Vanguard Review 2014 | Vanguard Personal Investor Services, Rates, Pros, Complaints

Below is this year’s review of the Vanguard Group, including the various pros, cons, consumer complaints, services and rates that we identified during our Vanguard research and review analysis.

Vanguard – An investment company on a mission

Vanguard Review and Personal Services Analysis

- Vanguard History, Origin and Growth

- Services Offered

- Added Benefits

- Vanguard Rates & Fees

- Vanguard Consumer Complaints

- Conclusion

[related1][/related1]

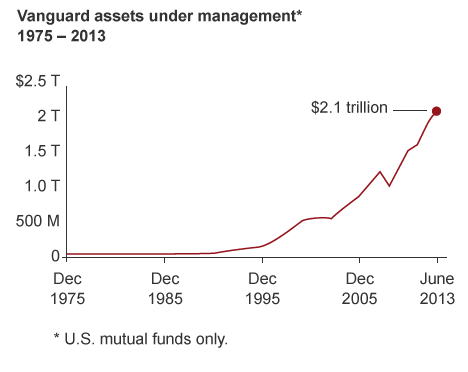

Vanguard History, Origin and Growth

The Vanguard Group was founded by Jack Bogle, after he discovered that over 80% of actively managed mutual funds and other investments weren’t beating market indices.

In 1975, in the wake of one of the worst bear markets since the Great Depression, Jack launched a bold experiment: a mutual fund company that wasn't designed to earn profits for a management firm. Instead, Vanguard would be the first ever to be owned by its member funds and operated solely in the interests of its funds' shareholders.

In the 1980s, news about Vanguard started to spread, largely by word of mouth. Other firms started to take notice and competitors began to emulate Vanguard by offering their own index and mutual funds.

[related2][/related2]

Today, Vanguard is one of the world's largest and most trusted investment management companies, with operations around the globe.

Services Offered

Vanguard’s flagship products are invested through Vanguard funds and ETF’s. However, they offer a wide range of investment types, ranging from standard ETF’s to IRA’s and brokerage accounts.

However, investments are just the tip of the iceberg when it comes to the services offered through Vanguard.

The biggest service that you’ll find at Vanguard is their advice. Their financial advisors are touted as some of the smartest, most forward thinking advisors in the industry. And the best part is that they’re at your fingertips when you need them.

[related1][/related1]

Added Benefits

The advice offered by the firm is one of the biggest benefits provided to investors. Vanguard’s founder was no standard advisor. Jack Bogle didn’t play the market; he became the market. In turn, he structured a unique methodology of hiring and teaching others to provide a similar form of knowledge and expertise.

Vanguard Rates & Fees

When it comes to investments, the first thing you’re going to focus on is the commission rates. So, we’ll start there.

The commission rates are based on a tiered pricing system. In all tiers, Vanguard ETF’s are absolutely free.

However all non-Vanguard ETF’s and all stocks are traded at the following rates.

- If your account maintains a balance of less than $50,000 you will be charged a rate of $7 per trade for your first 25 trades and $20 per trade thereafter.

- Accounts ranging in investment value from $50,000 to $500,000 will enjoy $7 per trade.

- For accounts with $500,000 to $1,000,000, all trades are $2.

- Finally, if you hold more than $1,000,000 in your account, your first 25 trades are free and you pay $2 per trade thereafter.

As you can see from the pricing on stocks and ETF’s, Vanguard is very competitive. They keep the same competitive nature in the pricing of all their products ranging from stocks and bonds to CD’s.

[related2][/related2]

Vanguard Consumer Complaints

Vanguard has had its share of consumer complaints. Below are some of the key Vanguard complaints that can be found online.

- Customer service on 401(k) loans.

- Trouble with the online platform.

- Transferring out of Vanguard takes too long.

Conclusion

Overall, Vanguard is a great company. When it comes to fees, they are incredibly competitive. However, when it comes to advice, they could be considered superior. If you’re looking to invest, Vanguard might just be your best option.

[related1][/related1]