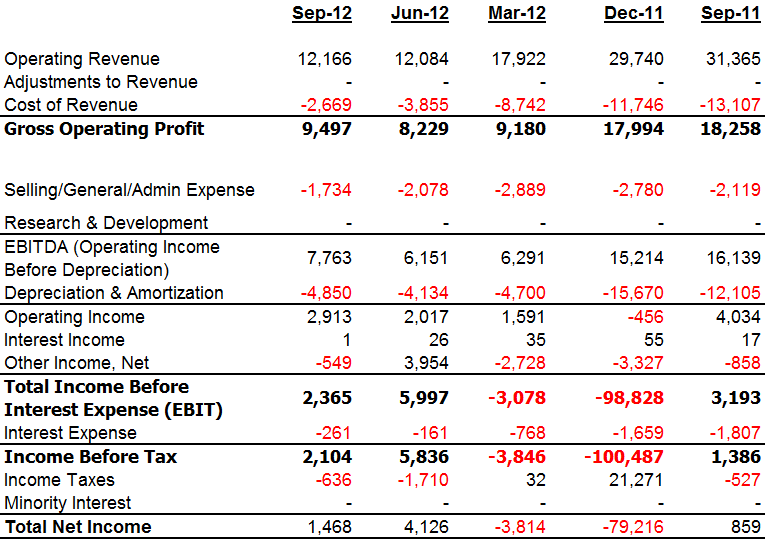

In the three months ended September 30, 2012, the firm recorded a deficit net working capital of -$3.39 million. Total net income for the quarter was $1.46 million. For the 2nd and 1st quarter of 2012, TORC earned net income of $4.12 million and -$3.81 million respectively (see below table).

Quarterly Income Statement for TORC Oil & Gas Ltd. (TOG:CA)

TOG also reported 1.78 million in cash reserves and total assets of $219.2 million – enough to cover the firm’s total debt of $67.18 million. It pays a cash dividend (CAD) of 0.30, an amount that has been of great attraction to “dividend seeking” stock investors.

Management also announced that in addition to the Vero acquisition, they had also raised $120 million (private placement and flow-through common share subscription receipts) which has positioned the firm "with a strong and flexible balance sheet heading into 2013. TORC remains on track to achieve its previously announced 2012 exit guidance of 3,900 BOE/d (75% light oil and NGLs) with a strong balance sheet of $40 million of net positive working capital".

Continue: 2/9/2013 Trading Strategy for TOG Stock (TORC Oil & Gas). TOG.TO Stock Analysis