Article 1 (News Corp Stock Surges 60% – Is NWSA a Good Buy or Sell?) presented a fundamental and valuation perspective of News Corp. stock (NWSA), followed by a determination (based solely on Fundamental and Valuation analysis) that News Corp. stock would rate as a BUY.

This article (part II of this 2-part series) will cover NWSA’s value proposition from a Technical Analysis and Positive/Negative Catalysts perspective and will present a bottom line perspective on whether investors should consider News Corp. stock (NWSA) a Moderate or Strong Buy.

- Technical Perspective – News Corp (NWSA)

At the time of this analysis, NWSA is trading around $31.42, which is within reach of its 52-week high of 31.49. A year ago around this time, the stock traded at $18.91, a 60%+ gain.

Over the past 12 months, News Corp’s stock has been making new highs. Travelling from lower left to upper right, the stock has never faltered in its upward march, despite the British phone-hacking scandal that the company was involved in during this period.

- Favorable/Negative Catalysts for News Corp. (NWSA) Stock

As reported by the Wall Street Journal, Fox News (a major revenue segment of the News Corp. empire), continues to grow its market share against its chief rival CNN.

Regional sports coverage works best when a sports network extends coverage to a sizable segment of local sporting events. News Corp's sports coverage spreads across the US, covering pro baseball, college sports and pro basketball. Additionally, by spacing out contract renewals at various strategic times during the sporting season, News Corp makes it difficult for competitors to disrupt an entire season with lower contract prices.

The very nature of diversification of NWSA's media assets, which includes cable TV, a film studio, sports, news channels, international cable business, and its staggering library of motion pictures and TV shows (e.g. "X-Files", "Star Wars", "American Idol") is an excellent catalyst for future growth for the company. For instance, low pay-TV penetration in burgeoning markets like Brazil and Australia, hold great opportunities for NWSA.

One major downside for NWSA may be its DVD movie sales business, which is a relatively high-margin segment for the company. As more and more homes transition to streaming and mobile viewing, the demand for DVDs continue to fall, leading to a declining growth situation for the firm’s DVD business.

- Stock Analysts Recommendations

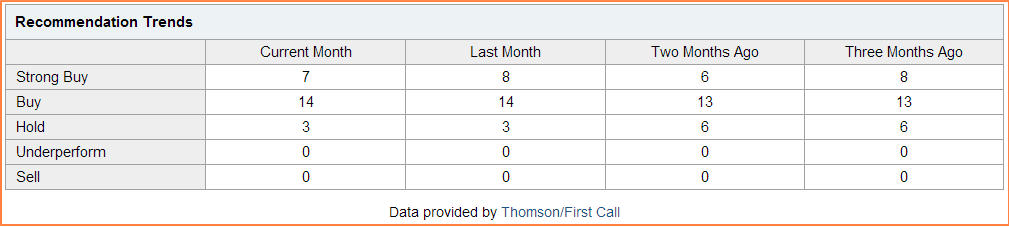

Analysts covering the stock have a Mean Target of $32.66, with a Low and High Target of $26.00 and $36.50 respectively. Of the 24 recommendations on record for the current month, 7 hold it as a Strong Buy, 14 as a Buy and 3 as a Hold. Some top firms have expressed favorable opinions about the stock, including Barclays (Overweight), Argus and Needham (Buy) and RBC Capital (Top Pick).

- Bottom Line Conclusion

Taking the various fundamental, valuation, technical and other analysis into consideration, we believe News Corp. (NWSA) stock has great potential for investors and will make a great long term buy. We rate News Corp. (NWSA) as a MODERATE BUY. Nevertheless, MarketConsensus News believes that investors should wait for a pull back on NWSA stock before jumping in.

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Google + (Connect with Us on Google+)

Facebook (Like Us on Facebook)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related2][/related2]