As discussed in the first article of this two part series (Delta Stock Soars 51% in 1 Year: Too High, or is DAL still a Good Buy?), Delta stock (DAL) has been experiencing a steady and increasing rise in the stock price, leaving many investors asking whether the stock will continue to rise. In other words, is Delta (DAL) stock a buy, sell or hold in 2013.

Article 1 presented a fundamental analysis and valuation overview of Delta Airline, including an overview of the company’s financial income statement and two major trends that have supported the company’s rising stock price.

In this article, we’ll be analyzing risk factors impacting Delta Airline and Stock Analysts’ recommendations on the stock followed by our bottom line conclusion on whether DAL is a good buy, sell or hold in 2013.

Delta (DAL) Company Analysis and Research Report

- DAL Fundamental Analysis (Article 1)

- DAL Valuation Overview (Article 1)

- Risk Factors Facing Delta

- Stock Analysts Recommendations

- Bottom Line Conclusion

- Risk Factors Facing Delta

- Price of Aircraft Fuel:

Delta’s business operations are dependent on the price of aircraft fuel. High fuel costs or an increase in oil prices could have materially adverse effects on the firm’s operating results. The cost of oil and fuel has been experienced dramatic increase in the last year. Delta’s ability to pass along the increased costs of fuel to their customers may be affected by the competitive nature of the airline industry. - Availability of Aircraft Fuel:

In addition to the price of aircraft fuel, Delta is also dependent on the availability of a steady supply of aircraft fuel. Significant disruptions in the supply of aircraft fuel would materially adversely affect Delta’s operating results. - Highly Competitive Industry:

The airline industry is highly competitive and, if Delta cannot successfully compete in the marketplace, their business, financial condition and operating results will be materially adversely affected. Discount carriers, including Southwest, JetBlue, Spirit and Allegiant have placed significant competitive pressure on Delta Airline - American Airlines:

American Airlines recently filed for bankruptcy protection, which may enable it to substantially reduce its costs. Delta’s ability to compete effectively depends, in part, on their ability to maintain a competitive cost structure. If they cannot maintain their costs at a competitive level, then their business, financial condition and operating results could be materially adversely affected.

- Price of Aircraft Fuel:

- Stock Analysts Recommendations

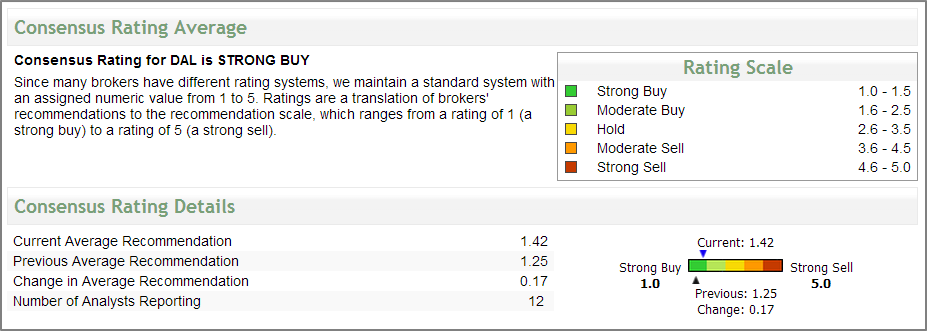

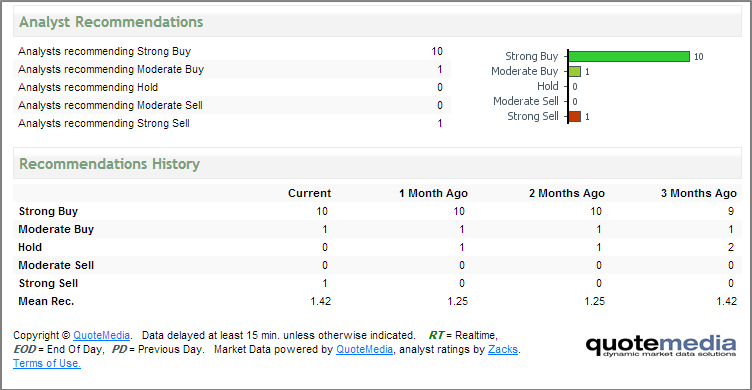

Stock analysts have a “Strong Buy” consensus on Delta stock. Between a 1 (Strong Buy) and a 5 (Strong Sell), they rated the stock a 1.42.

Delta Air Lines (DAL) – Analysts' Ratings

Analysts’ Recommendations

- Bottom Line Conclusion

Taking Delta’s improving fundamental and valuation situation into consideration, we believe the stock has great potential for investors and will make a great long term buy. However, investors might want to consider waiting for a significant pull back on the stock price before jumping in.

- Market Correction Impact

We would, however, like to caution investors on what we see as a coming 5% – 10% market correction. Market trend indicators are pointing to an overbought situation and a correction is a very real risk over the next 1-2 months. Investors should take this into consideration in their near term investing choices.

Good luck in your investing,

MarketConsensus Stock Analysis Team

Follow Us & Stay in Touch:

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related1][/related1]