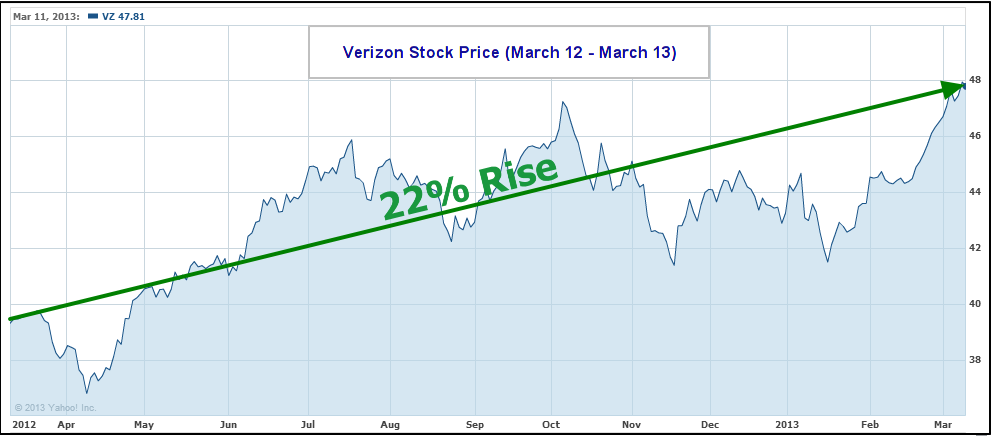

Verizon Stock (VZ) Soars 22% in 1 Yr. Time to Buy the Stock?

Since March of 2012, Verizon Communications stock (VZ) has surged 22% and lots of investors are now asking if the stock will continue rising in 2013 and whether Verizon is a good buy, sell, hold or short.

Article 1 (What's on the Horizon for Verizon) of this 2 part series, presented an overview of Verizon’s financial figures and a detailed analysis of the various fundamental and valuation variables impacting the stock price.

In this article, we’ll be analyzing the company from a technical perspective. In addition, we’ll review the various positive catalysts that may continue to support the rise in the stock price, followed by a bottom line conclusion on whether VZ is a good buy, sell or hold in 2013.

Verizon Communications, Inc. (NYSE: VZ) Analysis Breakdown

- Fundamental Analysis

- Valuation Overview

- Technical Perspective

- Favorable Catalysts for the Stock

- Bottom Line Conclusion

- Market Correction Impact

- Technical Perspective

Based on Morningstar data at the time of this analysis, VZ is trading at the higher end of its 52-week range of $36.80-$48.77. Over the past year, the stock has progressively been moving higher, from its $37.67 value on March 13, 2012 to its current price of $47.96. Along the way, the stock has found a fair bit of support at its 50-day Simple Moving Average (SMA) of $44.25, breaching that value several times, only to recover and move higher.

In late October 2012 the stock was on a downward trend, most likely as a result of the unfavorable impact that Super storm Sandy threatened to have for the company. The stock breached both its 50-day and 100-day SMA, but found support at its 200-day SMA of $43.38. Since then, except for a brief period in mid-Jan 2013, the stock has been on a up-tick, breaching all 3 SMA's to mark new highs.

Based on the chart above, it would seem that the strong base that VZ established between Nov 2012 and mid-Jan 2013 has set the stock up for a significant upward run. Barring some catastrophic fundamental challenges, it does look like VZ is in line to test new highs.

- Favorable Catalysts

Over the last few years, Verizon has invested heavily in its next generation telecommunication network. Despite setbacks from Sandy, the company was quickly able to repair its damaged infrastructure, and boasts of a network that more than 16 million subscribers and 94 million retail customers pay for. It is also in an enviable position of providing coverage to more than 95% of the population of the United States. These statistics are definitely a favorable catalyst for the company's future.

The company is a cash-flow generating machine and uses its cash reserves strategically, including paying down its debt, investing in long-term upgrades including FiOS, and making strategic acquisitions, similar to the highly accretive acquisition of Alltel in 2009. Such moves show Management's cautious approach and long-term vision, which are favorable catalysts for future shareholder value creation.

The primary negative catalyst for the company is the growing threat of competition that it's wireless and wireline businesses are under. With telephones accounting for approximately 2/3rd of the company's fixed-line revenue, VZ's ability to grow its margins from these subscribers is limited, if not declining. Unfortunately, despite this reality, the company has already made huge amounts of investment in its fixed-line infrastructure. It remains to be seen whether the company is able to capitalize from this expenditure in the coming quarters.

Given the foreseeable growth in demand for data plans, VZ will do well to start accumulating wireless spectrum so it can compete with other carriers to gain market share in this area. Wireless spectrum is auctioned by the government, and other competitors are likely to jump in and compete for those bandwidths. This is bound to drive up VZ's cost for acquiring the much needed bandwidth. How the company deals with this situation will likely be a catalyst for future growth and profitability.

- Bottom Line Conclusion

Based on the above analysis, we would rate VZ as a MODERATE BUY, with a recommendation that investors extend their buy activity on any weakness due to short-term technical or fundamental factors.

- Market Correction Impact

MarketConsensus would, however, like to caution investors on what we see as a 5-10% stock market correction. Market trend indicators are pointing to an overbought situation and a correction is a very real risk over the next 1-3 months. Investors should take this into consideration in their near term investing choices.

(By: Monty R. – MarketConsensus News Contributor)

Good luck in your investing,

MarketConsensus Stock Analysis Team

Follow Us:

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related2][/related2]