Vodafone (VOD) – Latest Results (Is VOD a Buy, Sell or Hold at Current Prices?)

On Thursday, 2/7/2013, Vodafone released its “Interim Management Statement for the Quarter Ended 31 December 2012”. Below are the highlights:

- Revenue declined by -2.6% in their "Service" business

- Revenue increased by +12.8% in their "Data" business

- They experienced earnings deterioration in their European markets (Northern, Central and Southern)

- U.S. revenue grew by 8.7% (the firm has a joint-venture with Verizon to operate in the U.S.)

- There was operational growth in their emerging market sectors

- They successfully expanded their business to six markets, including Italy, South Africa, Greece and Romania

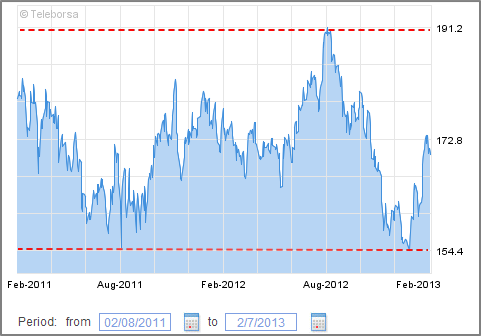

2 Year Trading Range of VOD Stock

Vodafone Group’s stock (VOD) is traded on the Nasdaq and also on the London Stock Exchange (LSE). It trades under the ticker “VOD” on both exchanges. For the past two years, the stock has traded within a range of $25 and $30 on the Nasdaq and a range of 154.4 and 191.2 pence on the LSE (See below charts).

(Pence) Stocks on the LSE are normally quoted in pence. As shares fluctuate often by a few pence during the trading day, it is a lot easier to have it displayed in such a format. (1 Pound = 100 Pence, just as 1 Dollar = 100 cents).

VOD – Nasdaq Exchange (Feb 2011 – Feb 2013)

Trading Range: $25 (Low) – $30 (High)

Source: Yahoo! Finance

VOD – LSE (Feb 2011 – Feb 2013)

Trading Range: 154.4 (Low) – 191.2 (High)

Source: LSE

Taking Vodafone’s financial and operational prospects into consideration, combined with the tight trading range of the stock, a lot of investors are asking: Is VOD a Buy, Sell or Hold in 2013?

Let’s take a look.

Vodafone Group (VOD) Analysis Breakdown

- Fundamental Analysis

- Valuation Overview

- High Dividend Yield

- Trading Strategy for Investors (“short term” buy and sell trading)

- Market Correction Impact

- Fundamental Analysis

Vodafone Group is considered the second largest mobile telecommunications company in the world. It is headquartered in the U.K and provides services to over 400 million customers in 30 countries across the globe.The firm experienced a revenue decline in the latest quarter. Revenue fell to $17.4 billion (11.4 billion pounds) due to a slow-growing global economy, tougher competition, a decline in its European markets and regulatory changes. Vittorio Colao, VOD’s Chief Executive stated that the firm is addressing difficult market conditions in Europe via a cost reduction program and further investments in high growth regions.

He also announced that the firm continues to make progress in its Vodafone 2015 strategy, with good revenue growth in data and emerging markets. And to drive growth in their enterprise business they have created a new enterprise business unit and accelerated their integration plans for Cable & Wireless Worldwide.

Continue: Vodafone's Valuation Analysis, Dividend Yield & Trading Entry Points for Investors