Union Bank Reviews 2014 | History, Rates, Fees, Pros, Services, Complaints

Below is our 2014 review and analysis of Union Bank. In our research and analysis of Union Bank’s services and customer reviews, we identified the various pros, cons, benefits, complaints, fees and rates involved with doing business with Union Bank.

Union Bank Review and Detailed Analysis 2014

- Union Bank History

- Union Bank Rates and Fees

- Union Bank Reviews – Credit Card Comparison

- Union Bank Products and Services

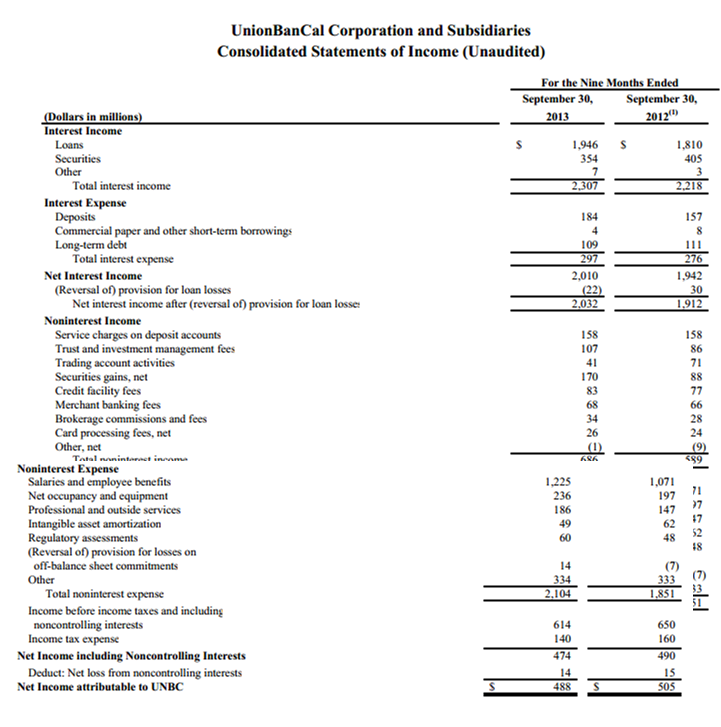

- Union Bank – UnionBanCal Corp Financial Statement (Income Report)

- Union Bank Pros and Cons

- Are the disgruntled customers few and far between?

[related1][/related1]

Union Bank History

Union Bank, as known to most Americans today, was founded in 1996 as a result of the merger between The Bank of California and Union Bank.

Union Bank, N.A., is a subsidiary of the San Francisco-based UnionBanCal Corporation. The UnionBanCal Corporation is a wholly-owned subsidiary of The Bank of Tokyo-Mitsubishi UFJ, Ltd., and has an asset base of $105.5 billion as of September 30, 2013.

The bank’s customers have access to more than 600 ATMs, 425,000 Star® and MasterCard® ATMs throughout the U.S., as well as over 1.7 million MasterCard ATMs worldwide. In July 2013, American Banker Magazine and the Reputation Institute ranked Union Bank #1 for reputation among its customers.

Union Bank Rates and Fees

- Savings and Certificates of Deposit: Union Bank, N.A. interest rates on savings accounts range from 0.01% to 0.25% depending on the type of savings account.

- Loan Rates: Fixed mortgage rates range from 3.375% to 5.25%, while adjustable mortgage rates range from 2.5% to 4.375%.

- Credit Cards: The bank offers customers five credit cards with interest rates ranging from 13.99% to 19.99%. Most of the credit cards do not attract an annual fee. The Union Bank Graphite American Express Card, however, attracts an annual fee of $99 after the first year. The bank’s Secured Visa Card attracts an annual fee of $19.

[related2][/related2]

Union Bank Reviews – Credit Card Comparison

Union Bank Products and Services

|

Retail Banking Products & Services |

Small Business Banking Products & Services |

Commercial Banking Products & Services |

Private Banking |

|

|

|

|

[related1][/related1]

Union Bank – UnionBanCal Corp Financial Statement (Income Report)

[related2][/related2]

Union Bank Pros and Cons

Top 5 Things Customers Like about Union Bank

- Favorable Interest Rates – The bank’s savings account interest yields are noticeably higher when compared to other commercial banks. (You need to deposit a considerable amount of funds, however, in order to earn the higher APYs.) For customers who are big on saving, favorable interest rates will no doubt be a significant factor in deciding where to save.

- The Language Factor – For their clients doing business in or visiting Japan, Union Bank has a dedicated Japanese Customer Service Unit to assist where necessary.

- Employees appear to be satisfied overall – According to the online jobs and careers community, Glassdoor.com, Union Bank, N.A. has a 3.1 out of 5 rating based on 180 reviews from current and former employees. In addition, a reported 61% of employees would recommend Union Bank to a friend. Job website, Indeed.com, rates Union Bank, N.A at 4 stars, based on 162 reviews.

- Diversity and Inclusion – Union Bank, N.A. reports that more than 55 percent of the members on its Board of Directors are women or individuals from minority groups. The bank also reports that its general labor force is comprised of 60 percent women.

- Display of Corporate Social Responsibility – Through its Community Outreach Group, the bank provides support for a number of projects in low income communities. The bank encourages its employees to use VolunteerMatch to identify opportunities to give back to the community. For the 2013 Christmas season, Union Bank, N.A. donated 175 Christmas trees to the families of men and women actively serving in the military, and an additional 15 trees to the Trees for Troops program. The 15 trees will be shipped to various military bases.

[related1][/related1]

Union Bank Customer Complaints

Union Bank’s Facebook page is riddled with complaints from its customers, most of which are centered around the below consumer complaints:

- Cumbersome online banking authentication system

- Unstable mobile apps

- Lengthy bill payment processing time

- Lengthy clearing time for deposits

- Poor in-branch customer service

To its credit, most of the customer complaints and requests for clarifications received on the bank’s Facebook page are addressed with some sort of response.

Considering the sensitive nature of some of the requests and the overall banking regulations regarding account information disclosure, most of the complainants are directed to call the Union Bank, N.A. contact center directly.

[related2][/related2]

How do most customers feel towards Union Bank?

Despite the numerous complaints, Union Bank, N.A. was ranked atop 30 banks in the 4th Annual Survey of Bank Reputations conducted by the Reputation Institute and American Banker Magazine.

The results of the survey were published in the magazine’s July 2013 issue, where Union Bank, N.A. was awarded 78.15 of 100 points.

The cumulative score measured customers’ perception of the bank in relation to respect, trust and overall admiration. No other financial institution in the history of the survey has scored a higher grade.

The accolades did not stop there. The bank also landed in the top five in a number of other categories relating to overall governance, performance, workplace culture, citizenship and leadership.

The bank’s President and Chief Executive Officer, Masashi Oka, was featured on the magazine’s cover and quoted as saying, "Banking at its heart is built on trust, and reputation is built on earning it . . . At Union Bank, we believe banking at its best is a noble profession that helps strengthen those it serves. That's why we place a priority on upholding the values of responsible banking, and why we incorporate those values into our culture and how we do business. It's an important part of our social contract."

[related1][/related1]