Top Best Mutual Funds to Invest In

Mutual fund investing has proven to be successful for investors since the end of the financial crisis.

Traditionally, they have provided investors with a way to increase their profits while minimizing their risk.

Many investors turn to mutual funds for retirement and college savings, so picking the right fund is extremely important.

With more than 8,000 types of mutual funds to invest in, it can be hard to make the right choice.

There are lots of factors to consider and the information can be overwhelming.

Criteria for Choosing the Best Performing Mutual Fund

When choosing the right mutual funds to buy, there are specific factors that need to be considered.

Depending on your reason for investing, you will need to know the below:

- Past performance of the fund

- Risk involved

- How long you plan to keep your money in your investment

- Fees associated with your investment

Below is a summary of the factors that we used to select our list of best mutual funds to invest in.

Holdings

The type of companies that the mutual fund invests in is extremely important for obvious reasons – you need to know and understand what you are investing in.

Not only do you need to consider the breakdown of stocks, bonds, and cash, but you also need to know what industries or markets make up the mutual fund.

Our list contains broad and diversified funds as well as some that have a market or regional focus.

The more focused the fund is, the higher the risk is. As always, with a high risk comes a high return or loss.

Risk Tolerance

Because mutual funds are a collection of stocks, bonds, and/or cash, they are considered to be less risky than stock investments.

This does not, however, mean that they are risk free.

Depending on the mutual fund that you choose, there will be a different level of risk that you take on.

Some industries and markets are inherently riskier than others and some funds have unique characteristics that create or mitigate risk.

It is important to evaluate how much risk you can take on before deciding on the right mutual fund to invest in.

Associated Fees

The fees associated with your mutual fund can mean the difference between profit and loss.

Many times, these fees are not obvious, so you need to be careful.

For the most part, a mutual fund’s expense ratio will tell you how much of your profit comes out of your mutual fund each year in fees.

Most annual fees fall between 0-2%, which may seem small, but an annual expense ratio of 2% could actually eat away at your profits so much that you will take a loss on your investment.

Past Performance

The past performance of mutual funds is important to consider because it can be a good indicator of what is to come in the future.

The 1 year, 5 year, and 10 year performance measures of your mutual fund will each tell you something different.

What happened last year is important, but is not nearly as powerful of an indicator of future performance as the 10 year measure is.

Our list places higher value on the 10 year performance figure to try and find the best long-term investment.

After taking all of these factors into consideration, here is our list of mutual funds that we think will be a good investment for 2014.

8 Best Mutual Funds to Invest in (Comparison Table)

|

Mutual Fund |

Holdings |

Expense |

Risk* |

1 year return (%) |

5 year return (%) |

10 year return (%) |

|

Vanguard Dividend Growth (VDIGX) |

companies that have consistently increased their dividend payments every year over the past 10 years |

0.29 |

low |

31.5 |

16.6 |

9.0 |

|

FPA Crescent Fund (FPACX) |

diversified mix of cash, stocks, and bonds |

1.16 |

average |

21.9 |

14.8 |

8.8 |

|

Vanguard International Growth Fund (VWIGX) |

stocks in large companies outside the US in both developed and emerging markets |

0.48 |

average |

22.9 |

15.8 |

8.7 |

|

Vanguard Selected Value Fund (VASVX) |

mid-sized US companies that are considered to be undervalued |

0.43 |

below average |

42.0 |

21.9 |

10.6 |

|

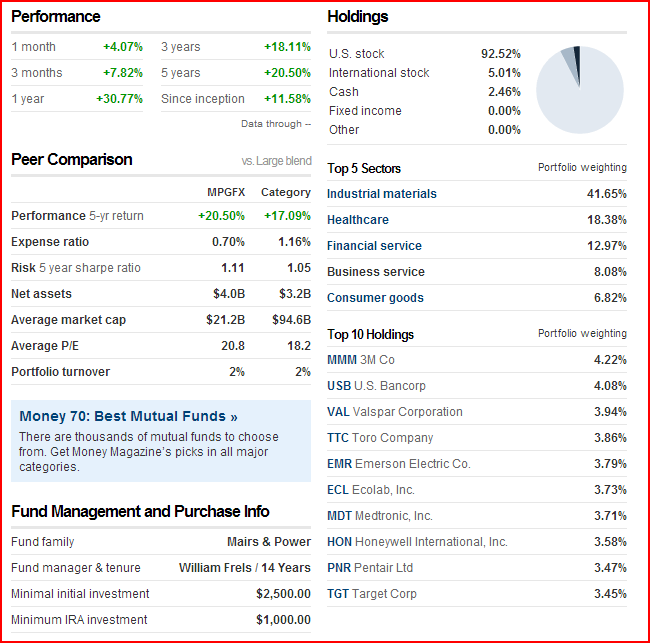

Mairs & Power Growth Fund (MPGFX) |

Midwest-based companies with a long-term outlook |

0.70 |

average |

35.6 |

19.1 |

9.3 |

|

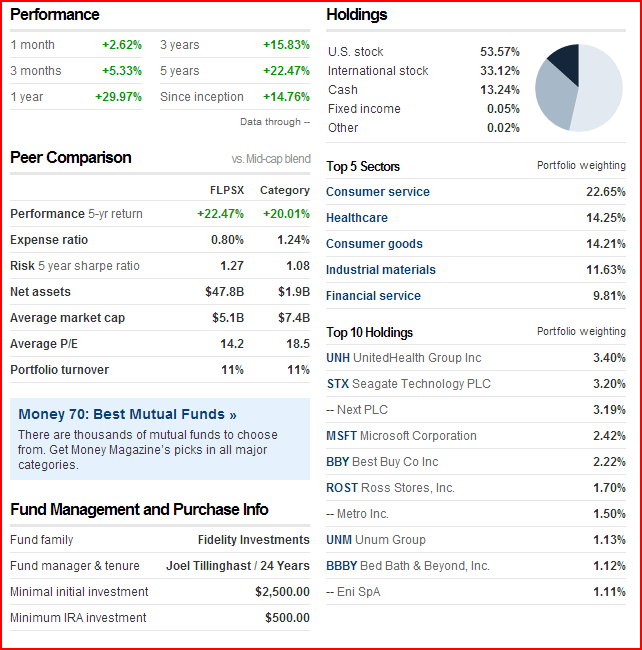

Fidelity Low Priced Stock Fund (FLPSX) |

small and mid-cap stocks whose share price is below $35 |

0.79 |

average |

34.3 |

21.7 |

10.6 |

|

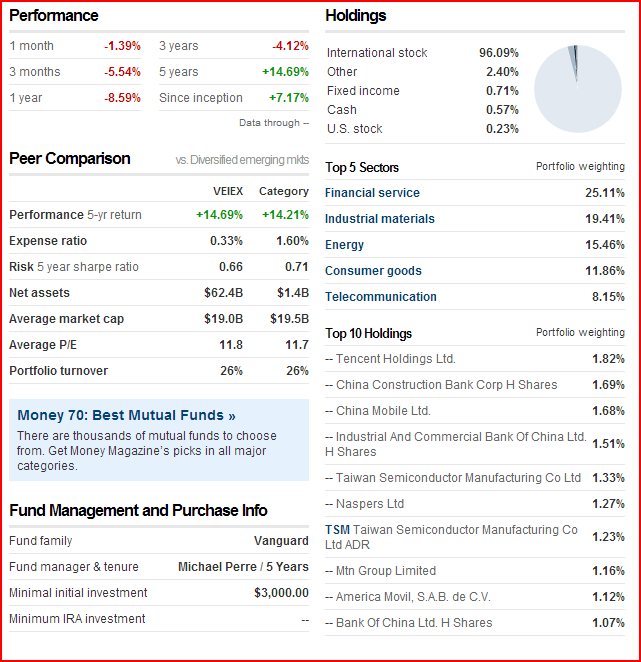

Vanguard Emerging Markets Stock Index (VEIEX) |

closely matches the MSCI Emerging Markets Index |

0.33 |

above average |

-5.2 |

13.8 |

10.4 |

|

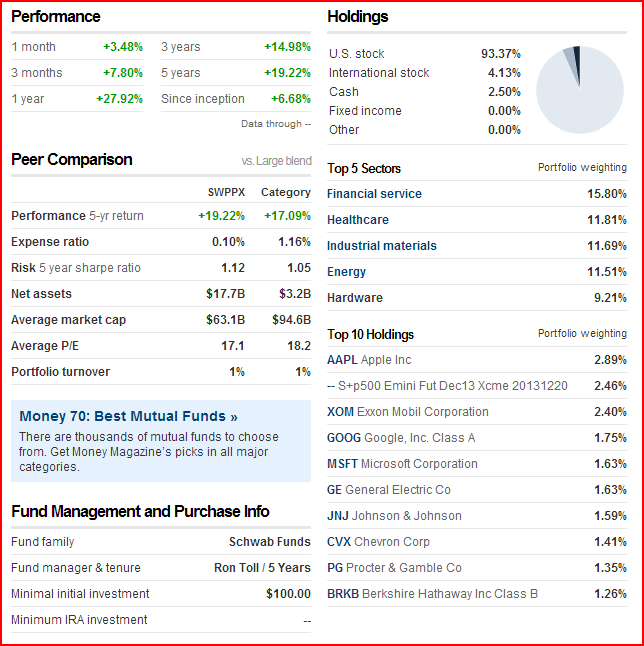

Schwab S&P 500 Index Fund (SWPPX) |

matches the S&P 500 Index |

0.09 |

below average |

32.3 |

17.8 |

7.4 |

All information is up-to-date as of 2014

8 Great Mutual Funds for 2014 (Brief Overview)

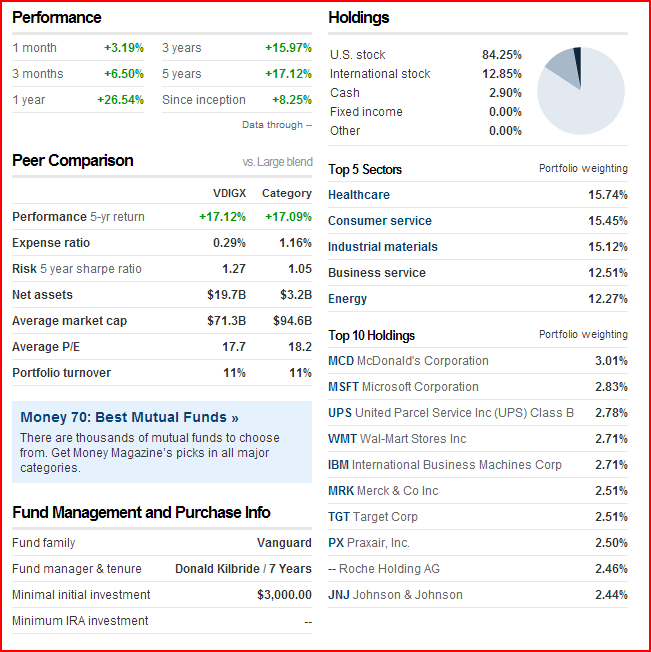

Vanguard Dividend Growth (VDIGX)

The Vanguard Dividend Growth Fund invests in companies that have consistently increased their dividends over the past 10 years.

Since consistently paying out a dividend, not to mention increasing it, can be very hard for a company, these businesses tend to be pretty stable compared to their counterparts.

Since this fund is considered to be low risk, it is a good choice for investors that cannot handle a lot of loss.

Vanguard Dividend Growth Fund (VDIGX) Snapshot

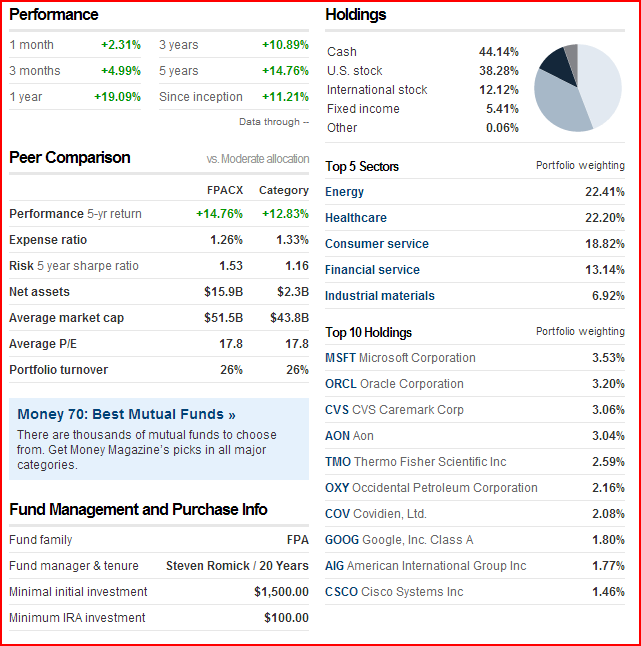

FPA Crescent (FPACX)

The FPA Crescent Fund, managed by the famous Fund Manager, Steve Romick, has an interesting mix of cash, bonds, and stocks, that shifts depending on the state of the current market.

Romick has a good reputation as a fund manager and tends to take advantage of market fluctuations, which has fared well for the Fund.

This fund gives Romick free reign over what holdings to invest in, which has allowed him to take advantage of good deals.

FPA Crescent Fund Snapshot

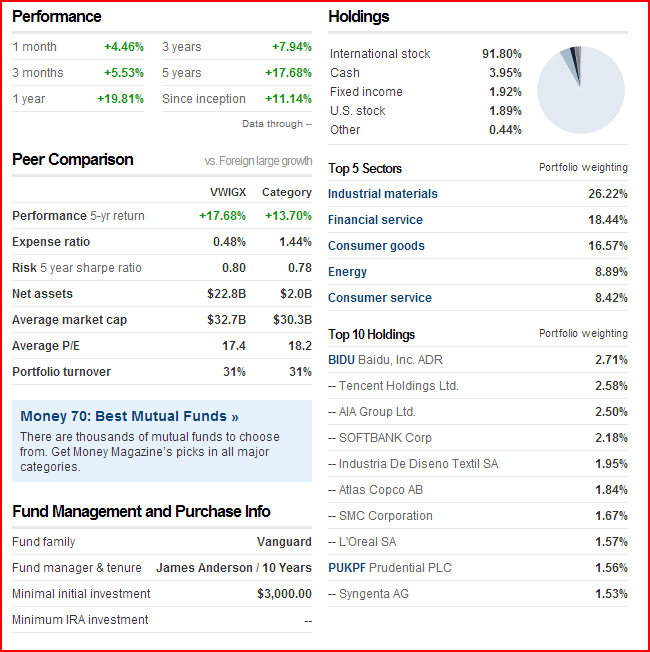

Vanguard International Growth (VWIGX)

The Vanguard International Growth Fund targets small, mid-sized, and large companies in both developed and emerging markets.

Because emerging markets are typically more volatile there is some risk in this fund.

However, Vanguard oversees 3 different firms that each manage a portion of this fund in an effort to lower the risk.

While foreign investments can be riskier, the payoff could also be larger, so this mutual fund would make a good addition to a portfolio that is already well diversified.

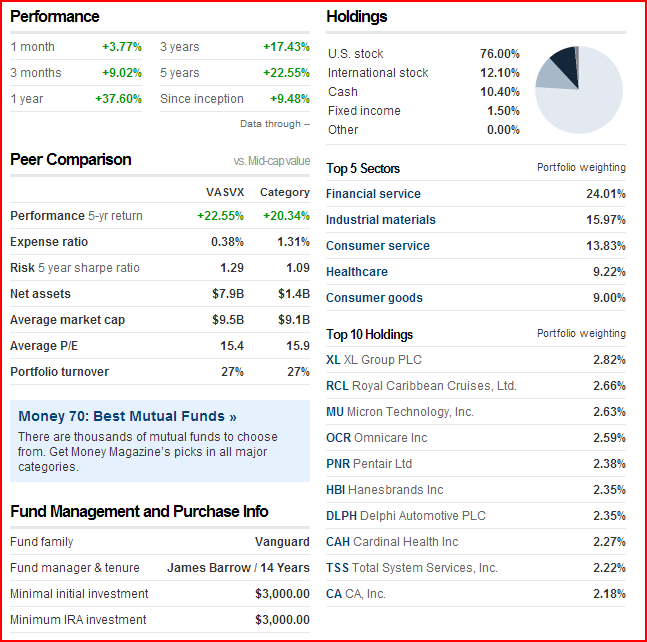

Vanguard Selected Value Fund (VASVX)

The Vanguard Selected Value Fund invests in mid-sized US companies that are considered to be undervalued.

Of all funds in our list, this has one of the highest 10 year performance figures and is also rated as low risk, making this fund a very attractive investment.

Mairs & Power Growth Fund (MPGFX)

The Mairs & Power Growth Fund is a unique investment in that it focuses on regional companies that are located in the midwest.

By focusing on this area, they are able to get to know the companies they invest in better than many other funds.

Because of the knowledge they gain, they are able to hold onto their investment for a longer period of time.

Fidelity Low Priced Stock Fund (FLPSX)

The Fidelity Low Priced Stock Fund invests 80% of its assets in stocks that have a share price below $35.

Their belief is that these low priced stocks are often overlooked and therefore undervalued.

This strategy has proven to be successful, as they have one of the highest 10 year performance figures on our list.

Vanguard Emerging Markets Stock Index (VEIEX)

The Vanguard Emerging Markets Stock Index follows the MSCI Emerging Markets Index.

Emerging markets are considered to be one of the riskier markets, so it may not be ideal for a short-term investment, but with more risk comes more reward, so it would make a good addition to an already diversified portfolio.

This fund is the only on our list that took a loss last year.

While it is never good to see a loss, it can sometimes act as an opportunity to purchase an investment that is currently cheaper than its counterparts and undervalued.

Schwab S&P 500 Index Fund (SWPPX)

The Schwab S&P 500 Fund follows the S&P 500 Index, so it will run in line with what the general market does.

This fund is well diversified, so could be considered a safer investment than those that are more focused on a specific industry or market.

It also has a very low expense ratio,which is a very important factor for a long-term investment.

Conclusion

The market is constantly changing, but it is more important than ever to make good investment decisions to achieve financial freedom.

Whether your investment is for retirement, college, or even short-term savings, mutual funds should play a role in your portfolio.

When buying mutual funds, it is important to understand your investment goals so that you can properly evaluate your options.

Your risk tolerance and the intended duration of your investment are important factors that can have a huge effect on your potential profits.

This list provides a good starting point for all investors so that you can build up your portfolio to achieve your investment goals.

** Please visit the respective mutual funds' websites for the most updated figures, rates, yields and information.