2 Microsoft (MSFT) Valuation Overview – continuing from: “Is MSFT a Good Buy in 2013? Microsoft Stock Analysis”

When valuing a stock, investors normally analyze a firm's financial margins, management effectiveness, growth rates and other valuation matrices (EPS, P/E, Debt Ratio, etc.).

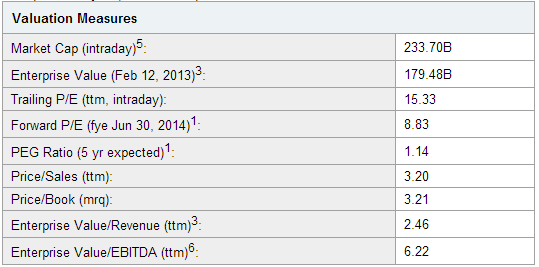

Microsoft has a Trailing Price/Earnings (ttm – trailing twelve months) of 15.33 (see below table). The Price to Earnings ratio tells investors what they are paying for each $1 of earnings.

A high P/E normally signifies high growth expectations for a stock. For example, LinkedIn (LNKD) has an extremely high Trailing Price/Earnings (ttm) of 817.95, meaning that investors are expecting a high level of growth in the future for LNKD. As such, they are willing to pay a lot now with the expectation of getting a big reward (much higher stock price) in the future. However a high P/E ratio could also mean that a stock has become overvalued.

MSFT’s P/E of 15.33 (ttm) and 8.83 (future), however, are on the low end of the average P/E scale signifying a “low growth expectation” scenario.

Despite the size of the firm, Microsoft continues to exhibit a high level of management effectiveness. The company’s Return on Equity (ROE) of 22.62% and Return on Assets (ROA) of 13.41% (ttm) are on the higher end of what should be expected. ROE and ROA are variables used by investors to determine management effectiveness.

For each $1 of equity, MSFT’s management is gaining $0.226 and for each $1 of asset, management is earning a high return of $0.134. The firm’s Profit and Operating Margins are also on the higher end, a sure sign that the firm continues to maintain a high level of profitability

- Dividend Payout Adds Value to MSFT Stock

Slow growing firms like Microsoft normally offer some kind of dividend to shareholders as a way to make their stock attractive. Investors are interested in getting a return on their investment. That return can be in the form of capital appreciation. (For example, you buy a stock at $5. It appreciates in value to $11. You sell it at $11 and make a $6 capital gain for each share of the company's stock.) Slow growing stocks do not have much potential for huge capital gains. As such, they provide dividend gains to investors in the form of "Dividend Payouts".

Microsoft Dividend Table

|

Forward Annual Dividend Rate: |

0.92 |

|

Forward Annual Dividend Yield: |

3.30% |

|

Trailing Annual Dividend Rate: |

0.83 |

|

Trailing Annual Dividend Yield: |

2.10% |

|

5 Year Average Dividend Yield: |

2.20% |

|

Payout Ratio: |

45.00% |

|

Dividend Date: |

Mar 13, 2013 |

Microsoft has a payout ratio of 45% meaning that for each dollar of net income, the firm pays out $0.45. The fact that the firm retains $0.55 per dollar signifies the company continues to reinvest in itself in an attempt (whether successful or not) to build future growth. The next dividend date is March 13, 2013.

- Analysts’ Recommendations on the Stock

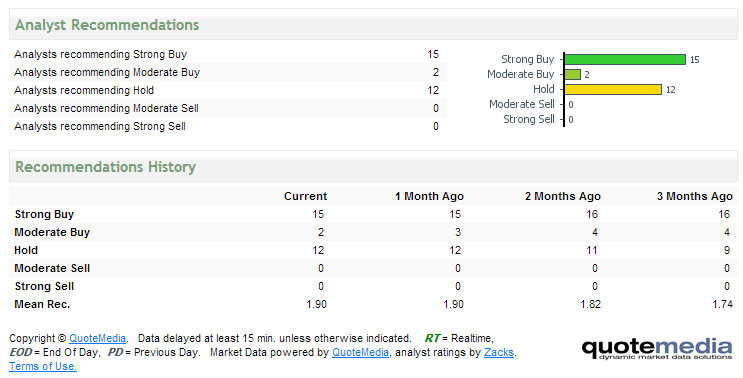

Stock analysts consider MSFT a buy. Between a 1 (Strong Buy) and a 5 (Strong Sell), they rated the stock a 1.9.

Microsoft (MSFT) Ratings Details

- Bottom Line Conclusion

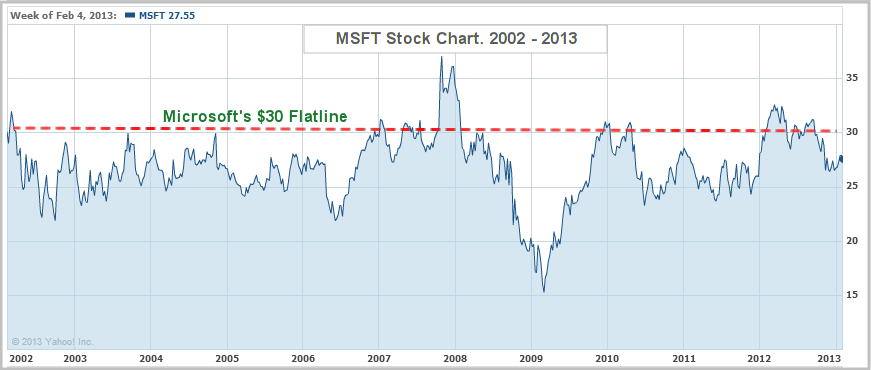

Taking the various fundamental, valuation and other analyses into consideration, we believe Microsoft stock has great potential for dividend seeking investors. Investors looking for growth opportunities will not find that with Microsoft. MSFT’s stock has remained essentially flat, not just for the last 6 months, but for the last ten years. During this period, the stock price has gone up and down, but never far from the $30 price line.

Investors with high risk appetites, however, can buy the stock at the current price (around $27) and sell when it gets close to or above the $30 mark. Traders can also trade the stock, buying at the dips and selling at the highs.

[related1][/related1]