Top 5 Ways to Protect Yourself against a Stock Market Correction

The longest winning streak since the last decade has taken U.S. markets into uncharted territory. The Dow Jones Industrial Average (DJI) is at its highest level ever, after rising 140% from its 2009 lows.

Both the NASDAQ and S&P 500 continue their upward trends as they inch ever higher past their previous highest levels.

However, as the market surges higher, the level of investor concern continues to grow.

“The stock market's not climbing a wall of worry – it's not worrying about anything. Typically when that happens something will come along to pull it back" stated Quincy Krosby, chief market strategist at Prudential, in a CNBC report.

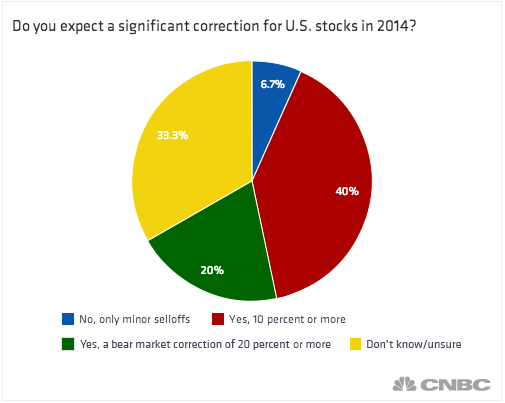

According to a poll of investment advisors conducted by CNBC, 40% of advisors believe there will be a 10% correction in 2014. 20% believe that 2014 will bring a bear market correction (a decline of 20% or more).

Cautiously optimistic for 2014

Below is a quick guide to better understand the current market dynamics. Are we due for a major correction? What are the top ways for you to protect your investments? Which of these can you implement today?

2013 – 2014 Guide to Protecting your Assets against a Correction

- Why the stock market continues to rally

- Are stocks in overbought territory, and is it time for a major correction?

- Here is what market fundamentals show

- Here are the top 5 ways to protect your portfolio

Why the stock market continues to rally

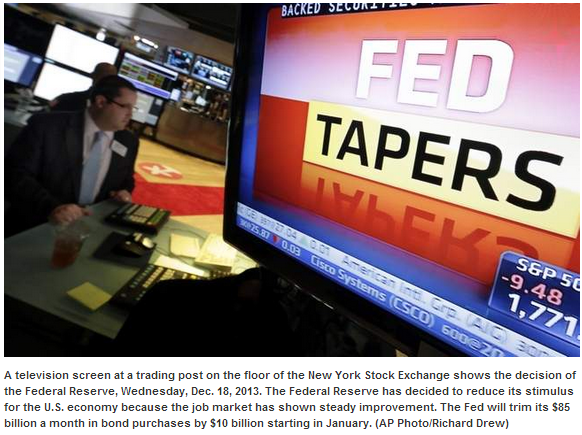

There are many factors contributing to this run up in stock prices, the biggest factor being the Federal Reserve’s quantitative easing (QE) program. Recently, the Fed announced that it plans to reduce its $85 billion monthly bonds buying. On the day the announcement was made, stocks surged to their highest levels.

The Wall Street Journal reports that "the Fed’s decision to start winding down its bond-buying program had a little something for everyone. It appeased those who had been calling for the Fed to pull back some of its accommodative policies, yet it also wasn’t drastic enough to rattle markets."

Image Source: Daily News

Are stocks in overbought territory, and is it time for a major correction?

A few weeks ago, Bespoke Investment Group labeled the S&P 500 as extremely overbought, while stock analysts at Strategas announced that from a valuation standpoint the market "exhibited tendencies similar to that of a runaway freight train."

Is a market correction coming?

However, a large number of investors including Edward Yardeni, independent economist and strategist, believe that “we're in a bull market, which can continue for the next few years."

Sentiment surveys also show that a majority of equity investors expect the rally to continue. The most recent survey from the American Association of Individual Investors had bulls outnumbering bears 46 percent to 29 percent.

Here is what market fundamentals show

From a fundamental perspective, the gains in stocks have been supported by better than expected corporate earnings, with companies like Exxon and Netflix reporting strong growth. The recently announced better than expected employment numbers have also helped to boost stock prices.

In addition, the super accommodative monetary policy from the Fed continues to fuel the fire.

Can the golden market era be sustained?

There are, however, still issues surrounding the global economy.

Europe might well come back as a concern for investors, which has proved to be the case every year over the past four years. A recurrence of the European crisis would put pressure on stock markets around the world.

Or, the Fed could reduce its QE program too quickly (as some fear), leading to an unexpected impact to the economy. As reported by Reuters, market investors expect “the Federal Reserve to reduce its monthly bond purchases to $25 billion by July of 2014 and to end the program at the October 2014 meeting.”

Here are the top 5 ways to protect your portfolio

Below are five strategies to help protect your portfolio during a market correction.

- Buy Defensive “Market Correction” ETFs

- Conduct Short Selling (Short stocks that have soared and are overbought)

- Diversify (Invest in Savings and I-Bonds)

- Invest in Value and Income Stocks

- Buy Beaten Down Stocks (Start buying stocks after markets have fallen 3%-6%)

1. Buy Defensive Exchange Traded Funds (ETFs)

There are numerous “market correction protection” ETFs (FAZ, ERY, BGZ, etc.) that provide a great level of portfolio protection during a market downturn.

These leveraged securities are structured to move inversely to the markets (Dow, S&P, etc.) or to specific market sectors (financial sector, technology sector, etc.).

By their nature, they perform very well (go up in value) when markets are on a decline and do very poorly when stocks are rising.

Read More >> Using Leveraged ETFs to Protect Your Stock Portfolio

2. Short Selling (Short stocks that have soared and are overbought)

In addition to defensive leveraged ETFs, short selling is another way to hedge your stocks or portfolio against a market correction. Aside from hedging, short selling can also be used as a revenue generating strategy.

Many individual investors find short selling confusing, which is why they don’t engage in it. Here, we break it down with an easy to understand guide on short selling.

Let's assume you believe a stock (for example, AAPL – Apple) is going to decline in value. If you ….

Read More >> Short Selling as an Investment Strategy

3. Diversify (Invest in Savings Bonds and I-Bonds)

There are many ways for you to diversify your portfolio. You can diversify into bonds, mutual funds, and indexes, amongst others. For various reasons, however, average individual investors often invest only in stocks.

For one thing, many investors just don’t understand the mechanism of bonds. Also, with stocks you are more likely to get a quick or high return on your investment than you are with bonds. Take Twitter’s IPO as an example – its stock surged 70% on its first day.

Nevertheless, stocks are also much riskier than bonds.

There are two savings bonds options you might want to consider when diversifying your portfolio.

Click below for a quick and easy-to-read guide on EE and I-Bond savings bonds.

Read More >> Smart Investing – Savings Bonds and I-Bonds

4. Invest in Value and Income Stocks

Most investors invest in order to get a “good return".

Whether you invest in equities, bonds, real estate or commodities, the end goal is generally to make more money than you initially invested.

Value stocks are stocks that pay dividends on a regular basis. “Income stocks represent mature and stable companies that pay consistent dividends. These companies often don't have much growth room, but are steady income producers”

In times of a market decline, Value and Income stocks do not decline as much as growth stocks, which are highly volatile. As such, these types of stocks are essential for a diversified portfolio.

Here are some fundamental factors you should consider when analyzing Income and Value stocks…

Read More >> Investing in Value and Income Stocks

5. Buy Beaten Down Stocks

This strategy does not necessarily protect your portfolio. What it does is allow you to buy stocks at a bargain in preparation for the inevitable bounce in the stock market.

For this strategy to prove profitable for you, however, you’ll want to ensure that you avoid buying “deadbeat stocks”.

These are stocks that’ll just sit around in your portfolio collecting dust rather than making you money.

Such stocks tend to continually decline in value.

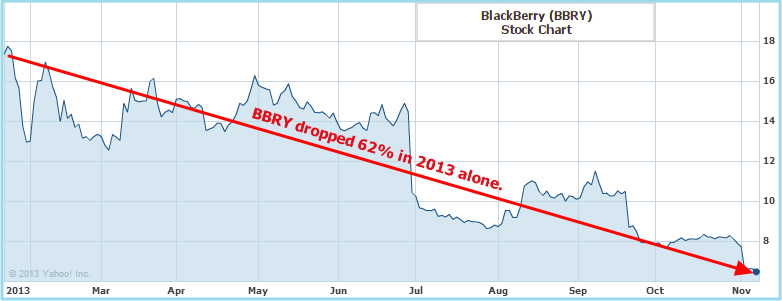

A stock like BBRY (BlackBerry) could be considered a deadbeat stock.

What you want to do is invest in stocks with strong growth and high future potential.

Click below for a quick read on investing in growth stocks

Read More >> Growth Investing for The Individual Investor (Growth Stocks)

In addition

You might want to check out this review article on the top 12 banks with very high interest paying accounts: 12 Best Banks to Bank With | No Fees, High Yield Savings Accounts, Reviews.

Instead of (or in addition to) investing in bonds, CDs or other low earning financial instruments, you can open a simple checking or savings account that offers you a very high yield (0.80% to 3% APY).

We wish you the best of luck in your investments and hope this guide has been valuable to you.

Connect with us on Facebook or Twitter, and let us know if you have any questions or comments.

Regards,

Ogbe Airiodion

Contributor – MarketConsensus News Blog