As discussed in our previous article, there are hundreds of trading software available to the average investor or trader.

The previous posting (Top 7 Trading Tools for Investors and Day Traders) presented an overview of four such tools: Stock Screeners, Streaming Quotes Platforms, Watch Lists Tools and Trading Strategy Builders.

Below are the last three on the list of top seven:

5. Auto-Trading

Tired of figuring out which trades to place each time?

Too busy to sit behind a PC, Tablet or a mobile device to study Stock Screeners and Watch Lists so you can execute your winning trade?

If only there was a way for you to "outsource" your trade decision-making and execution to the pros.

Well, you asked for it and TradeKing’s Trading Platform delivered!

If you subscribe to popular newsletters, including TradeGreek, you can have Tradeking’s Auto Trading tool automatically execute the trades recommended by the publishers of those newsletters.

You simply set up certain parameters on your brokerage account to authorize execution of the trades recommended by the newsletters.

A trade alert is normally sent via a broadcast to subscribers of the newsletter.

The Auto Trading tool picks up the signal and automatically executes the trade on your behalf. It's that simple (and in my opinion, very risky, and not recommended for new investors).

If you already have a trading account with top-line brokerage sites like E*Trade or TD Ameritrade, and wish to engage in auto trading, then subscribing to CoolTrade's robotic trading system may be another option to consider.

Their trading tool plugs-in with major brokerage software and allows users to automatically trade the market based on specific strategies.

See Also:

- How Mobile Banking is Disrupting How We Bank | Security, Trends, Payments

- 5 Best Online Trading Sites – Best Online Brokers

- 12 Best Banks to Bank With | No Fees, High Yield Savings Accounts, Reviews

- Top 10 Best Forex Brokers, Futures and Options Trading Firms (2013 Review)

6. Research, News Flashes, Graphs, Data Analysis

You should never enter into a trade blind.

The key to making money trading is by executing each trade with your "eyes wide open".

That means doing solid research, reading up on the latest news about the target company, assessing various trading parameters – both numerically as well as graphically, and resorting to other forms of data analysis.

Once all of this is done, you can then confidently put in an educated trade, knowing when to get in and when to get out.

Questrade offers a handy research and analysis tool called Bulls Eye that puts the power of intelligent trading in the hands of traders who wish to follow an "eyes wide open" approach to their trades.

Using a 4-step process the tool guides investors through the process of coming up with investment ideas. From GER (Growth, Earnings, Revenue) analysis, to Valuation and Fundamental analysis to Technical (SRI MACD) analysis of a ticker.

Traders also have a broad range of resources at their fingertips, from market news to industry assessment to sector-moving stories and commentaries.

[related1][/related1]

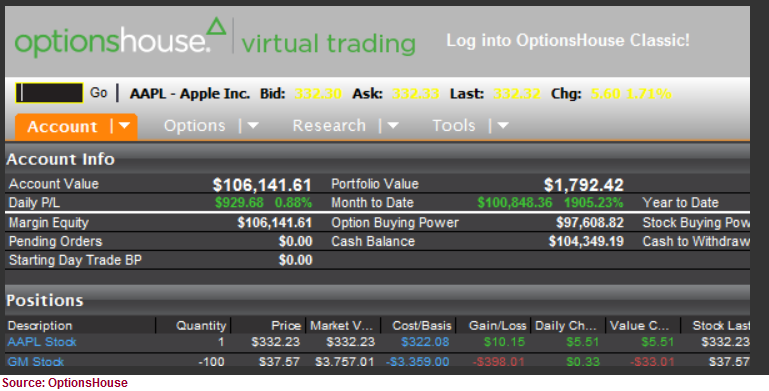

7. For New Investors: Virtual Trading

If you are thinking about taking up online trading, but haven't really had the drive to jump in with both feet, then maybe you need to be eased into the trading world: There's a trading tool for that!

At OptionsHouse, once you open an account you'll have access to a neat little virtual trading software tool that you can use to test-drive online trading.

And you don't even need to fund your account to get access to this tool.

What's more, they even pay you $5,000 – albeit in virtual currency!

You are essentially using a simulated trading environment that mimics everything you'll see in real life, except that the data you have access to is delayed.

However, as a novice trader, this should not detract you from building a trading strategy and horning your trading skills using this great tool.

It even allows you to switch (almost) seamlessly between two worlds – the virtual and real – by effortlessly allowing you to move between your test account and your funded one.

[related2][/related2]

Conclusion

Most online brokers provide the above trading software tools in some form or another.

Although we have identified these trading platforms using distinctive terms, some brokerages have designed their software to integrate one or more of these features.

For instance, while some brokerages offer a specific Watch List tool, Scottrade includes it as part of its Streaming Quotes platform.

Don't be overwhelmed however, because the objectives are pretty much the same in all cases.

And just as a motor vehicle is only as good as the person behind the wheel, so too are trading tools only as effective as the user behind the keyboard, or tapping away on a mobile device screen.

To truly benefit from these awesome tools, traders must invest whatever time is required to master each tool.

And just as an untrained driver behind the wheels of a car can cause untold mayhem, so too can an untrained trader bring mayhem to their portfolio (using tools that he/she is unfamiliar with).

Today's trading tools provide traders with a means of getting better information fast, and in a format that is much easier to understand than was ever before possible. However, most retail trading tools are designed to be complimented by a cautious dose of human intelligence.

Use the tool intelligently, taper your expectations accordingly, and you'll likely minimize any disappointment.

- Are Bonds a Good Investment? Should Investors Buy Bonds in 2014?

- Top Stocks of 2013 – Biggest Stock Gainers (Highest Top Gainers over 100%)

- US Savings Bonds | Quick Guide for Investors | EE, I Bonds

- Bonds Investment 101 | What are Bonds? How Can I Invest?

– Monty R.